Transportation and logistics provider ArcBest reported Friday that less-than-truckload shipments from core accounts have increased 10% in the past week.

A potential shutdown at competitor Yellow Corp. (NASDAQ: YELL) is placing more freight in the market. ArcBest said it has renewed its focus on primary accounts, following a period in which it leaned heavily on transactional shipments (dynamic pricing) to keep the network full.

Old Dominion Freight Line (NASDAQ: ODFL) noted a 6% uptick in volumes over the last few days when it reported second-quarter results on Wednesday.

“ArcBest is uniquely positioned to meet customers’ needs, especially in a market that is rapidly changing,” stated Judy McReynolds, chairman, president and CEO, in a news release. “We serve as trusted advisors — ready to keep customer supply chains moving with a full suite of logistics solutions, including a nationwide network of asset-based LTL capacity.”

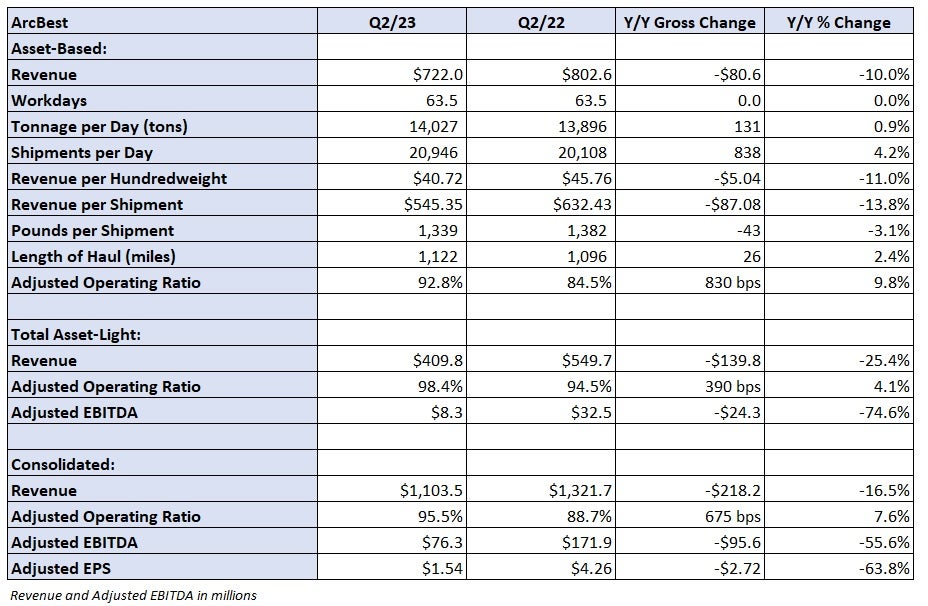

ArcBest (NASDAQ: ARCB) reported adjusted earnings per share of $1.54 Friday before the market opened. The result was 51 cents light of consensus and well below the year-ago result.

ArcBest’s asset-based unit, which includes less-than-truckload operations, reported a 10% year-over-year (y/y) decline in revenue to $722 million as tonnage was up 1% and revenue per hundredweight, or yield, fell 11% inclusive of fuel surcharges. The yield metric was up against a tough comp (up 18% y/y) from the second quarter of 2022. Lower fuel prices, down nearly 30% y/y in the period, weighed on the comparison as well.

Excluding fuel, yield was off by a mid-single-digit percentage on LTL shipments. However, pricing on the company’s core LTL business (excluding fuel) increased y/y by a high-single-digit percentage. Contract renewals and deferred pricing agreements saw an average y/y increase of 3.1%.

Less freight from core customers, smaller shipments and lower fuel surcharges were some of the revenue headwinds in the quarter. Less-than-truckload tonnage increased from the first quarter but shipments were flat, “which is weaker than normal, seasonal expectations,” it noted.

ArcBest said it recently implemented a cost-savings plan in the unit, which resulted in total daily shipments declining 5% from the second quarter. Even with the increase in core LTL shipments over the last week, the company’s transition from dynamic pricing has kept volumes lower in July. Tonnage for the month is down 5% y/y.

However, the volume weakness will likely be cured quickly if Yellow closes.

ArcBest exited the quarter moving 19,500 shipments per day, which was down from 21,000 in June.

It is making sure the freight onboarded is a long-term fit and plans to review it weekly to ensure it is producing the appropriate yields and margins. Management said it could exceed 21,000 shipments per day if needed, pointing to a recent increase in employment applications as an indication of labor availability. It also said it could increase its usage of purchased transportation and hold its trade cycles on equipment to increase capacity.

Some of the new freight in the market is from ArcBest’s existing customers.

“These are opportunities that we’ve seen before,” McReynolds told analysts on a Friday call. “We have to sort through that and make sure that we feel really good about it being an incrementally good decision for us” versus “saying yes to too much and regretting that.”

Excluding the Yellow disruption, management said demand hasn’t really changed.

Total billed revenue per day is down 12% y/y so far in July. Total yield is down 7% y/y but pricing on core LTL business is up by a low-single-digit percentage excluding fuel.

Management said it is taking rates higher on the remaining portion of its transactional business and noted competitors are doing the same.

The unit posted a 92.8% operating ratio, 830 basis points worse y/y. Most expenses as a percentage of revenue were higher, including the compensation line, which was up 680 bps.

The segment normally sees no change in its OR from the second to third quarters. Management hopes to keep margins level sequentially even though it implemented a new five-year labor deal with the Teamsters at the start of the month. The new contract includes a 13% wage increase in the first year, a 9% all-in bump when including health and pension benefits.

ArcBest has also reduced overtime, cartage and purchased transportation expenses. Rents and purchased transportation expenses were down 100 bps as a percentage of revenue in the quarter. The company said it will increase the usage of training programs to driver better productivity.

The company’s asset-light division, which includes truck brokerage, reported a 25% y/y decline in revenue to $410 million. The unit’s adjusted OR deteriorated 390 bps to 98.4%. During the quarter, the unit achieved $3 million in previously announced cost savings and management said it will continue to align costs with demand.

More FreightWaves articles by Todd Maiden

- Yellow shops 3PL unit; negotiations with Teamsters yield nothing

- Landstar not ready to call market bottom

- Old Dominion uses cost control to mitigate slumping demand in Q2