Return to normalcy – a phrase that has been uttered repeatedly for the better part of six months. Everyone wants to know when supply chains will return to normal. 2024 was expected to be that year. A new report by the Association for Supply Chain Management and KPMG has found that despite tremendous improvements in the global supply chain community, 2024 might not be the year we return to that elusive pre-pandemic normalcy.

According to the KPMG Supply Chain Stability Index, the good thing that has happened over the past few years is that just-in-time (JIT) inventory strategies are making a tentative comeback with manufacturers, wholesalers and retailers as a balanced approach to inventory levels has returned. Meanwhile, in the labor market, the intense competition for talent is easing slightly. Lower unemployment and the growing adoption of automation are contributing to this shift.

But the index found significant challenges that are preventing 2024 from being the year that everything returns to normal. “The greatest potential disruption lies in the logistics sector, where geopolitical factors and ongoing volume fluctuations due to reshoring and nearshoring continue to be major risks. As supply chains navigate the ever-evolving path to stability in 2024, maintaining vigilance and adopting resilient strategies will be crucial for continued progress.”

To continue that move toward a more stable supply chain, it’s important to keep focusing on other areas of the sector, such as inventory optimization and the growing adoption of automation. The report detailed how companies were able to carry less inventory to meet demand in 2023, after the pandemic led to surpluses across most major industries. It also laid out the need to balance the efficiency of automation with concerns over job displacement.

2024 looks to be the end of the uneasy supply chain, and 2025 should return to normal, should the rest of the world remain stable.

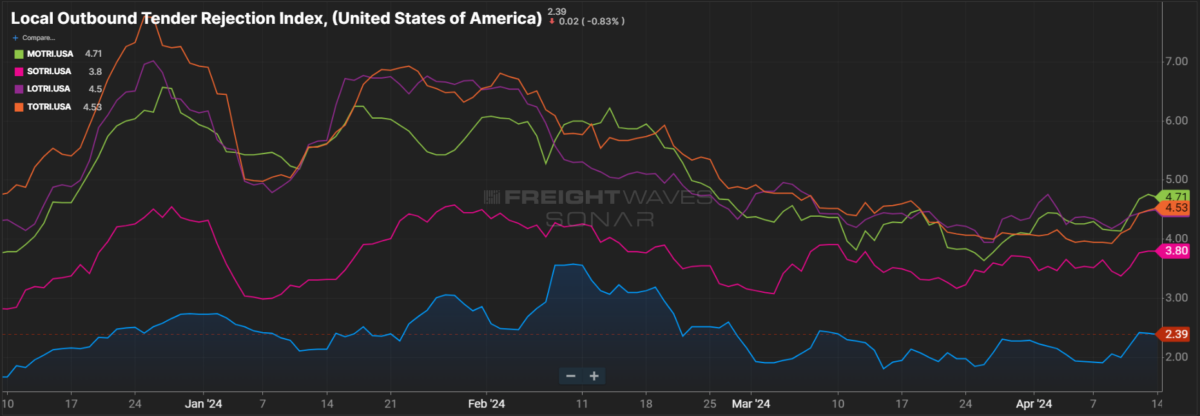

Market Check. Outbound tender rejections reveal more than just which markets are seeing a spike in rejections that could lead to a capacity squeeze. Outbound tender rejections by length of haul are one of the key indicators of what carriers are more willing to accept. They are more indicative of the general market itself as rejection by length of haul will describe what is available and desirable. If carriers are rejecting generally desirable regional freight more frequently, it is a sign that capacity is tightening. It can also indicate the volume of freight available in each range is changing. Currently, local moves, which are loads under 250 miles, are maintaining the top spot, with midhauls of 250 to 400 miles coming in as the least desirable among carriers.

Who’s with whom? The Panama Canal is so back. More like boats are back. The Panama Canal Authority has predicted it’s the end of the canal’s dry season, which means a significant reduction to rerouting around the canal and no reducing weights for ships to make it through the canal. One could say it’s a “return to normalcy.”

The National Weather Service’s Climate Prediction Center forecasts a swift end to El Niño conditions in the coming months with 85% confidence. Good old-fashioned weather has come to be the saving grace of the canal. Without the incoming rainy season, the canal would have been center stage in the upcoming presidential election in Panama, as tricky decisions would have to be made on allowing ships to pass and ensuring drinking water gets to residents.

According to an article by FreightWaves’ Michael Rudolph, “The Panama Canal sees nearly half of all container volumes from China and East Asia pass through to the U.S. East Coast. The current drought and ensuing operational impediments have caused delays to the Port of Savannah to rise from an average of three days in May 2023 to nearly nine in late March — though the Port of Baltimore’s closure has certainly had no small impact on other East Coast ports.”

The more you know

High schools driving students to trucking with training classes

TCA’s Heller: Trucking has adjusted to route diversions post-Baltimore

Borderlands Mexico: Samsara opens new office to focus on expanding cross-border trade

Scopelitis co-director: False hours-of-service log reports rise despite ELDs