Colonial Pipeline’s operations are getting back to normal rapidly, with the company saying Thursday morning that deliveries of petroleum products have “commenced in a majority of the markets we service.”

The reaction in commodity markets undercuts the suggestion of recent days that the Colonial outage was not having a bullish impact on ultra low sulfur diesel prices traded on the CME commodity exchange. The prices for ULSD Thursday morning were down roughly 2.5% and gasoline was lower by a little more than 2%.

In an early morning release, Colonial said it had made “substantial progress in safely restraining our pipeline system.”

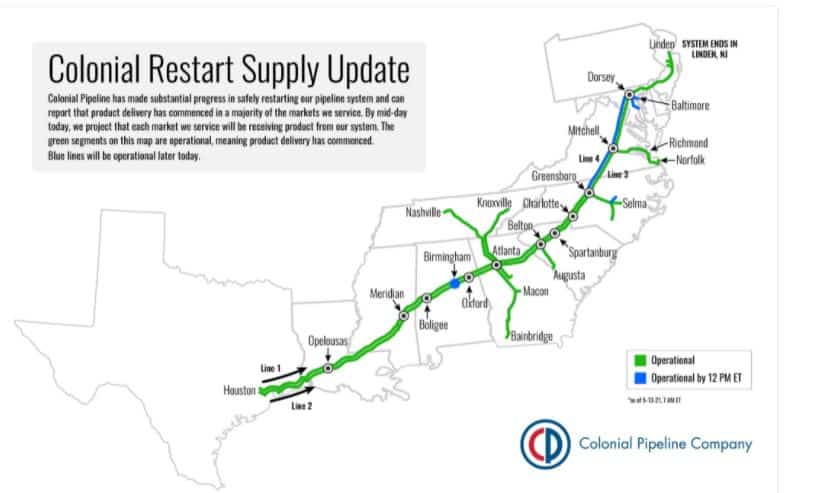

Colonial released a map on the current status of the line. It said of the map below that green segments were operational. Lines in blue will be operational later Thursday.

On the ground, indicators for diesel availability have actually deteriorated since late Wednesday. The extensive online database of RaceTrac outlets that showed late Wednesday a little more than 100 outlets of the chain with no diesel had risen to more than 125 by late morning Thursday. Pilot Flying J was reporting that 10 of its outlets had no diesel while eight had no diesel or gasoline. That combination totaled seven a day earlier.

But heading the other way, the number of outlets that Love’s reported as having no diesel fell back to five late Thursday morning from eight late Wednesday afternoon.

Through the first trading days of the Colonial outage, gains in the commodity price of ULSD or RBOB gasoline on the CME could be explained by factors other than the Colonial outage. In terms of diesel, it could be tricky to make an argument that the outage should impact the CME price. The ULSD contract on CME is for material to be delivered on any date in June, by which time the market would assume to be getting back to normal, even before the announcement of the restart. And the problems on Colonial were hitting the Southeastern U.S., not the New York Harbor area, which is the delivery point for both CME’s diesel and gasoline contract.

Additionally, the physical markets for products to be delivered in the next few days in the Gulf Coast or New York Harbor did not noticeably strengthen over the past few days. That is not surprising; having diesel or gasoline in the Gulf Coast that you can’t get to the affected markets doesn’t do you much good, and supplies of products in New York Harbor would have much the same problem.

But markets Thursday were showing that the Colonial outage may have been a factor in recent upward moves. At 11 a.m., ULSD on the CME was down 5.65 cents per gallon to $2.013, a drop of 2.73%. RBOB gasoline was down 2.34%, a drop of 5.05 cts/g to $2.1105/g.

The other significant news on Colonial Thursday morning was a Bloomberg article, citing sources, that said Colonial did pay a ransom to the hackers who shut the line.

Citing two individuals familiar with the transaction, Bloomberg said Colonial paid $5 million to the Eastern Europe hackers. Companies that do pay ransoms for cyberattacks generally do not comment when asked if a payment was made.

More articles by John Kingston

Diesel outages starting to rise in Southeast on back of Colonial closure

Colonial Pipeline outage: what to watch for in diesel markets Monday

Jobs report shows getting drivers into the pool remains a struggle