Coyote Logistics believes that trucking freight markets in the United States are at or near an inflection point. Capacity and spot rates will reach an equilibrium in the second quarter while contract rates will gradually fall through the year.

“The further we get into 2019, the lower [contract] rates will go as fear, uncertainty, doubt and general pessimism compound in the supply base,” wrote Chris Pickett, Coyote Logistics’ chief strategy officer.

Coyote’s thesis accords with recent information that FreightWaves has received from enterprise truckload carriers that report some Fortune 100 shippers are now attempting to claw back rate reductions even after contracts have been awarded.

According to Coyote’s updated model, in the fourth quarter the spot market will start looking better relative to contract, carriers will fall out of their routing guides, and spot rates should accelerate back above contract prices.

“Resist the temptation to be short-sighted. We expect 2020-21 to feel a lot like 2017-18, and shippers that lose focus on their long-term strategy will face challenges when the pendulum swings,” Pickett wrote in the new paper, which is addressed primarily to shippers. Coyote is holding a webinar discussing its findings at 2:00 p.m. EDT this afternoon.

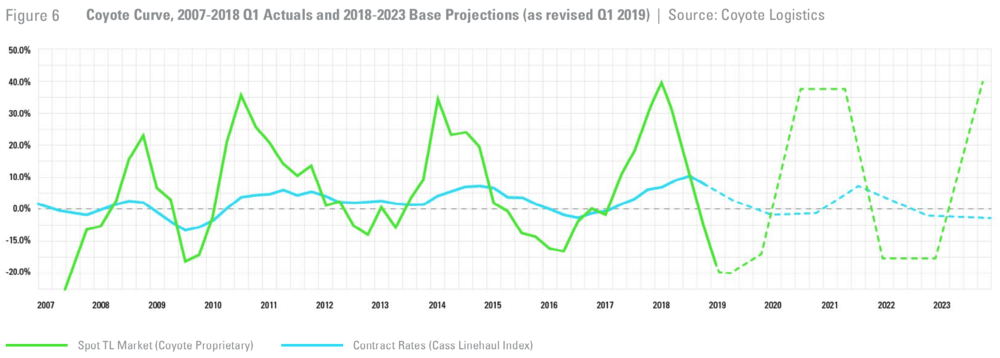

In September 2018 FreightWaves covered the Coyote Curve, the sophisticated freight market model published by Coyote Logistics. At the time, freight markets were still frothy, with historically high trucking spot rates pumped by hurricane activity, strong economic growth and confusion over unpredictable import volumes. But Coyote detected underlying weakness and called peak truckload well before other forecasters saw it, predicting that spot rates would collapse in the fourth quarter of 2018 and the first quarter of 2019.

Of course, that’s exactly what happened, but the depths of price deflation went even further than Coyote predicted. Part of that may have been caused by public policy. The Trump tax cut not only gave corporations an unexpected windfall of cash, but it also allowed carriers to write off 100 percent of the depreciation on new trucks in the first year. Record truck orders and wage inflation juiced an historic run-up in capacity that rapidly crashed spot rates from extraordinary highs to extraordinary lows.

The Coyote Curve overlays seasonal freight demand, annual procurement cycles and capacity cycles to build a dynamic, predictive model of freight markets. As FreightWaves wrote in September 2018, the model is insightful and useful. The biggest question mark is the one hanging over the macroeconomy, which has generated decidedly mixed data so far this year, including relatively robust consumer spending but, for example, an acute drop in residential construction activity.

“If this deceleration [in industrial production and imports] continues (relative to consumption) or we see a rise in Inventory levels (relative to sales), it will likely have a negative impact on truckload volume growth. If truckload volumes shrink, it will likely drive spot rates lower, deepening deflation. The opposite is likely true if one or more of these leading indicators reverses course and begins to grow,” Pickett wrote, acknowledging the uncertain macro outlook.

Predicting market movements is as much an art as a science, and Coyote does not claim to be able to forecast rates with absolute precision. Instead, Pickett wrote, the model is useful for calling the direction the market is likely to move in and the approximate timing of its turns.

“If we re-draw our original first quarter 2018 forecast line given our current position, we still project an inflationary market by 2020, only coming from a deeper 2019 deflationary trough,” Pickett concluded.

One of the most difficult components of the freight market to predict is how quickly bottom-of-the-barrel spot rates will bleed capacity out of the market. It’s difficult to get visibility into average fleet sizes and the number of fleets due to the fragmentation of the trucking industry, but FreightWaves reporters have heard anecdotally from an insurance provider that the number of trucks in the fleets insured by this firm has started to draw down.

It is unlikely that truckload carriers will be able to reduce capacity fast enough to support high asset utilization; at least that has not been the case in past cycles. Expect lower revenues per truck on a go-forward basis as shippers lean in and demand further contract rate reductions.