Growth in the US economy improved considerably in the second quarter of the year, as a rebound in consumer spending helped drive the strongest quarter of growth in nearly four years

The Bureau of Economic Analysis reported that US gross domestic product rose at a 4.1% annualized pace in the 2nd quarter, up from 2.2% growth in the previous quarter. This marks the strongest quarter of growth since the 3rd quarter of 2014, as strong fundamentals and some temporary factors supported activity during the quarter.

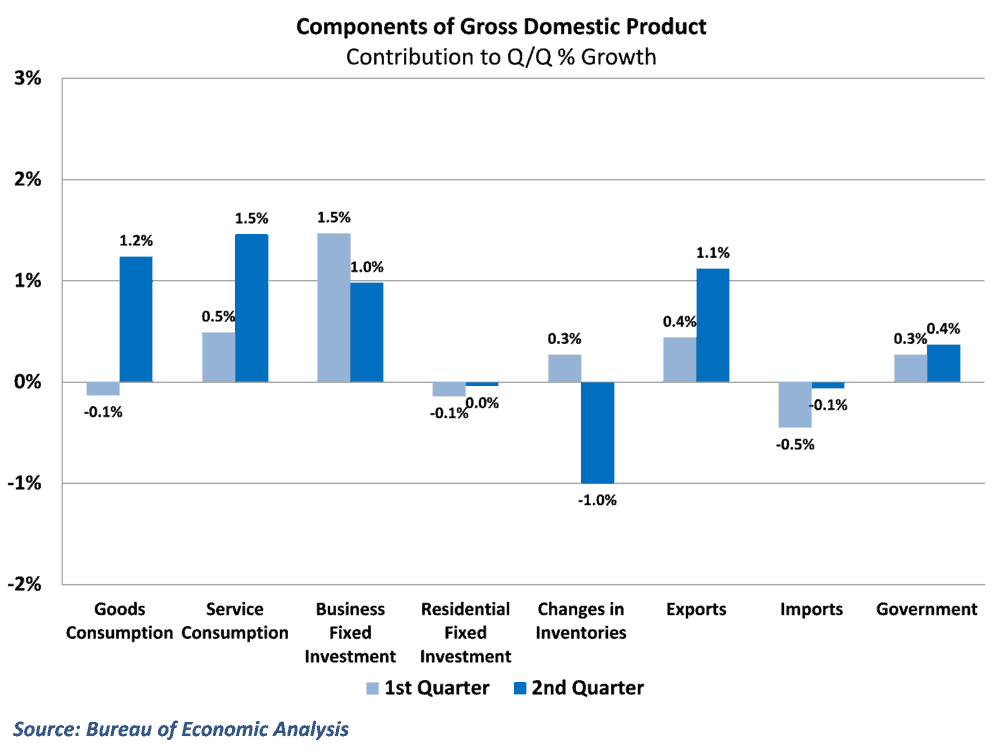

A rebound in consumer spending, particularly on goods, was the primary force behind the 2nd quarter rebound. Boosted by recent tax cuts and rising household wealth, real consumption of goods and services rose at a 4% annualized pace and contributed a whopping 2.7% to overall growth for the quarter. Business fixed investment slowed from the torrid pace in the 1st quarter, but still grew an impressive 7.3% and added a full percentage point to GDP during the quarter.

In addition, economic growth benefited considerably from international trade, which added another full percentage point to activity during the quarter. Much of this was driven by a one-time surge in soybean exports however, as fear of retaliatory tariffs led many foreign buyers to alter their buying patterns and purchase early. This helped offset a slowdown in the pace of inventory building, which subtracted 1.0% from growth in the 2nd quarter. Final demand, which subtracts out inventory fluctuations, grew over 5% during the quarter in a sign that demand from nearly all sectors was robust during the spring.

Some easing ahead

Fundamentals in the economy look generally strong for the 3rd quarter, but it is highly unlikely that the economy will grow at this fast of a pace going forward. The temporary surge in exports during the 2nd quarter is likely to be reversed in upcoming months, which will subtract from growth during the quarter. In addition, consumer spending benefited from a good amount of pent up demand in the 2nd quarter after such poor performance at the start of the year. Consumer fundamentals still look good, but the pace of growth is likely to moderate some going forward.

Still, things look healthy overall for economic activity going forward. Temporary fluctuations aside, the economy is still benefitting from the effects of tax cuts and high consumer and business confidence, and activity should remain strong in upcoming months even if it’s not quite as fast as the 2nd quarter.

GDP and freight markets

In a broad sense, gross domestic product is the most often utilized measure of the state of an economy. GDP measures the value of all goods and services produced within an economy during a given period, and provides the broadest measure of economic activity.

Most of the activity in the US economy revolves around the production of services, however, which has looser ties to freight movements. Spending on things like health care, recreation, and financial services are a significant chunk of economic production, and headline GDP numbers may not accurately reflect the state of the freight market.

That is not to say that the GDP data releases are useless. Many of the components of overall GDP, such as goods consumption, residential investment, inventories, and goods exports and imports, are tied directly to the goods side of the economy and provide useful insight into which areas of freight are experiencing a healthy demand environment.

During the 2nd quarter, most of the components of GDP on both the service and goods side of the economy exhibited quite a bit of strength. There was plenty of good news to go around for freight markets, as improved retail spending and strength in investment demand helped drive freight movements in the economy

Behind the numbers

This morning’s report confirmed what many in the freight markets have already known about the 2nd quarter. It’s no secret that demand has been exceptionally strong in recent months and the gaudy numbers in the various components of GDP help illustrate the broad-based strength. In fact, many were calling for even stronger growth a few weeks ago, before some late poor results from trade and inventories dampened expectations.

Some will point to the temporary fluctuation in export performance as a reason to not get too excited over this morning’s report, and there is certainly ample reason to suggest growth will slow down some. But consider that there was also a big inventory building slowdown that is also unlikely to repeat itself. Final domestic demand strips out both inventories and exports and also grew over 4% during the quarter. With the exception of stubbornly poor results from the housing sector, the economy appears to be firing on all cylinders, and even if growth slows some, it will still be slowing to a healthy pace.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.