Image: Shutterstock

The amount of capacity that has flooded the market in 2019 has put downward pressure on rates. Rates for long distance trucking declined for the third straight month in March, and year-over-year growth continued to decelerate, falling below 5 percent.

While falling rates are making the market feel soft for carriers that rely heavily on the spot market, national freight volumes were actually on par with April 2018 volumes through the beginning of the month. Volumes have started to soften more in the latter half of April.

Carriers should pay attention to the strength of individual markets before deciding where to send trucks. Fresno, California is a particularly strong market for carriers.

Outbound volumes in Fresno increased 6 percent on Wednesday, April 24, while outbound rejection rates increased 19 basis points. Headhaul Index values also jumped from -0.24 to 6.52, making Fresno a weak headhaul market, according to FreightWaves Director of Freight Intelligence Zach Strickland.

“The move is not historic nor lengthy by any means, but national volumes are off 7 percent since the start of the month and appear to be getting softer as we near the end of April,” Strickland said in a newsletter to SONAR subscribers early Thursday. “There is the Easter impact to volumes this week which should subside soon, but any market currently outperforming the national trend is worth attention from carriers.”

Chart: FreightWaves’ SONAR

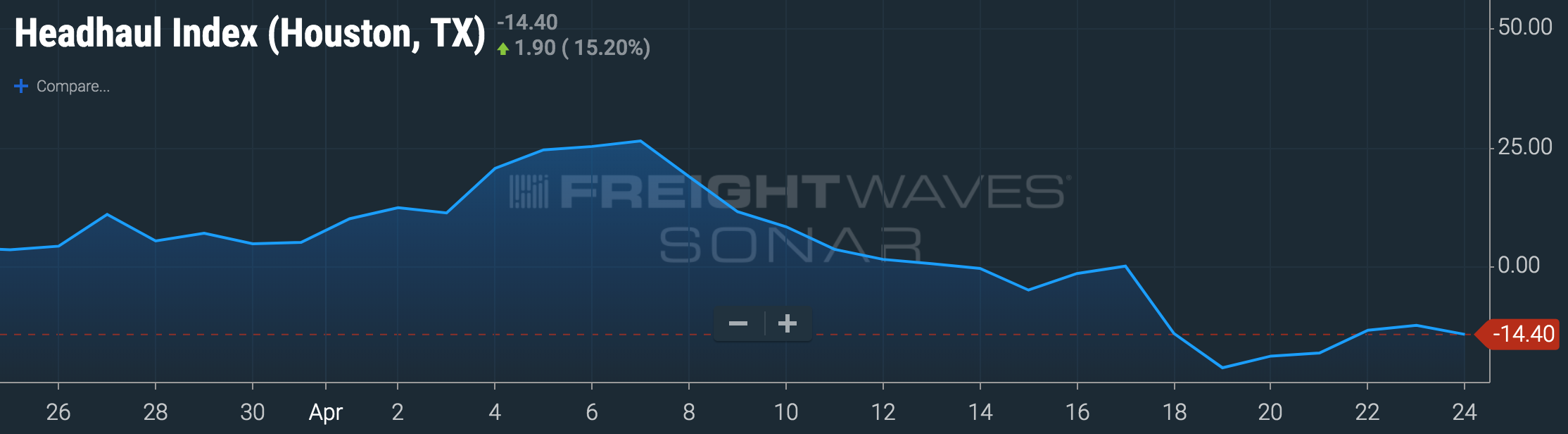

While volumes in Fresno are climbing, Houston volumes have dropped over 20 percent over the last two weeks after starting the month strong. Houston’s Headhaul Index value followed suit, dropping from a value above 20, a moderate headhaul market, to -14.4, a weak backhaul, according to Strickland.

“Inbound tender rejection rates bottomed out at 3.12 percent earlier this week, hitting an all-time low, which indicates carriers are as willing to go into the area as ever, even as volumes begin to fall,” Strickland said. “All these signals point to a weakening market for carriers.”

The Dallas market is behaving similarly, though the changes in that market have been less dramatic. Dallas is maintaining positive HAUL, according to Strickland. San Antonio is still a backhaul market but has been strengthening.

“Accept loads to Dallas or San Antonio over Houston if given the choice. Houston, at least for the moment, is showing early signs of a big drop in volume,” Strickland said in a newsletter to SONAR subscribers early Wednesday. The overall national market is soft, but avoiding ‘black hole’ formations, where trucks go to die without freight to move, will help mitigate utilization concerns.”