After years in the doldrums, commodities are finally having their day. When equities markets underwent a correction in January, commodities escaped the worst of the pain, rallying on strong projections for global growth in demand: just because large corporations suddenly seemed overvalued compared to their earnings did not mean that people would stop using oil, copper, wheat, and nickel. Traditional havens like gold have also performed well against equities.

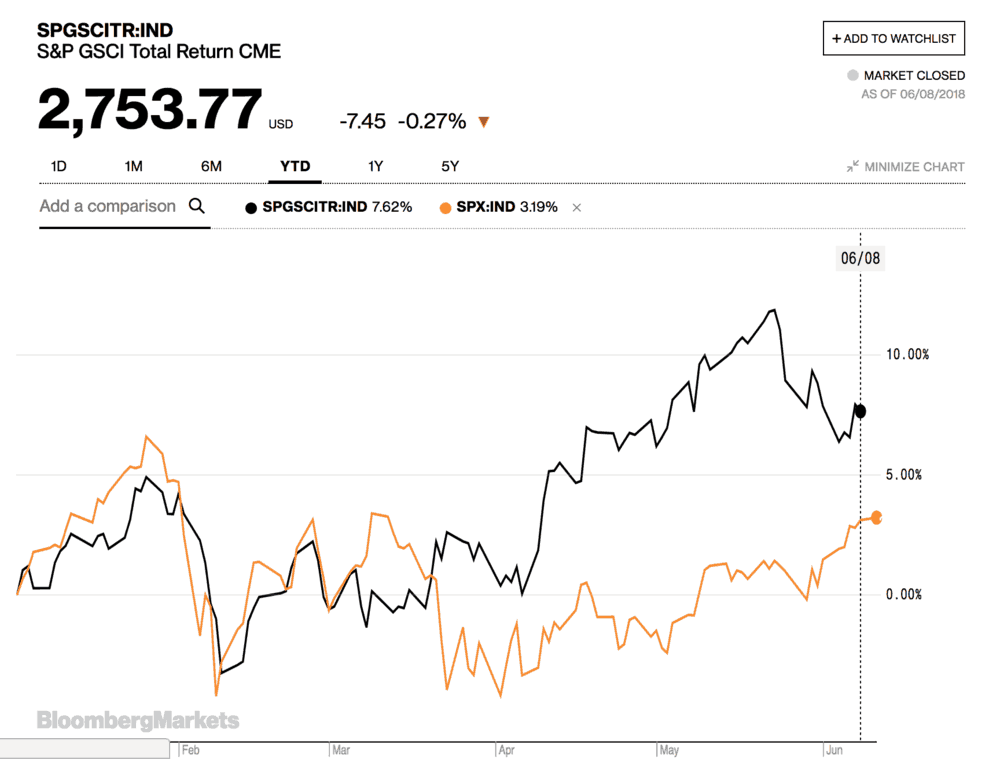

The chart below compares the year to date relative returns on S&P’s Goldman Sachs Commodities Index (black) with the S&P 500 (orange):

West Texas Intermediate crude is up about 10% year to date (at just over $66 from just over $60, after falling from a high at $72.24 on May 21). Frozen concentrate orange juice is bringing 156.8 cts per pound, up 12.6% this year. Nickel, trading on the London Metal Exchange, is bringing $15,235 per metric ton, up 20.1% year to date. CME Lumber futures are up 30% year to date, settling at $589 last Friday. Meanwhile, the S&P 500 is up only 3.2% since January 1, and the Nikkei 225 has grown only .17% in 2018.

Surging commodity prices can be something of a double-edged sword for freight markets, though. On the one hand, robust industrial and manufacturing sectors consuming resources are a positive signal for transportation providers—whether by truck, rail, ship, or plane—because both raw materials and finished goods have to be moved. On the other hand, too much price inflation can eventually affect demand, as we might be starting to see with lumber prices and housing starts.

Bullish price action on commodities sourced in the U.S. will bolster trucking-intensive resource extraction: but the catch is that these movements are highly localized and mode-specific. Flatbed trucks move rigs and equipment in West Texas’ Permian Basin to support the shale boom and haul logs out of the timber-rich Southeast and Pacific Northwest regions, while reefers carry oranges out of Florida.

Nickel is an interesting commodity right now because of its use in two industries: stainless steel smelting and lithium-ion batteries. The most common kind of stainless steel, type 304, contains about 8% nickel, and about 68% of global nickel production goes into steel. By contrast, only about 3% of the nickel produced in the world is used in lithium-ion batteries, but the nickel composition of batteries can be much higher, and demand for those batteries is expected to accelerate alongside the growth of electric vehicles.

Electric car companies like Tesla Motors, which is locked in a struggle to rapidly expand its production this year, may have avoided one metal shortage only to run into another. Our cobalt story in January pointed out that the metal had experienced a doubling in price in less than a year, and Tesla executives spoke openly about their supply chain’s exposure to cobalt on corporate earnings calls. Last month, though, Tesla released some details about the Model 3’s battery chemistry, which is built on a nickel:manganese:cobalt ratio of 8:1:1.

As noted above, nickel is now up 20%: this is thought to be mostly due to speculators betting on the future size of the electric vehicle industry, but trade turbulence, including steel tariffs imposed by Mexico on the United States and by the U.S. on the E.U., has also driven the price up.

“If you think this is just a temporary rise in prices, let me tell you that over the past 15 years, $4.00 a pound is roughly the bottom for nickel,” wrote Bill Maurer at Seeking Alpha Monday morning. “A little over a decade ago, prices spiked to about $23.00 a pound. With growing demand thanks to the rise in EVs, it wouldn’t surprise me to see prices get into the double digits in the next couple of years. Cobalt and lithium prices have certainly soared in recent years, and the recent rally in nickel could just be the start of a similar trend.”

The commodities rally of the past year has been driven by two primary factors: synchronized global economic growth and a lack of cap-ex projects during the previous years’ commodity slump that could come online and create new supply—and that under-investment applies to everything from crude oil to cobalt.

“The commodity rally was both due to strong oil prices and stable domestic demand,” Larry Hu, a Hong Kong-based economist at Macquarie Securities Ltd, told Bloomberg last week. “The economy has held up well in the second quarter, but will gradually slow in the second half of this year.”

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.