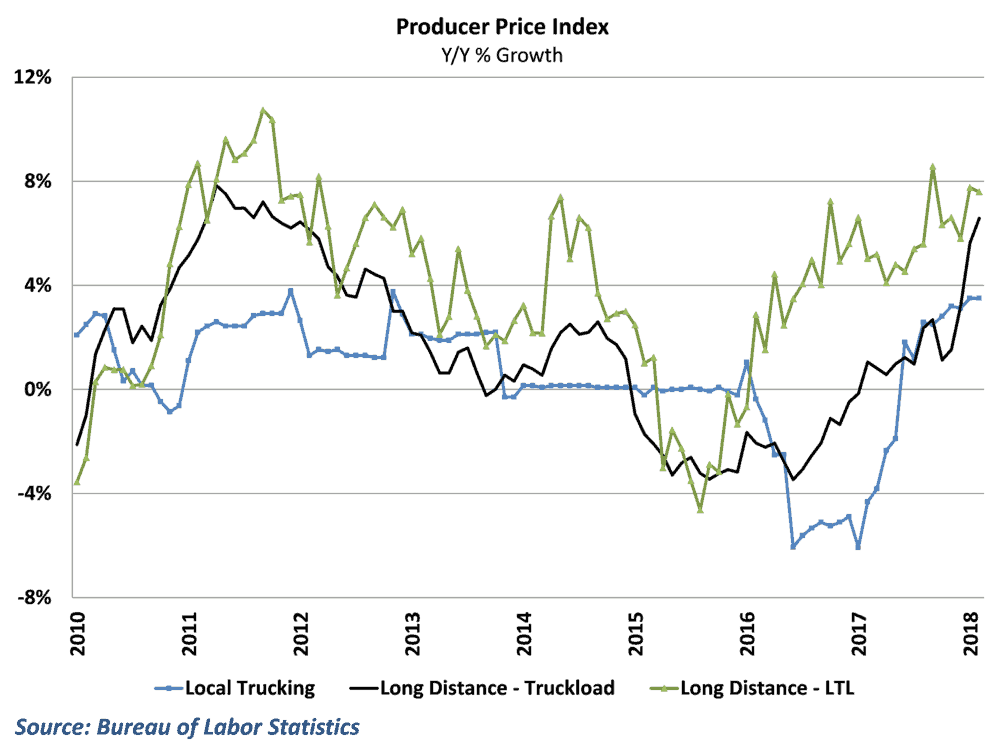

Producer price inflation remains modest, but not for trucking and LTL where rates continue to soar

Data on producer prices show that there remains some building pressure for overall inflation in the economy. Earlier this morning, the Bureau of Labor Statistics reported that the producer price index (PPI) rose a modest 0.2% in February from January’s levels and is now 2.8% higher than at this point last year. This month’s increase was driven primarily by a gain in service prices, as the price for goods in the economy actually fell on aggregate in February.

The situation is quite different within the trucking industry, where rate increases continue to push to new heights. The producer price index for general freight trucking rose another 0.6% in February and is now up over 6% from this point last year.

Keep in mind that much of this surge in pricing is coming despite relatively modest (below 4%) price increases for local trucking services. The biggest acceleration in pricing has come from long distance truckloads, which rose nearly a full percentage point in February and are now up 6.6% year over year. This marks the fastest pace of price inflation for long distance trucking since late-2011. LTL prices also continued to rise at a rapid pace, with yearly inflation remaining near 8% in February. (Story continued below)

There is good reason to expect that freight rates will continue to accelerate in upcoming months, despite the mounting signs that the economy is cooling off after rapid growth in the second half of last year. Rising delays and increased costs are going to remain an issue for the industry as it approaches the April implementation of out-of-service criteria associated with the ELD mandate. These forces will continue to put upward pressure on freight rates even as demand from the overall economy returns to more normal conditions.

Behind the Numbers:

The overall PPI data didn’t come as much surprise, as much of the recent results related to price levels in the economy suggest a modest acceleration in inflation. Markets have been particularly sensitive in recent months for any sign that inflation might be gaining steam faster than expected, as this would have implications for Fed policy for the remainder of the year. Fed official have other preferred metrics for inflation in the economy, and there is not much in the headline numbers to excite policymakers in one way or another here.

On the freight side, the surge in pricing for long distance trucking is certainly striking. Keep in mind that at some point the economy is expected to get an additional boost in activity once the tax cuts passed last December begin to take hold in the economy. To the extent that this materializes, it would only exacerbate the current capacity crunch in trucking. There are some signs that these trends are beginning to filter into other areas of transportation as well, as intermodal and rail carriers are increasing being called on to carry load that would typically be hauled by long distance trucking. Intermodal rates in particular will be an interesting trend to keep an eye on, as prices jumped nearly 2% in February. The strength in pricing is generally good news for carriers, but rising transportation costs have put a great deal of pressure on businesses involved in the goods economy.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.