More ocean shipping signals are flashing green. First came a recovery in the container sector, driven by surging U.S. consumer demand. Now comes a rebound in dry bulk, the world’s largest freight market in terms of volume.

Rates for large bulkers known as Capesizes — ships carrying iron ore and coal that have a capacity of around 180,000 deadweight tons (DWT) — just hit year-to-date highs, driven primarily by industrial demand.

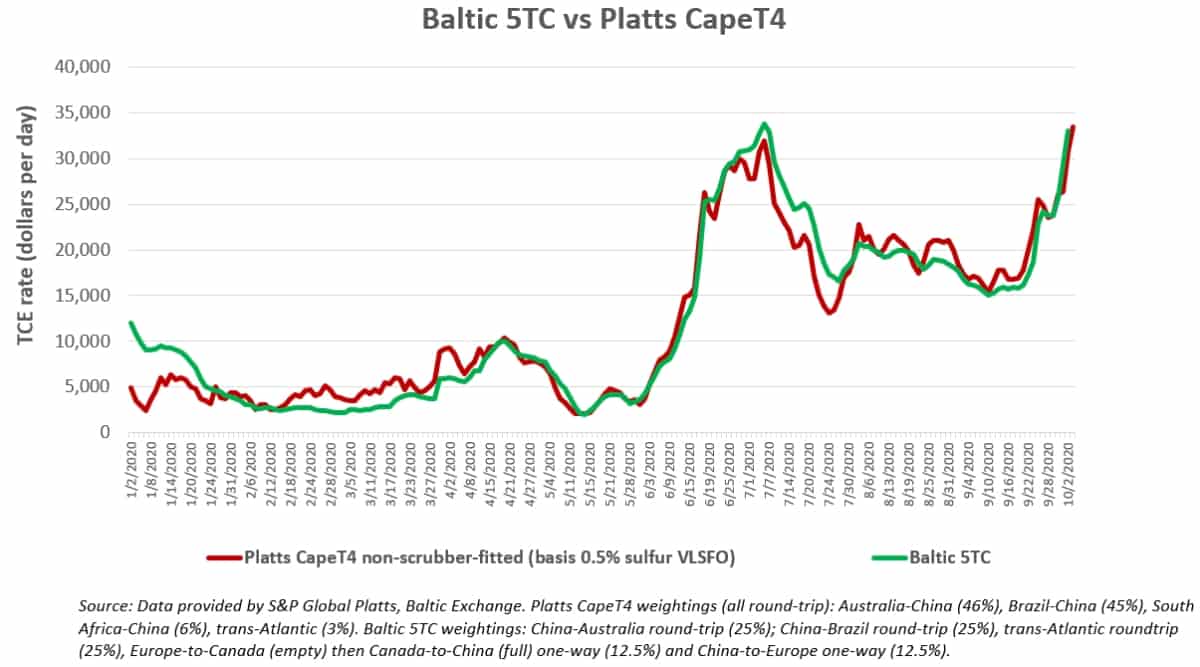

The Baltic Exchange’s 5TC index assessed Monday’s time-charter equivalent (TCE) rates for Capesizes burning 0.5% sulfur fuel at $34,293 per day. That’s up a whopping 127% month-on-month, marking the highest daily average since Sept. 23, 2019, and a year-on-year rise of 45%. Similarly, the Platts CapeT4 index assessed Monday’s rates for Capesizes burning 0.5% sulfur fuel at $33,438 per day.

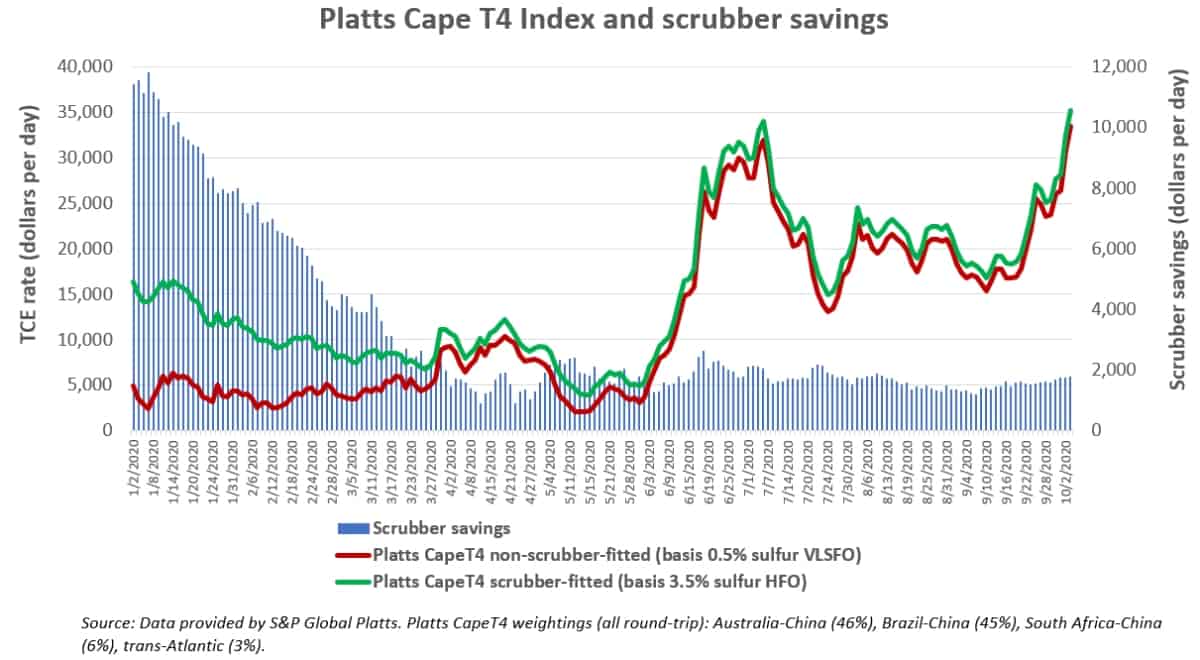

Platts also assesses rates for Capes that use exhaust-gas scrubbers and burn 3.5% sulfur heavy fuel oil. Due to much-slimmer-than-expected fuel spreads in the wake of the coronavirus, scrubber-equipped Capes currently save just under $1,800 per day. That brought scrubber Capes’ TCE rate to $35,253 per day.

Capesize rate drivers

Capesize rates are largely driven by iron ore volumes from Australia and Brazil and the extent that exports from those two sources match up (or not) with vessel tonnage positioned in the Atlantic and Pacific basins.

“The Cape index has been very strong on a lack of tonnage in the Atlantic,” Nick Ristic, lead dry cargo analyst at Braemar ACM Shipbroking, told FreightWaves. “Brazilian charterers have been extremely busy over the last couple of weeks covering October volumes, while shipments have jumped. Daily shipments from Brazil over the past seven days averaged 1.25 million [metric] tons per day, up 18% over the previous 10 days.”

And it’s not all about Brazil and the country’s giant iron-ore miner, Vale (NYSE: VALE). According to Clarksons Platou Securities analyst Frode Mørkedal, “During the July-September period a good amount of Australian cargoes were removed from the market due to normal seasonal maintenance on the part of the large iron ore miners. But higher volumes have now returned to the market.”

Regardless of whether the iron ore is coming from Brazil or Australia, the demand driver is Chinese steel production. “Iron-ore demand from China continues to boom,” affirmed S&P Global Platts.

Sub-Cape vessel classes

Rates for smaller bulkers — which unlike Capes have high exposure to grain transport — have yet to follow the Capes’ lead.

The rates for Panamaxes (60,000-95,000 DWT) are only $12,400 per day, down 17% year-on-year, according to Clarksons. Rates for Supramaxes (45,000-60,000 DWT) are $10,900 per day, down 19% year-on-year.

Asked about the smaller bulker classes, Ristic told FreightWaves, “We are fairly positive on grain trades in the fourth quarter. U.S. soybean volumes are picking up, Brazilian corn shipments remain strong and Ukrainian corn exports are about to kick off.”

On the downside, “seriously depressed coal volumes globally are keeping some pressure on Panamax earnings.”

On the upside, Capesize strength should trickle down. “If high Cape rates are sustained, Panamaxes will naturally follow as Cape stems will start to be split,” said Ristic. A “stem” is a shipper’s quantity of cargo. Shippers will split a Capesize cargo into two Panamax cargoes if it’s cheaper to do so.

S&P Global Platts reported Monday that charterers are already starting to split Atlantic Basin Capesize cargoes into smaller stems.

Dry bulk stocks to bounce?

Shipping stock performance has diverged over the past three months. Tanker stocks have languished near their year-to-date lows, battered by storage-destocking headwinds. In contrast, container-ship leasing stocks have risen sharply over recent weeks, playing catch-up with already recovered charter rates. Will dry bulk stocks now bounce as rates rise?

Stocks with high Capesize exposure include Star Bulk (NYSE: SBLK), Golden Ocean (NASDAQ: GOGL) and Genco Shipping & Trading (NYSE: GNK). Dry bulk stocks with high exposure to smaller asset classes include Scorpio Bulkers (NYSE: SALT) and Eagle Bulk (NASDAQ: EGLE). In addition, the Breakwave Dry Bulk Shipping Exchange Traded Fund (NYSE: BDRY) buys freight futures to offer investors more direct exposure to rates.

These equities have been rising over the past week, however, with one exception they are still down 22%-43% year-to-date. (The outlier is Scorpio Bulkers, which is doing far worse: down 75%.)

When will rates retreat?

The problem for dry bulk stocks is that rates will almost certainly retreat in the months ahead. Is fleeting rate strength is enough to entice investors? “Some seem to be wondering how much more juice is left in the cherry [but] don’t be Boo-Boo Bear. There’s more juice. We promise!” wrote a broker at Barry Rogliano Salles.

Looking at the forward curve, Cape futures for the month of October rose to $28,553 per day on Monday — a positive sign. That said, December futures fell to $18,672 per day.

As Ristic explained, “Fourth-quarter FFAs [futures] are lower than current earnings and it’s extremely unlikely for these levels to be sustained for months at a time. The longer the current spike is sustained, futures will continue to rally. But if rates start to rapidly fall, the sell-off will likely be even more aggressive than the rally.”

Breakwave Advisors argued in a new blog post that it’s not about where rates peak, it’s about the average. In the past decade, Capesize rates peaked at $42,000 per day in 2013. “It will not be surprising to surpass such levels soon,” Breakwave predicted, acknowledging that rates would then inevitably correct.

Instead of dismissing the current situation as “another short-term spike,” Breakwave advised investors to focus on freight cost relative to the price of a cargo of iron ore or another dry commodity. Looked at this way, the freight cost percentage is now at a seven-year low relative to the cargo price.

Breakwave maintained that this creates room for the freight cost to rise, as the percentage of freight cost relative to the cargo price could revert higher. This could benefit rates over time. And for investors, the average rate over time is what to watch, not press headlines like Monday’s on new highs. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON DRY BULK: Dry bulk rates slashed in half in July: see story here. Can dry bulk woo stock gamblers who bet on tankers? See story here. Will dry bulk remain the ‘Wile E. Coyote’ of ocean shipping? See story here.