Freight brokerages are experiencing the recent drop in volume in different ways, depending on their mix of contract and spot business.

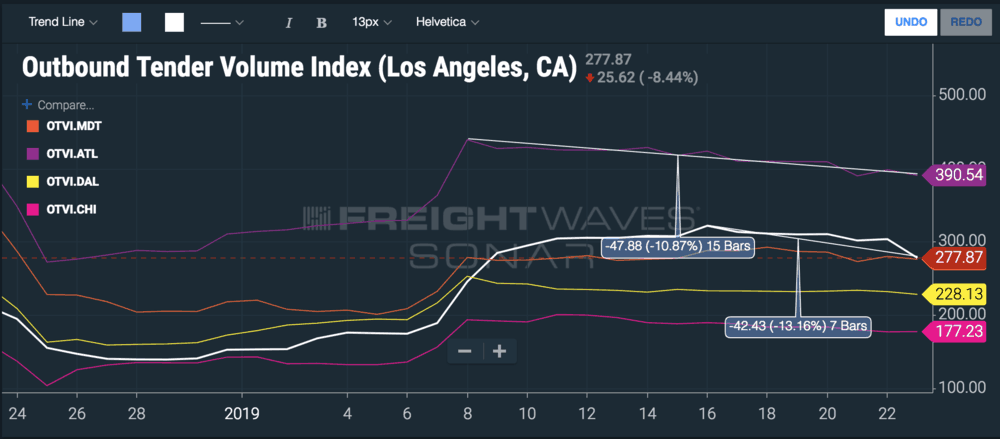

National truckload volumes (OTVI.USA) are down 5.54 percent since their year-to-date peak on January 8, and demand has fallen off even more in some major freight markets. Atlanta volumes (OTVI.ATL) have dropped 10.8 percent since January 8, and while Los Angeles maintained its momentum (OTVI.LAX) longer, peaking on January 16, volumes there have since slid 13.2 percent.

The capacity side of the industry had already loosened up substantially by November and December, and this month we’ve heard from freight brokers that trucks are easier to find than they have been in years. “Freight is flying off the boards,” one broker said. Now that the demand side is softening in major markets by double-digit percentages, we expect further downward pressure on spot rates.

In general, freight brokerages are in their happy place when both freight and trucks are plentiful. But when demand dries up, brokerages that are heavily exposed to the spot market also slow down. FreightWaves asked one experienced broker at a large Chicago-based 3PL concentrated in spot freight whether he had noticed volumes slipping in the past week or so.

“Does a bear s—t in the woods?” he responded. “It sucks. Lots of cold calls.”

Not all brokers are experiencing the downturn in the same way. MoLo Solutions, an upstart Chicago shop, paid its dues last year when it was willing to eat losers to service its customers’ freight. Now those grateful customers are giving MoLo more loads than ever.

“MoLo is experiencing higher and higher volumes week over week even in this slower market, but it seems like there’s less transactional freight out there,” said Matthew Vogrich, MoLo’s president. “We’re still in growth mode, and our customers are rewarding us for the service we provided them in a very hectic 2017-8.”

Vogrich seemed confident when he described the 88-strong team he had built over the past year and a half, saying that they were “ready for anything.” MoLo is undertaking construction work to double its office space to about 17,000 sq. ft. by March.

FreightWaves also spoke to Keith Gray, VP of Operations at LYNC Logistics, a Chattanooga-based brokerage that actively pursues contract business. We wanted to know if LYNC has felt the effects of the downturn yet.

“It’s not been bad,” Gray said. “So far through the month of January, [volume’s] staying up. I don’t know that we always expect it to fall in January or February, but for us it’s at least kind of remaining flat.”

“Capacity seems like it’s loosening up even further,” Gray continued, “and it looks like rates are dropping.”

LYNC expects one of its core businesses in food and beverage to begin accelerating about a month from now, and Gray referred to a perhaps idiosyncratic season opener.

“Everything starts to kick off right around Daytona,” Gray said. “[The race] kicks off the food and beverage spring season.” The Daytona 500 will be held this year on February 17.