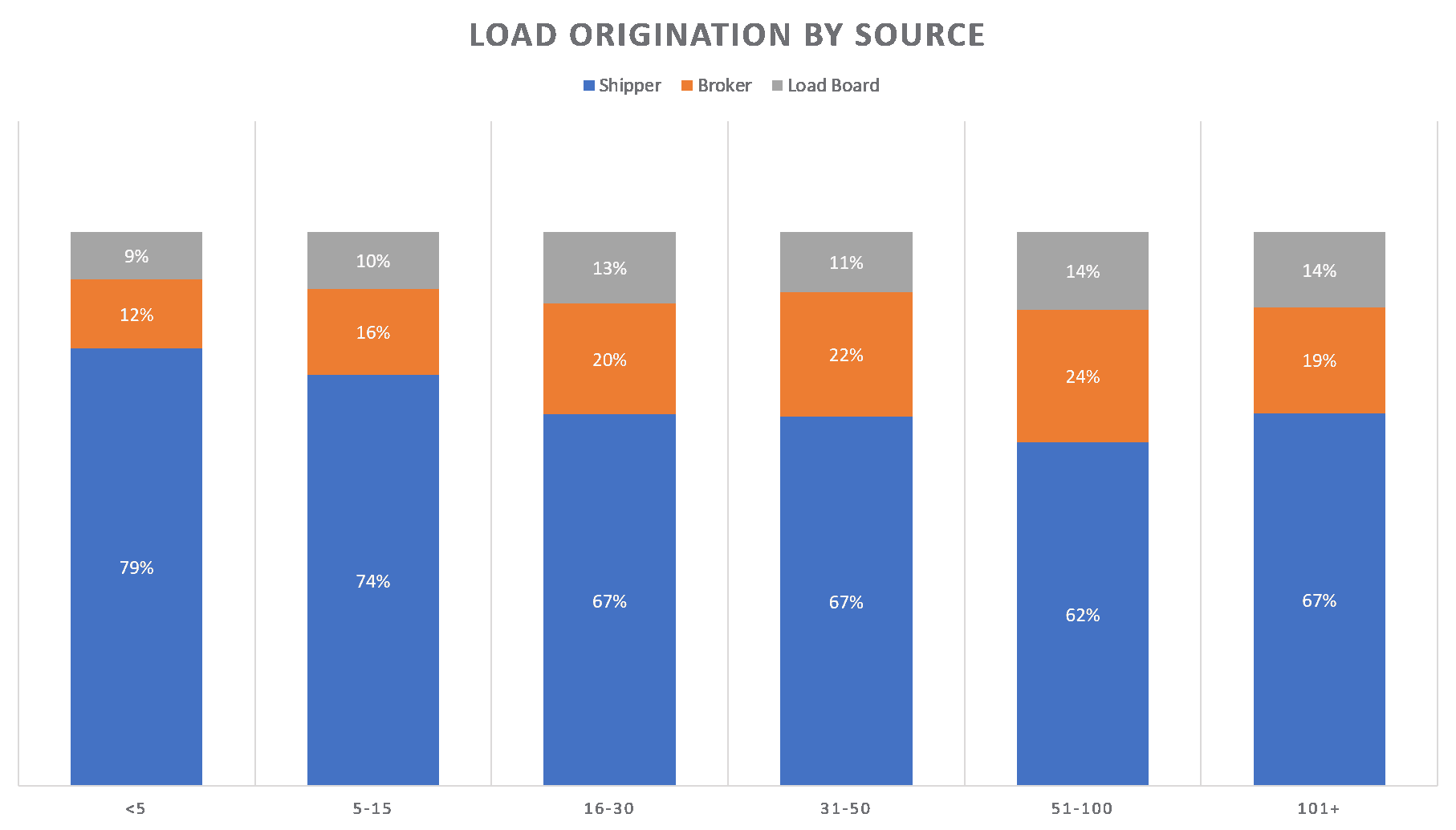

The union of technology and trucking is like an arranged marriage where the two parties must learn to love each other over years of interaction. Last week FreightWaves, in cooperation with CarrierLists, shared with you the results of their survey data indicating small carriers (<30 trucks) are more inclined to receive their loads from a direct interaction with shippers in comparison to mid-size carriers (30-600 trucks). The Load Origination Index (LOI) is still showing this to be the case with 68% of the volume being a direct shipper-carrier interaction, 20% is broker-carrier, and 13% of the loads come off load boards and almost none being reported come from the use of digital apps.

The digital app is a non-factor in the freight market at this point, representing just .02% of the total volume handled by survey respondents. App users across the globe number in the billions, according to a report done by the Business of Apps, which referenced the popular (or infamous depending on your perspective) Facebook app active user base. According to the same site’s report, the purchased app market revenue has grown from $7.1B to almost $29B in the last 10 years. The question is: why is this relationship taking so long to mature?

Before you look at the digital broker app from a functional standpoint, you need to understand a little history of freight brokers in general. Freight brokers found a niche in the industry over 10 years ago by exploiting a glaring weakness in most trucking companies. Technology and customer service in trucking were not being developed at a sufficient pace to meet the needs of the rest of the supply chain. The freight brokers were able to put all their energy into developing transportation management systems (TMS) and combining them with the flexibility of the human element. 3PLs, with their low overhead, were able to leapfrog trucking companies technologically as they had no infrastructure to maintain, or more accurately, overcome.

The large carriers could not compete with the brokers’ technological resources. They had large IT departments that spent most of their time maintaining outdated systems. There was no real motivation to develop another system as the cost to them would be too great and internal politics of large organizations are a natural enemy to progress. Simply put, the juice was not worth the squeeze.

The small carrier does not have the size to support developing a TMS. Managing 5-10 trucks is easily done with basic software and computer systems. The mid-size carrier is starting to have enough reason to develop a TMS, but most of their energy ends up being spent on managing internal structures and processes. In many trucking companies there is a large communication gap between the IT and operational departments. Inevitably, cost reduction becomes a priority as managing larger fleet sizes becomes more challenging.

For all these reasons, the freight broker could only be developed in an environment that was not tied down by internal processes and assets. They can focus strictly on linking the service to the customer, a need that was being largely ignored by asset-based carriers.

The digital app seems to be the obvious next step in freight brokerage. There’s one major problem: most digital apps are currently attempting to solve a problem that has already been solved. Apps, and technology in general, are about convenience and simplicity. A digital app that has the same information, but on a mobile device, is not that much more convenient or simple than the desktop version. The app needs to offer more.

The shippers have access to posting on load boards from their desk. The carriers have access to the same load boards at their desk. Very few have a need to book loads from a mobile device. If they do, most of your brokerage houses, such as Echo Global Logistics, already have some type of app or mobile friendly site available for booking or tracking their freight. They also have the established relationships and trust.

For digital apps to take the relationship with trucking to the next level they need to achieve what the TMS did in the middle to late 2000s. They need to make someone’s life in the supply chain simpler. As of now, the traditional freight broker has automated the booking process, but they also solve multiple other needs. They handle the carrier management, they provide updates, they manage the flow of money, and they monitor all the minor details that come with getting a load from point A to point B in a timely manner.

For the digital app to get real traction, it will need to offer something more than simple freight matching and tracking with short term discounts. With all the moving parts involved in any single freight movement there is a lot of opportunity.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.