Alaska Air Group (NYSE: ALK) reported its financial results for the first quarter of 2019 after markets closed on April 25. Net income according to generally accepted accounting principles (GAAP) was flat at $4 million and $0.03/share, while non-GAAP earnings excluding merger costs and mark-to-market fuel hedge adjustments came in at $21 million or $0.17/share.

According to Barchart, analysts expected earnings per share of $0.13.

ALK generated $470 million in cash flow in the first quarter, including merger costs.

“We performed well in the first quarter despite severe winter storms in the Pacific Northwest,” said Alaska CEO Brad Tilden in a statement. “The leadership team and I want to thank our employees for running the operation safely, and as smoothly as possible, and for taking great care of our guests throughout the quarter. Our margin improvement initiatives gained traction despite the storms, and we are optimistic about the rest of 2019.”

Total operating revenues grew 2 percent year-over-year to $1.87 billion. Passenger revenue grew 2 percent year-over-year, Mileage Plan revenue grew 3 percent compared to the first quarter of 2018, but cargo revenue grew 22 percent to $50 million from $41 million. Cargo revenue represents about 2.6 percent of Alaska Air’s business.

Alaska Air performed well enough to return a substantial amount of cash to shareholders, paying out a $0.35 per-share dividend and repurchasing approximately $13 million in shares in the first quarter of 2019.

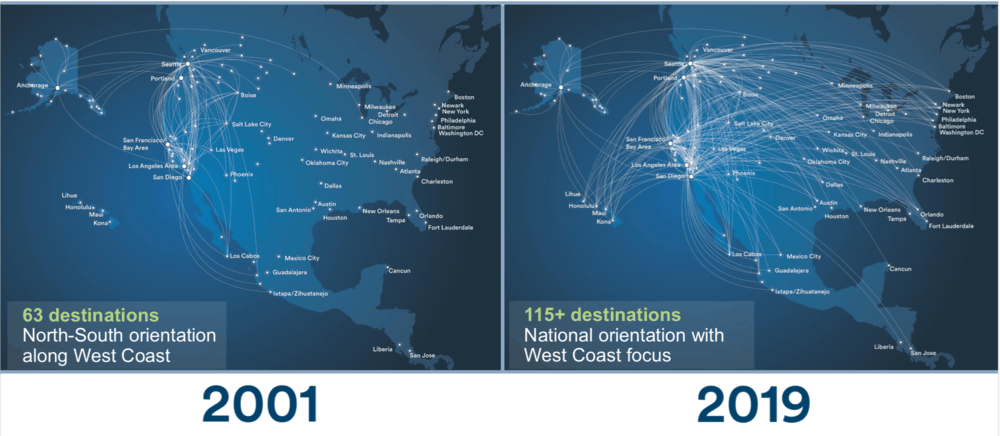

The merger costs Alaska Air is adding back to earnings stem from its acquisition of Virgin America for $2.6 billion in December 2016. According to a recent ALK investor presentation, Alaska Air is now entering the “Optimization” phase of its business plan, which followed 2010-2016’s “Expansion and merger” and 2017-8’s “Integration.”

“We’ve slowed our growth in 2019-2020 and have shifted focus to harvesting the value of our larger network,” the company wrote. ALK expects 2 to 4 percent growth in available-seat-miles (ASM), the airline industry’s standard capacity metric, in the “Optimization” phase, and wants to improve margins and focus on synergy capture and business optimization.

Alaska Air believes that it is poised to capture $235 million in additional revenue synergies over the next three years. ALK says that combined revenue and cost synergies should yield $195 million this year. By merging with Virgin America and consolidating passenger capacity out of San Francisco and Southern California, Alaska Air may be able to achieve some pricing power over those routes. Many of Virgin America’s destinations, though, to the Midwest, East Coast and Florida, were adjacent to Alaska Air’s core West Coast business and it’s unclear where revenue synergies will come from.