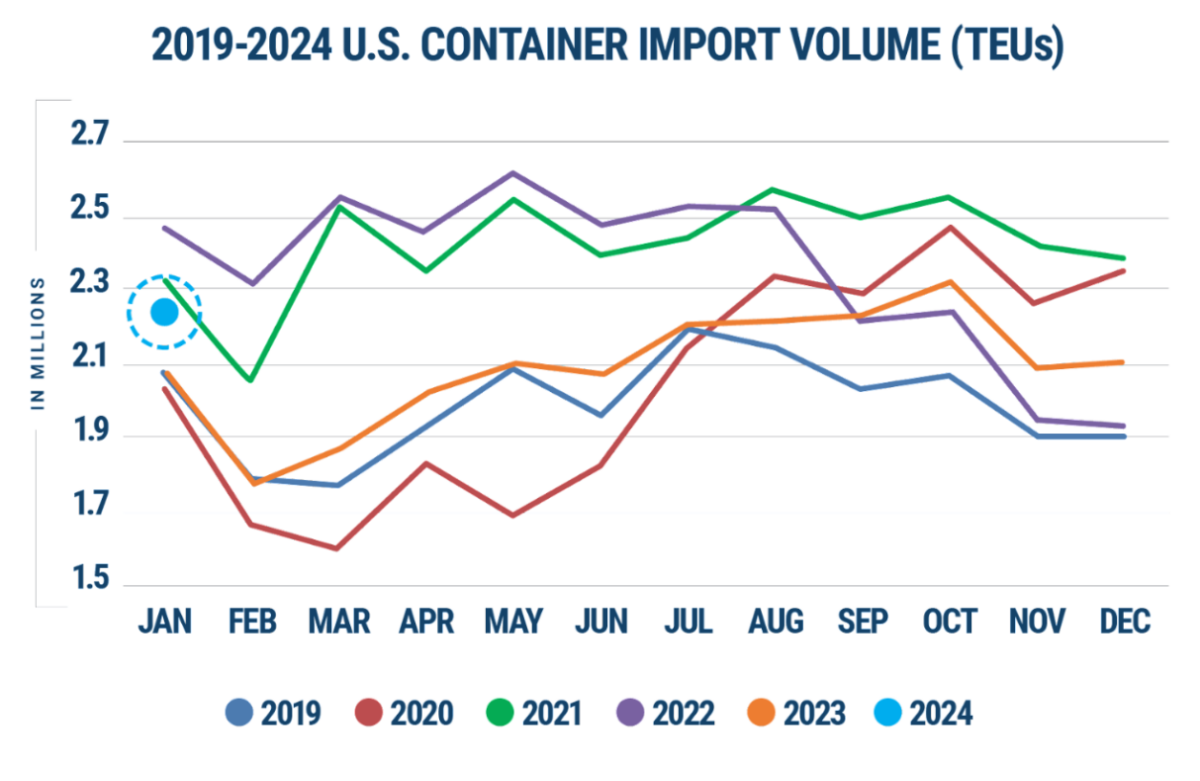

With geopolitical tensions rising around the Suez Canal and water levels dropping at the Panama Canal, one could be forgiven for expecting U.S. imports to fall in January. But, according to new data from Descartes, they were shockingly robust.

The U.S. imported 2,273,125 twenty-foot equivalent units of containerized goods in January, up a surprising 7.9% from December and 9.9% year over year, said Descartes (NYSE: DSGX) on Thursday. This 7.9% gain marks the largest month-over-month growth for January since 2017.

January is not typically the most active month for containerized imports, though it does benefit from the run-up to China’s celebration of Lunar New Year. During the two-week holiday, which began on Saturday, nearly all manufacturing plants and port facilities shut down.

In the weeks leading up to Lunar New Year, then, there is a rush to get goods from China closer to their final destinations. A 14.9% m/m rise in Chinese imports indicates seasonal trends are playing out as usual, very much unlike 2023’s anemic performance.

It stands to reason that West Coast ports would benefit most from this surge of Chinese imports, as in fact they did. But with the Panama Canal struggling to ramp up its number of transit slots amid an ongoing drought and dry season, it also stands to reason that volumes at East and Gulf Coast ports would suffer.

This inference, however, was not wholly true to reality.

East Coast performance was a mixed bag

According to Descartes data — which is derived from U.S. Customs filings and differs from official port data — imports to the Port of New York and New Jersey rose 23,138 TEUs, or 6.8%, in January versus December.

There were some other bright spots on the East Coast, albeit at smaller ports like that of Norfolk, Virginia, where volumes rose 6,087 TEUs or 5.1% m/m, and Baltimore, which saw TEUs rise 1,558 for a 3.4% m/m gain.

But the remainder of ports along the East and Gulf coasts saw sluggish activity in January. The Port of Savannah, Georgia, suffered a slight m/m dip of 360 TEUs or 0.2%, while import volumes at the heavyweight Port of Houston declined by 6,042 TEUs or 3.6% m/m.

It was little surprise that ports in Southern California felt the lion’s share of the surge in Chinese imports. Descartes data shows that imports to Long Beach, California, were up 48,054 TEUs or 15.1% m/m in January, while volumes at the nearby Port of Los Angeles were up 77,085 TEUs or 21.1% m/m.

This growth was enough to secure the lead for market share among major West Coast ports, where the top five saw their share of containerized imports rise to 43% (up from 39.7% in December), while the top East and Gulf Coast ports’ share fell to 42.4% (versus 44.9% in December).

Warning signs for the year ahead

Besides the ongoing disruptions at the Suez and Panama canals, Descartes noted some risk factors that could weigh on growth in 2024, which has thus far continued to surpass the pre-pandemic levels of 2019.

The labor agreement between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) will expire at the end of September. Last November, ILA leadership cautioned its members that “the union will hold firm on its pledge not to extend the contract,” citing the touch points of automation and wage increases, and that “members should prepare for the possibility of a coast-wide strike in October 2024.”

Other considerations mentioned by Descartes were the health of the U.S. economy, rising port transit wait times and the possibility of new COVID subvariants hitting vital links in the supply chain, particularly in China.