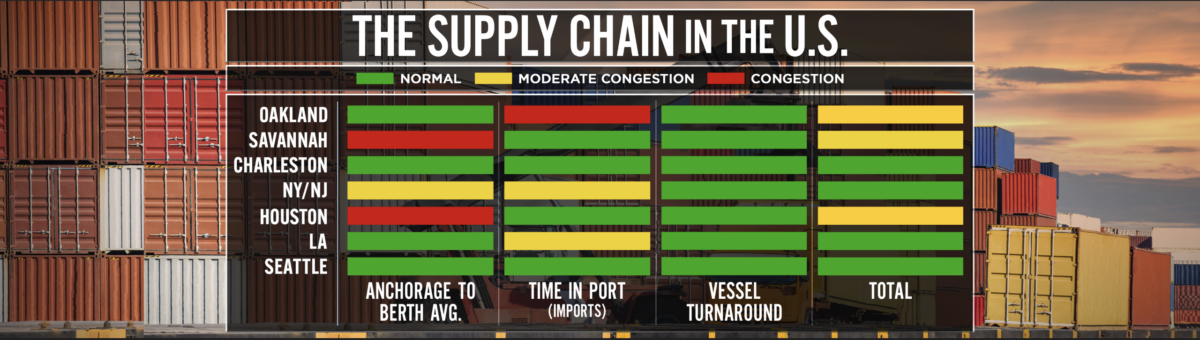

The peak season of 2022 presents a variety of challenges for logistics managers, according to the latest findings of the CNBC Heat Map. East Coast ports continue to see tremendous volume. A buildup of vessels is being seen off the ports of Houston and Savannah.

Alex Charvalias, the supply chain in-transit visibility lead at MarineTraffic, tells American Shipper, “On the U.S. side, Savannah is seeing its worst days, with an average waiting time of eight days before berthing. No signs of relief there, as well, with four times the TEU capacity waiting outside the port compared to the total TEU capacity the port is able to serve at any point of time.”

The Houston Port Commission is in the process of channel expansion and has awarded approximately $30 million toward investments in landside infrastructure and terminal operations.

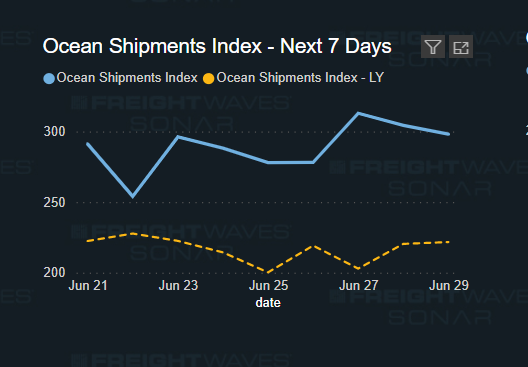

The Port of New York and New Jersey is also starting to see a buildup of vessels. The length of time the vessels are in port is contributing to this increase along with more vessels calling on the port from China. In the next seven days, SONAR is showing an 11.6% increase year over year in shipments and a 56.1% increase in ocean TEU volume.

To learn more about FreightWaves SONAR, click here.

To learn more about FreightWaves SONAR, click here.

Off the West Coast ports, volumes are also increasing. In the Pacific Northwest, John Wolfe, Northwest Seaport Alliance (NWSA) chief executive officer, tells American Shipper they are ready. Wolfe said the port has been working closely with supply chain stakeholders, expanding its service and capacity with its modernized Terminal 5.

“Currently, vessels proceed directly to berth and our multiple near-dock storage yards are poised to handle increased cargo volumes,” he explained. “We’re glad to share that marine terminals in our gateway have reduced the number of long-dwelling imports and their empties inventory, which better prepares the NWSA gateway to move additional containers. Truck power seems to be adequate at this time and warehousing seems to be recovering from near full capacity last year. While rail dwell remains challenging, rail service in Seattle and Tacoma is improving and our team remains in close communication with our railroad partners to continue to increase rail service. We are expecting a rise in the number of westbound trains, which will better align equipment balance and reduce dwell times. The westbound trains have been impacted by inland supply chain challenges. As an example, chassis turn times at inland rail hubs are a watch item that can affect availability for unloading container units at inland hubs. That can ultimately act as a governor to rail loading at the ports.”

The issue of rail capacity has been an ongoing problem at the West Coast ports for a couple of months.

The Port of Oakland, which has been a victim of canceled sailings as a result of ocean carriers trying to make up time on its schedule due to congestion in San Pedro Bay, is expected to see a pickup in vessel arrivals. Starting in early July, The Alliance’s PS4 service is expected to return to Oakland. This is a transpacific route between Asia and the U.S. West Coast.

According to Mike Baudendistel, FreightWaves’ head of intermodal solutions, “Intermodal volume has held up better than truckload volume as bloated retail inventory levels have lessened shippers’ speed requirements. That is most evident when comparing domestic intermodal to domestic truckload. Still, a lack of chassis availability in some locations is holding back intermodal volume and service levels. One data series that stands out is the average number of loaded intermodal cars in revenue service that has not moved in 48 hours — by that measure, delayed intermodal equipment is well above the three-year average for four of the five U.S. Class I railroads.”

China’s COVID status quo

In China, Shanghai is still in the grips of now-called “dynamic COVID-zero” restrictions. Trucking is still a challenge in some areas, impacting manufacturing with raw material shortages and container delivery.

While the container volumes will be high this peak season, a pullback is expected later in the year. Logistics companies and retail insiders tell American Shipper that Chinese manufacturers are receiving decreased orders by 20% to 30%. This decrease in orders will impact container volumes but after peak season and once Shanghai fully reopens.

“Spiking energy prices and inflation are driving consumers back to pre-pandemic spending habits,” explained Pervinder Johar of Blume Global. “And assuming this reduction in demand for products, orders will likely follow the decline. The two major unknowns for potential freight rate declines will be whether congestion will return resulting from possible work actions as the ILWU and PMA negotiate a new contract in the USWC and whether Ocean Carriers will exhibit the same capacity control disciplines that we saw in the early days of the pandemic in 2020.”

Alan Baer, CEO of OL USA, says they are seeing the U.S. consumer replaced as well. “As consumers move from purchasing stuff to buying services, importers continue to work on balancing order flow with sales expectations. Some industries are forecasting purchase order reductions of 20% to 30%, while others see no interruptions in their order flow. Overall, the risk appears to be to the downside. The decrease appears tied to economic uncertainty and not the migration of operations out of China.”

Europe labor watch

Logistics managers need to keep an eye on the U.K. as the railroad is on strike this week.

“The strike will most likely impact passengers, but surely also cargo moved on the railways,” explained Peter Sand, chief analyst at Xeneta. “It’s too early to see if ships en route would omit to call ‘North Germany,’ we’ll have to see. What is more worrying is that containers end up in the wrong place — and local feeder networks can’t work magic either bringing the boxes into the congested ports.”

“Some carriers are shying away from offering long-term contracts with the destination being the U.K.,” he added.

British union Transport Salaried Staffs’ Association (TSSA) has warned of a “summer of discontent” as they dispute pay, working conditions and job security.

The labor discussions going on at the German ports continues. Andreas Braun, EMEA ocean product director for Crane Worldwide Logistics, said new talks were planned by the unions and the port for June 21. “That does not mean a short warning strike would come before to support the union’s negotiations like we saw the last time. In Antwerp, the 24-hour general public strike on Monday will not make the situation any better.”

The container congestion, unfortunately, shows no signs of easing, and it is another game of whack-a-mole for the logistics world.

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight benchmarking analytics firm Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; and air, DHL Global Forwarding, and freight logistics provider Seko Logistics.