A general assumption that state restrictions because of COVID-19 drove consumers from retail stores to online sales may not be completely accurate, according to a data analysis. While e-commerce sales skyrocketed in 2020, and in-store sales declined across the board, data from Commerce Signals indicates that some of the states with the largest percentage increases in e-commerce sales also saw among the smallest declines in in-store sales.

Commerce Signals tracks consumer spending through credit card and debit card data, collecting information from over 40 million U.S. households. It anonymizes that data and sells the information and analysis to retailers, marketers and others interested in consumer spending trends.

“We have some clients who are retailers in various categories – they are national merchants and we’re working with their corporate marketing groups,” Nick Mangiapane, chief marketing officer of Commerce Signals, told Modern Shipper. “Obviously, every merchant knows what their own stores are doing … but what is really hard for them is to understand if that is something they’re doing [nationally] or that the local store manager is doing well … or is that [store] in a county that has very rigorous restrictions or very loose restrictions?”

A Modern Shipper analysis of the firm’s data from the period of March 15, 2020, through Feb. 13, 2021, found that of the 10 states with the smallest percentage decline in in-store retail sales, six of them – West Virginia, Mississippi, Alabama, Kentucky, South Carolina and Idaho – ranked in the top 10 of states with the highest percentage of e-commerce growth. Additionally, eight of them, including the top six, ranked among the top 10 in highest percentage of overall retail sales growth during that period.

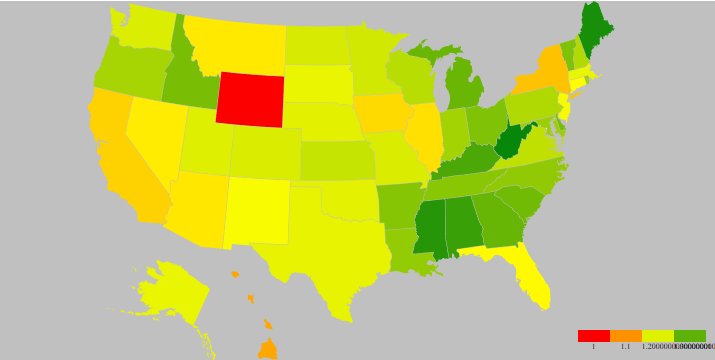

Heat maps show this, suggesting that in general, states in the Southeast performed better in both areas.

State-by-state e-commerce sales growth

In-store sales declines by state

West Virginia saw the highest e-commerce growth in the country during this period, with sales up 30%, Commerce Signals data shows. The state also ranked third in all sales channel growth at 7.1% and ninth in in-store sales growth at minus 7.7%.

The top state for in-store sales was Alabama, which saw a decline of only 3.3%. That state, though, was fourth overall in e-commerce growth at 26.1% and second in all channels at 9%. Mississippi was third in e-commerce sales growth at 27.6%, second in in-store sales at minus 3.7% and first in all channel sales growth at 10%.

Maine was second in e-commerce retail sales growth at 28.8% but did not rank in the top 10 in the other segments.

The remainder of the top 10 in e-commerce sales was Kentucky (24.7%), Georgia (22.6%), Michigan (22.5%), South Carolina (21.8%), Delaware (21.5%) and Idaho (21.2%).

The bottom 10 states in terms of e-commerce growth were Florida (10.6%), Nevada (9.6%), Montana (9.4%), Arizona (9.3%), Illinois (8.8%), Iowa (8.4%), California (7.8%), New York (6.7%), Hawaii (4.8%) and Wyoming (minus 6.7%).

In terms of the rankings based on in-store sales, the top 10 performing states were Alabama (minus 3.3%), Mississippi (minus 3.7%), Idaho (minus 4.7%), Kentucky (minus 6%), South Carolina (minus 6.1%), Utah (minus 6.7%), Louisiana (minus 7.3%), Indiana (minus 7.7%), West Virginia (minus 7.7%) and Arkansas (minus 8.3%).

The bottom 10 were Rhode Island (minus 17.3%), New Mexico (minus 17.8%), Maryland (minus 18%), New Hampshire (minus 18%), New Jersey (minus 18.4%), Connecticut (minus 18.5%), Massachusetts (minus 20.6%), California (minus 20.8%), Wyoming (minus 21.5%) and New York (minus 22.4%).

Retailers benefited from Amazon’s (NASDAQ: AMZN) decision to move Prime Day from its traditional summer time slot to Oct. 13-14 in 2020 jump-started the holiday shopping period, Mangiapane said.

“The holidays really started with Amazon when it ran Prime Day in the middle of October. There was a big spike there and it was actually bigger than the spike on Black Friday,” he noted.

The pandemic turned the retail world upside down, and brands without data have struggled to take advantage. For instance, many retailers assumed the week of Christmas would see a drop in sales, but that didn’t happen, Mangiapane said, noting that online sales that week were up 67.44% year-over-year.

Since the March/April 2020 time frame, online purchases are up 52.9% while in-store sales dropped 0.6%. Prior to COVID, online purchases were trending about 20% above prior year, slightly better than the 2016-2019 time frame, when e-commerce purchases ranged from 13.37% to 15.58% growth, according to U.S. Census Bureau data.

U.S. Census retail sales

The Census Bureau data also shows that during that same time period, in-store retail sales grew on a range of 1.8% to 3.3%, suggesting that 2020’s declines were entirely the result of COVID and state restrictions.

Looking deeper into the numbers, Commerce Signals data found that total consumer retail spending increased 21% in October, 17.9% in November and 16% in December. Online, though, grew 55.9%, 53.2% and 47%, respectively.

Starting with Prime Day and tracking through Black Friday, year-over-year growth for all channels was up 34%, but the online channel was up 83%. Starting with Black Friday, online year-over-year growth increased 53%.

Commerce Signals data tracks spending at more than 1,300 merchants, including major retailers such as Walmart, Amazon, Target and The Home Depot, across 26 categories like discount stores, hardware stores, clothing stores, gas stations, restaurants and hotels. For the merchants, this information is presented through dashboards that can break down the spending by ZIP code, giving them insight into how individual stores are performing or how online spending in given areas is tracking. Many also use this information to create targeted marketing programs, Mangiapane said.

The company offers a free tracking tool (free registration is required) that allows anyone to track consumer spending compared to diagnosed COVID-19 cases. The tool found a 21.1% growth in online sales since the start of COVID through Feb. 13 of this year. In-store purchases were up 2.5% during that time. The tool shows credit and debit card data usage by state, which helped identify that states with looser restrictions saw higher in-store sales growth, and those with tighter restrictions saw more online sales growth.

“When you compare sales by states and which states seem to have consumer purchases growing … there is definitely a relationship in brick-and-mortar sales and the level of restrictions in place there,” Mangiapane said. “There’s been a significant shift in online purchases and there is no signs of it slowing down.”

In addition to tracking sales, users of Commerce Signals dashboards can drill down to see how they – or their stores – are performing against peers. For instance, Amazon saw 51.1% year-over-year growth, but its comparative group of retailers saw sales increase 8.6%.

“It’s a way for them to focus in on where they are winning. The tool does everything except tell them why – it helps them focus,” Mangiapane said.

Click for more Modern Shipper articles by Brian Straight.

You may also like:

Social Auto Transport raises $1.5M in seed funding to expand gig economy auto-moving business

Bringg’s collaboration with Uber opens new doors for e-commerce