New research by the American Transportation Research Institute (ATRI) provides more evidence that large legal “nuclear” verdicts against truck fleets are increasing dramatically in both number and size of awards along with a corresponding increase in insurance costs.

The study, Understanding the Impact of Nuclear Verdicts on the Trucking Industry, is based partially on a new trucking litigation database with information on 600 cases between 2006 and 2019. The first five years of the data showed 26 cases over $1 million but nearly 300 cases over the last five years.

The research supports evidence included in a white paper published by FreightWaves earlier this year outlining how nuclear verdicts are changing the face and complexion of the trucking industry.

“This issue has had a stifling impact on motor carriers and industry stakeholders – well beyond those involved in a truck crash,” said Rob Moseley, Founding Partner with Mosely Marcinak Law Group. “ATRI’s research on litigation provides important guidance on leveling the playing field between truckers and trial lawyers, both in and outside of the courtroom.”

From 2012 to 2019, the number of cases with verdicts over $1 million increased to 265 cases, an increase of 335%, according to the research. The number of verdicts between $1 million and $2 million increased by 300% in the same period.

The research also revealed that the average verdict across the 15 years covered by the ATRI’s database was $3.16 million, but that the average size of verdict from 2010 to 2018 increased from $2.31 million to $22.3 million – “indicative of a rise in the size of verdicts from 2005 to 2019,” ATRI noted.

The study also provides evidence to refute arguments that nuclear verdicts reflect real-world cost increases. ATRI’s research found that from 2010 to 2018, the size of verdict awards grew 51.7% annually at the same time standard inflation grew 1.7% and healthcare costs grew 2.9%.

In addition to case analysis, ATRI surveyed and interviewed defense and plaintiff attorneys, as well as insurance and motor carrier experts.

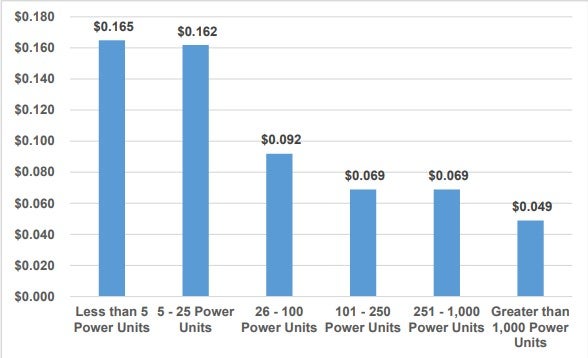

“While all fleets now pay more, premiums definitively scale based on safety records,” according to ATRI. One respondent noted that motor carriers considered low risk are experiencing annual insurance cost increases of 8-10%, while new ventures and “average-to-marginal” carriers are experiencing increases of 35-40%. Also, small fleets and owner-operators pay out-of-pocket considerably more on a per-unit basis than larger fleets, according to ATRI’s operational data.

The research also affirmed that insurance companies are becoming more selective in who they insure. “As a result, motor carriers have fewer options for purchasing full coverage to protect their balance sheets. Consequently, fleets continue to accrue increased risk (e.g. higher deductibles, less coverage) to mitigate costs. To offset this increased risk and fearing nuclear verdicts, motor carriers have generally increased their focus on safety and hiring practices.”

Respondents to the study agreed that while nuclear verdicts are not common and are not a direct cause of motor carriers going out of business, “many respondents reported that increased insurance costs, an indirect consequence of large verdicts, is a primary reason for closing,” ATRI noted.

“Inability to compete in a competitive freight market, poor operation and business practices, and inability to adequately adjust their prices quickly are several other reasons reported as to why motor carriers may have to file for bankruptcy.”

Click for more FreightWaves articles by John Gallagher