Hapag-Lloyd CEO Rolf Habben Jansen said while the German container line is well positioned to weather the coronavirus pandemic, it is cutting costs this year by a “middle-three-digit million-dollar number.”

In addition to blanking sailings, “we’re also restructuring services to mitigate costs and taking a whole variety of other measures as well. One of the ones that’s been the most public is, for example, trying to avoid the Suez Canal in some cases,” Jansen said during a press briefing Wednesday.

Suez Canal tolls can total about $500,000 per vessel and some container shipping lines are avoiding those costs by sailing around the Cape of Good Hope instead of transiting the canal.

“We have business continuity plans and we have a crisis committee that’s meeting every other day to make sure we all stay on top of what is happening, and where needed we take more measures,” Jansen said. “On the financial side, of course we manage costs and cash very closely these days as probably everybody does. We are having another look at our investment plans and where possible we will push some of that out.

“And then we have secured additional liquidity just in case we need it, not foreseeable at this point in time, and if we would see a scenario in which we see a gradual recovery somewhere in the third quarter, then we would not need that but we better be prepared,” he said.

“When you look at the overall balance sheet, it’s quite healthy,” Jansen continued. “We’re well positioned to weather this storm.”

Jansen did not give a preview of Hapag-Lloyd’s first-quarter performance during Wednesday’s video conference, only saying those figures will be released May 15. Most certainly Hapag-Lloyd, the world’s fifth-largest container carrier, will not be celebrating as it did when it reported a full-year 2019 in which it had improved its year-over-year operating results by a whopping 80%.

“When we look at 2019, the reason why we did well is because we had a good combination of controlling our costs, getting rid of some loss-giving business and slightly better freight rates than the year before,” Jansen said.

And there was no coronavirus spreading around the world.

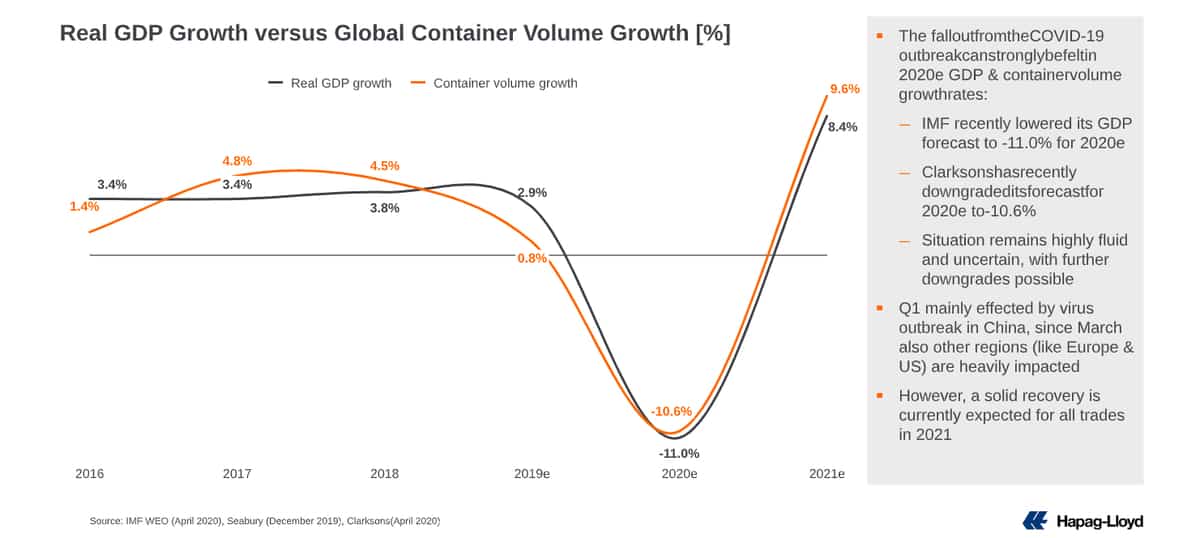

“The coronavirus is heavily affecting the world’s economy and definitely also container shipping in 2020,” Jansen said. “The IMF has just recently lowered its GDP forecast for 2020 to minus 11% for the full year. I think when you look specifically for container shipping, Clarksons’ loss estimate also is a decline of more than 10%, which of course is even worse than what we saw in the 2008-2009 crisis.”

He acknowledged there is a “tremendous amount of uncertainty around all these forecasts” as the coronavirus situation remains fluid. “One can only speculate about where we’re going to be in four or eight weeks.”

Jansen did say he expected an economic recovery to begin sometime in the third quarter of this year, and he pointed out a difference in Hapag-Lloyd’s order book this year from the one during the global financial crisis of 2008-09.

“In 2008-2009, we had an order book which was half of the global fleet, so that meant that a tremendous amount of new ships was scheduled to come into the fleet just after a crisis, which of course results in an imbalance between supply and demand. Today that situation is materially different as the order book is pretty much a record low,” he said.

According to presentation materials provided by Hapag-Lloyd, the order book-to-fleet ratio has dropped from 50% in 2008 to 11% year to date in 2020.

“I would also be very surprised if we see a lot of orders coming in anytime soon. So one would expect that order book to come down even further, and if anything that should help to prevent a very catastrophic situation beyond the immediate crisis we see now,” Jansen said.

During the question-and-answer portion of Wednesday’s press briefing, Jansen said, “It is not a secret that we have been looking at ordering new ships. I think it’s also logical that we will not put an order out there anywhere in the next couple of weeks. That would be illogical. We will wait until things settle down. You should expect some delay in us placing that order.”

While Hapag-Lloyd is not ordering new ships, it is procuring additional containers. With a supply and demand imbalance caused in large part by the coronavirus pandemic, containers are standing empty on European and U.S. ports waiting to be returned to Asia.

“When we look at our customers and our business, we have to adjust capacity to demand simply to control costs. On the other hand, we also have to invest in certain places, and that means we have on-hired a significant amount of equipment both in Asia and Europe and to a lesser extent in the U.S. to make sure that we have sufficient availability of boxes as the flows today are quite disrupted and as such, we simply need more boxes to cope with reduced demand,” Jansen said.

“We hired about 100,000 TEU extra compared to what we had, which for us is about 5% of our global fleet. Some are still being built,” so the container fleet will increase by 5% to 10% this year, he said.

The supply-demand imbalance means more containers are being procured although volumes are down.

“When you look at the east-west trades, which are the ones that are the most impacted so far, we see that capacity, especially in Q2 right now, is being reduced 15 to 20% across the industry and we are not very different,” Jansen said.

He said although volumes are down, Hapag-Lloyd is doing everything it can to support its customers to ensure uninterrupted supply chains.

“We will continue to adjust the network … where needed. That means if there’s more demand, we’ll scale up. If there’s insufficient demand, we’ll take costs out. And of course we’ll continue to manage costs tightly and secure sufficient liquidity to weather this storm,” Jansen said.

He said is not laying off employees but is being cautious about backfilling open positions.

“Right now we have no plans to make massive adjustments to our workforce. That, however, is not a guarantee forever. Based on today’s expectation, that does not seem necessary. If things got materially worse … I cannot rule out that we would have to look at it,” Jansen said.

He said the health and safety of Hapag-Lloyd employees on land and at sea remains a top priority as the COVID-19 pandemic rages on.

“Our approach will be that we will keep protective measures in place for quite some time,” Jansen said. “Right now the vast majority of the land-based staff is working from home in order to minimize any risk of the virus being transmitted. We have done significant investment in our IT infrastructure to make sure that works, and today outside of China we have well over 90% of our people working from home and that works.”

Richard von Berlepsch, Hapag-Lloyd’s managing director of fleet management, said port restrictions in place around the world have made crew changes extremely difficult and many seafarers have had to stay on board vessels significantly longer than scheduled.

“It’s a huge challenge,” von Berlepsch said. “It is very frustrating for the sailors because they sometimes have to wait for weeks until … they can sign off.”

He said rules that vary country by country make the situation even more complex.

“In some countries, we are allowed to sign off a crew member but cannot sign on a new crew member. The logic is very puzzling,” von Berlepsch said.

When asked, von Berlepsch said currently about 200 Hapag-Lloyd seafarers are stuck on ships and prevented from disembarking after completing scheduled working periods of between four and seven months.

Jansen said the crew situation “remains difficult. We are continuing to work together with other lines, with authorities in various places to try and do our utmost to get our sailors home and get the new crews on the ships.”