As 2020 draws to a close, the world’s container-shipping network is bursting at the seams. The Shanghai Containerized Freight Index jumped again last week, to another all-time high. There’s market chatter of all-in Asia-West Coast rates (including premiums) of over $8,000 per forty-foot equivalent unit (FEU) and Asia-East Coast rates of $10,000 per FEU.

The Container xChange box-equipment availability index is down to its second-lowest point ever. And there are still around 20 container ships sitting at anchor in San Pedro Bay, waiting for berths in Los Angeles and Long Beach.

The pivotal question for 2021 is: Will this import boom leave buyers with excess inventory? Have they been “borrowing” transport demand from the future? Is container shipping due for a hangover or is the party just getting started?

Common pattern in ocean shipping

The binge-now-pay-later pattern is commonplace in ocean shipping. Cargo shippers often transport cargoes and stockpile them well before they’re consumed, leading to transport-demand spikes followed by slumps.

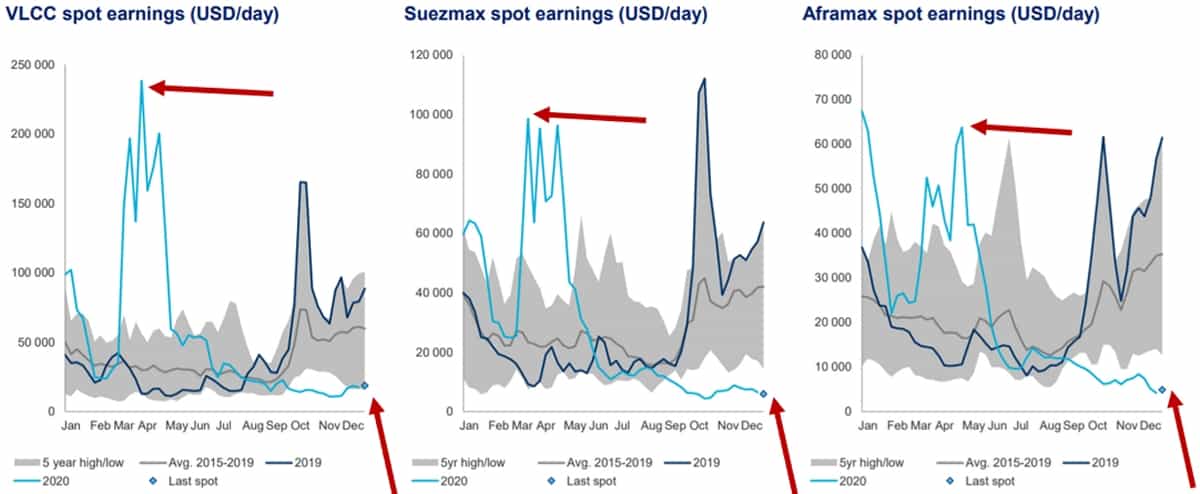

Tanker shipping is just the latest example. Spot rates reached astronomical levels in the first half as shippers put crude and refined products into floating storage. Rates are now at or below breakeven because refiners have yet to consume all that stored oil.

As Jefferies shipping analyst Randy Giveans previously told American Shipper: “Obviously the surge in tanker rates in March and April was great for profitability. But a lot of that was pulled-forward demand.”

Container shipping experienced a similar scenario two years ago. U.S. importers rushed to beat Trump administration tariff deadlines and front-loaded their imports. As a result, Asia-West Coast rates tracked by Drewry (SONAR: WCI.SHALAX) rose sharply in the second half of 2018 and fell hard in 2019.

Paul Bingham, director of transportation consulting at IHS Markit (NYSE: INFO) recounted, “The irony of what happened in 2018 is that the tariffs acted as an external stimulus to the freight industry, because it brought forward some of the 2019 freight movements. In 2019, we got the payback.”

Import demand hangover in 2021?

Opinions diverge on whether the current container boom will suffer the same fate next year. On the bearish side, both Sea-Intelligence and Panjiva raised red flags on Monday.

“It is clear that there is a mismatch between container volume growth and total sales,” warned Sea-Intelligence CEO Alan Murphy.

He pointed out that total sales rose 2.2% year-on-year in October but U.S. container imports were up 20.4%.

Murphy foresees “a distinct likelihood that the ongoing cargo boom supports a large inventory buildup, bringing inventory levels significantly above pre-pandemic levels.” He cautioned that this “would imply that at some point in 2021, we are due for an inventory correction.”

Christopher Rogers, a senior analyst at S&P Global-owned Panjiva, saw ominous signs in the November data. According to the Commerce Department, retail sales grew 4.1% year-on-year. But Panjiva data shows that imports of consumer discretionary products jumped 30% in November, after growing 31.8% year-on-year in October.

“Retailers face a growing mismatch between sales and import growth rates,” said Rogers. “The ongoing surge in consumer goods imports raises the risk of oversupplies and expanded inventories after the holiday season. That comes as the U.S. port system, particularly on the West Coast, remains congested, making late deliveries more likely.”

Bull theory: Party on in 2021

The bullish counterargument is that Americans will keep spending in 2021.

In a K-shaped recovery, the bottom leg of the “K” will be hard-hit by unemployment. But the top leg could more than compensate. Meanwhile, federal stimulus could help bottom-leggers bridge the gap until vaccines are widely available.

When the COVID threat finally lifts, consumers could redirect more of their spending toward services as opposed to goods. But even so, end-of-pandemic exuberance could keep goods sales elevated.

“Importers are not overshooting,” insisted Deutsche Bank analyst Amit Mehrotra in an interview with American Shipper last month. “They’re buying just to break even with their sales throughout. And at some point in 2021, when there is a vaccine [widely distributed], you’re going to see an incredible pent-up demand release.”

In a research note sent to clients Monday, Evercore ISI Senior Managing Director Dennis DeBusschere wrote, “As vaccines are rolled out globally over the next few quarters, a drawdown in savings will set up a consumer boom in the back half of 2021.”

He explained, “As is normal during recessions, consumers reacted to lost jobs and increased uncertainty by boosting their savings. Stimulus checks, increased unemployment insurance benefits and the sudden shift in spending helped drive savings to its highest level in at least 70 years.

“As economic uncertainty has declined, those pent-up savings have supported a rebound in spending. There is still plenty of room for the savings rate to decline,” asserted DeBusschere. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: Liner capacity control and the future of container shipping: see story here. Q&A: Flexport on 2021, container crunch and liner pricing coup: see story here. The mystery of the frozen trans-Pacific spot rates: see story here. COVID lockdown sequel threatens container shipping demand: see story here.