( Photo: Amazon )

Today, freight brokers’ and carriers’ worst nightmare has come true: Amazon has quietly taken its digital freight brokerage platform live at freight.amazon.com, and it is undercutting market prices from 26 to 33 percent.

Early this morning, in a client note responding to Amazon’s (NASDAQ: AMZN) announcement that it would begin offering free one-day shipping to Prime members, Morgan Stanley equities analyst Brian Nowak made a cryptic prediction.

“We see AMZN’s 1-day Prime shipping raising consumer expectations and increasing the cost to compete in e-commerce. Over the long term, we also see this as a Trojan horse for Amazon to grow its next disruptive business… a third party logistics network,” Nowak wrote.

Amazon already moves an enormous amount of freight through its distribution and sortation centers and has an extensive network of trucking carriers. For many industry observers, it was only a matter of time before Amazon leveraged the implicit network effect — the total number of shippers and carriers who do business with Amazon — and connected both sides of its business.

Part of this business may be to hedge against the volatile price of trucking capacity: by building a large freight brokerage business, AMZN is turning part of its cost into revenue. After all, Amazon is already a top ten international freight forwarder for Asian ocean freight inbound to North America.

A few weeks ago, a former Amazon executive reached out to FreightWaves to explain the e-commerce giant’s disintermediation strategy.

“The advantages that then come from disintermediation and the monetization of those capabilities are secondary to the immediate need of self-preservation, but then serve to feed very critical needs of Amazon’s ability to continue to succeed,” the Amazon veteran wrote. “This innovation and growth then manifests as continuously evolving towards the ability to sell everything and anything that is or can be sold. That’s the true Amazon flywheel: disintermediate to survive; monetize to fund innovation; innovate to grow; disintermediate to survive…”

The entry of Amazon into freight brokerage is the ‘disintermediate to survive’ phase of the flywheel. AMZN is under pressure to re-accelerate its top line revenue, which has slowed from upward of 30 percent annually three years ago to less than 15 percent projected for this year. Amazon cannot allow trucking capacity to constrain its growth and is entering freight brokerage to lock that capacity up.

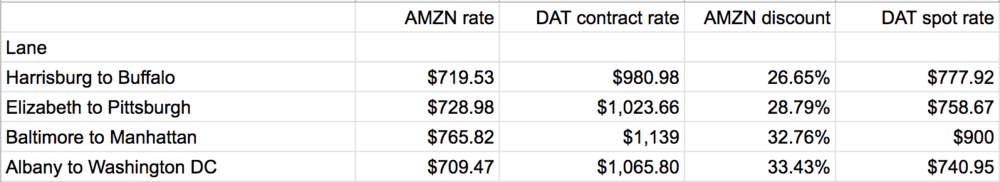

Notice how ‘monetize’ comes after ‘disintermediate’. From a cursory review of four lanes in Amazon Freight’s current offering, it’s clear that Amazon is not trying to realize fat gross margins on its brokerage. Instead, it is massively undercutting market prices. Amazon’s new portal is intended for shippers who want Amazon’s rates for full truckload dry van freight in Connecticut, Maryland, New Jersey, New York, and Pennsylvania.

As this table makes clear, Amazon quotes rates to shippers that are below even DAT’s broker-to-carrier spot rates. In other words, in its current form, Amazon Freight is a free, marginless brokerage.

Monetization will come later, but this is the digital freight brokerage startup model on ‘Georgia overdrive’: massive capital deployed to rapidly scale a network on thin or negative margins and take share. There is no telling how big Amazon wants this business to grow, but at a certain point, prices will creep up as Amazon monetizes the brokerage service to fund further innovation.

That day may be some time away. In the first quarter of 2019, Amazon spent $7.3 billion on transportation, which it lumps together with sortation and delivery centers for the line item “shipping costs.” Approximately annualized, AMZN’s “shipping costs” are $28 billion per year, and, crucially, purchased transportation is not formally broken out on its P&L. Amazon could grow its brokerage into a $10 billion operation — effectively a shadow C.H. Robinson — selling capacity at cost, add it to ‘shipping costs’, and it could be years before investors begin asking about margins.

We think that building a third-party logistics network will allow Amazon to blow out retail peak season. By taking no margin during soft freight seasons and keeping trucks running, AMZN will have capacity locked up and ready to move truly staggering e-commerce volumes in November and December.