There may be doom and gloom about the future, but America’s ports are still posting historically high numbers for the recent past. The ports of Long Beach, California, and Charleston, South Carolina, just reported exceptionally strong throughputs for May.

Long Beach had total throughput of 890,989 twenty-foot equivalent units, the second best tally ever, topped only by May 2021.

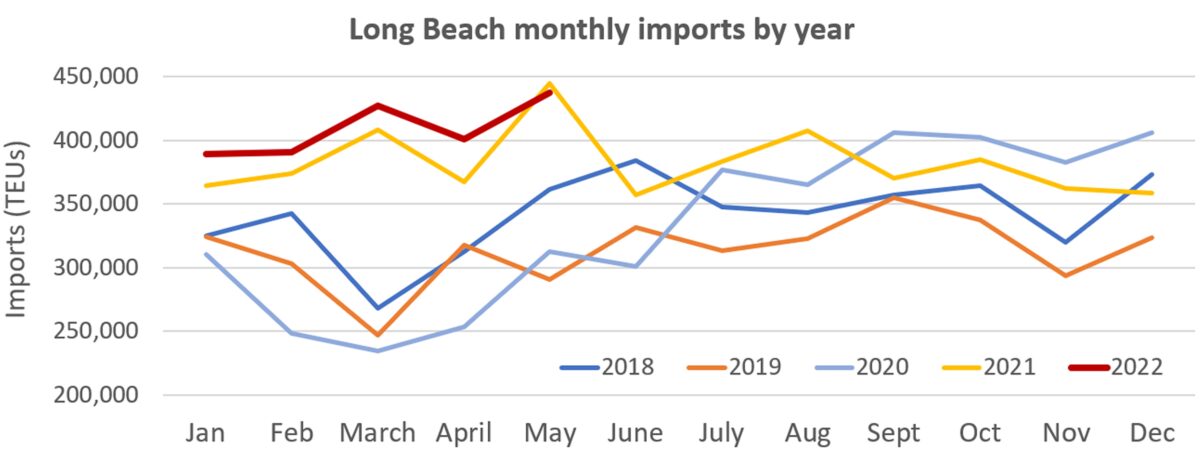

Imports totaled 436,977 TEUs, again the second highest except for May 2021. Imports last month were more than 30% above pre-pandemic levels in May 2018 and May 2019.

The neighboring Port of Los Angeles will report May numbers in the coming days. A spokesperson told American Shipper that it was “a great month” with throughput “well north of 900,000 TEUs.”

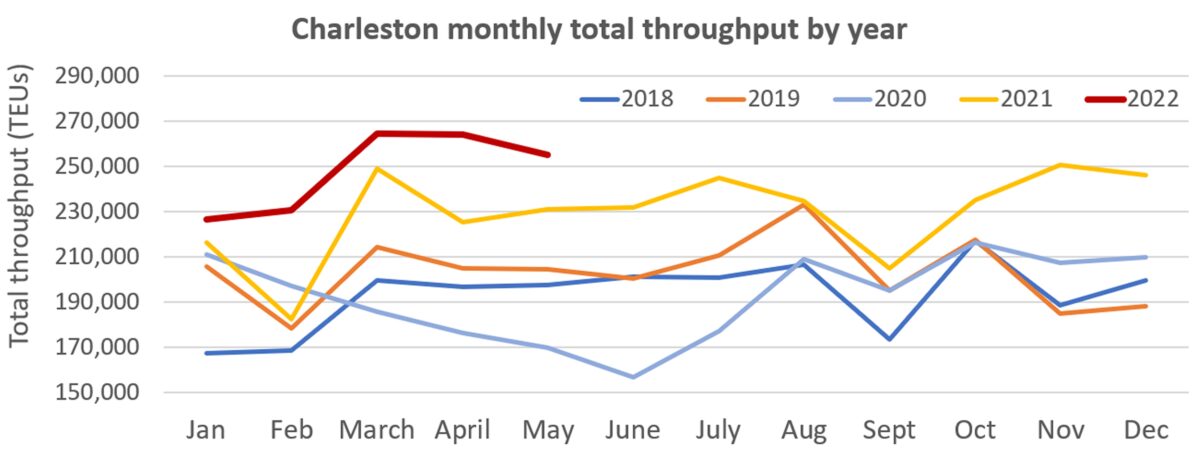

On the East Coast, Charleston handled 255,104 TEUs in May (including imports, exports and empties), up 11% year on year. It was the port’s third highest monthly total in history, topped only by March 2022 (264,334 TEUs) and April 2022 (264,099 TEUs).

Ports working through ship queues

Offshore queues of waiting container ships fell at several ports in May. Ship-position data from MarineTraffic showed over 30 ships stuck waiting off Charleston in late February. On Friday, there was only one.

Over the course of last month, as both Long Beach and Los Angeles handled strong import volumes, the number of container ships waiting offshore fell 32%, from 44 to 30, according to data from the Marine Exchange of Southern California.

The ongoing process of working through the offshore backlog should continue to support Long Beach and Los Angeles import volumes this month. In 2021, queues fell in February through late June, as they have thus far this year, then headed back up again.

What’s next?

On Wednesday, Henry Byers, head of ocean intelligence for FreightWaves, wrote that “U.S. import demand is falling off a cliff,” citing a FreightWaves SONAR index showing a sharp decline in bookings for U.S. imports over recent weeks (based on the scheduled day of departure).

Some port and retail reps predict strong imports in the coming months.

And there were still 92 container ships waiting off U.S. coastlines on Friday, according to data from MarineTraffic and the Marine Exchange. In January-February, there were around 150. The current count includes 25 off Savannah, Georgia, 20 off Los Angeles/Long Beach, 18 off New York/New Jersey and 14 off Houston, Texas. Until queues are cleared, the unloading of cargo from waiting ships will help support import volumes (with the caveat that a portion of inbound cargo is counted in Customs import data before it leaves the queue).

According to Mario Cordero, executive director of the Port of Long Beach, “We are moving an extraordinary amount of cargo. Looking ahead, we are ready for the traditional summertime surge to coincide with China’s recovery from a lengthy port lockdown.”

Jonathan Gold, vice president for supply chain at the National Retail Federal (NRF), predicted, “We’re in for a busy summer at the ports. Back-to-school supplies are already arriving, and holiday merchandise will be right behind them.”

The NRF expects imports in June-October to rise 2% versus the same five months last year. Following 2.26 million TEUs of imports in April, it projects 2.31 million in May, 2.31 million in June, 2.3 million in July, 2.28 million in August, 2.13 million in September and 2.13 million in October.

Click for more articles by Greg Miller

Related articles:

- Ports get ‘much needed respite’ as container-ship traffic jam eases

- Container shipping jackpot continues: CMA CGM profits soar

- Blockbuster container shipping results collide with sinking sentiment

- Container shipping rates: Still sky high but falling back to Earth

- Has the peak of container shipping’s epic boom already passed?

- Demand for shipping containers is falling. Transitory or turning point?

- Despite rising risks, shipping lines on track for another record year

- Container shipping at the crossroads: The big unwind or party on?

- How invasion of Ukraine could ease shipping logjam off US ports