Editor’s note: This story was updated to reflect that the company’s CEO says he is working to bring drivers home.

HVH transportation, a 344-unit trucking company, has abruptly shut down. It’s the latest in a string of trucking failures stemming from an economic environment that has put pressure on operating ratios.

The Denver, Colorado truckload carrier operated in all contiguous states west of the Appalachian mountains, with the exception of the deep South. According to Pitchbook, the trucking company had been operating since 1956 and was acquired by HCI Equity Partners, a private equity firm, in October 2012.

Initial reports in the wake of the abrupt shutdown indicated that the company left drivers stranded over the road, in a situation that was eerily similar to the sudden closure of Falcon Transport, another private equity backed trucking company that abruptly closed earlier this year.

Subsequent to the publication of this story, the company’s CEO, John Kenneally, said he is actively working to avoid stranding drivers and get them back home.

HVH, which has also gone by the name of Thacker Brothers Transportation, had 344 power units and employed 324 drivers. The company’s website and social media accounts were still operating as of Wednesday morning.

HCI Equity Partners has $957 million dollars in assets under management and has made investments in trucking and logistics buy-outs in the past, including investments in Road Runner (NYSE: RRTS) Naumann Hobbs Material Handling, GO2 Logistics, Milan Supply Chain, Southern Ag Carriers.

HCI exited its investment in Road Runner earlier this year, when the hybrid truckload/LTL carrier recapitalized the company with an investment from Elliott Management.

2019 has been the worst year of profitability in the trucking industry in over five years. Even the downturn of 2016 was not nearly as painful in terms of operating losses.

According to operating ratios across the industry, the average dry-van truckload carrier has teetered on losing money every month in 2019.

SONAR users can interact with this dashboard by clicking here.

Operating Ratios (OR) measure operating costs in relation to revenues. A high operating ratio is considered a bad thing (a 100 is an operating break-even, anything above one-hundred is a loss and anything below represents operating profit). OR will come before any debt servicing, distribution, or taxes.

This data is compiled based on financial reports from over 220 truckload fleet profiles, representing over 70,000 trucks, ranging from mid-sized (75 trucks to enterprise 7000 trucks). The operating KPI data is aggregated in partnership with the Truckload Carrier Association’s Truckload Indexes and available exclusively on SONAR.

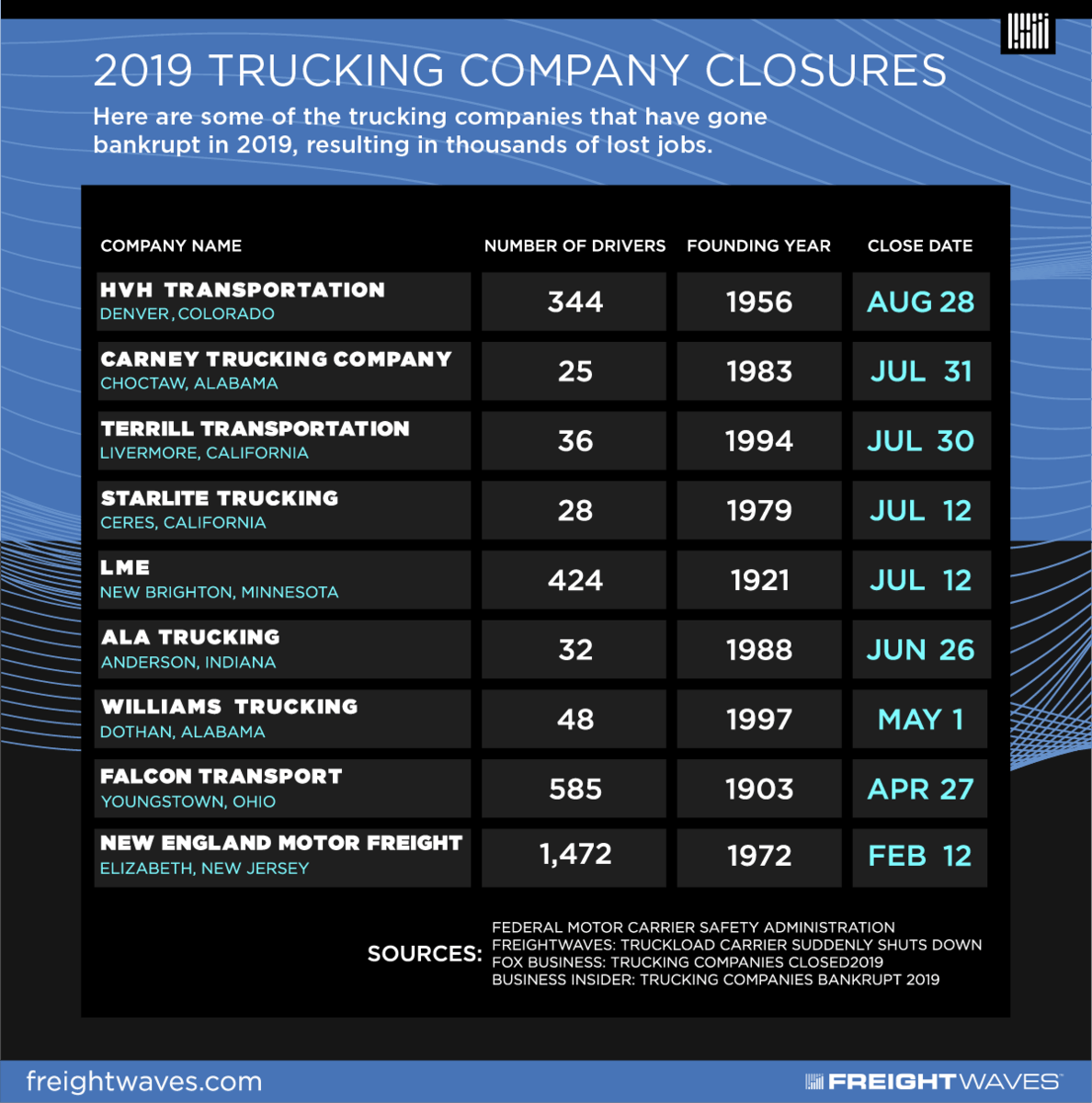

Eight mid-size and large carriers have shut their doors in 2019 including NEMF, Falcon, and LME.