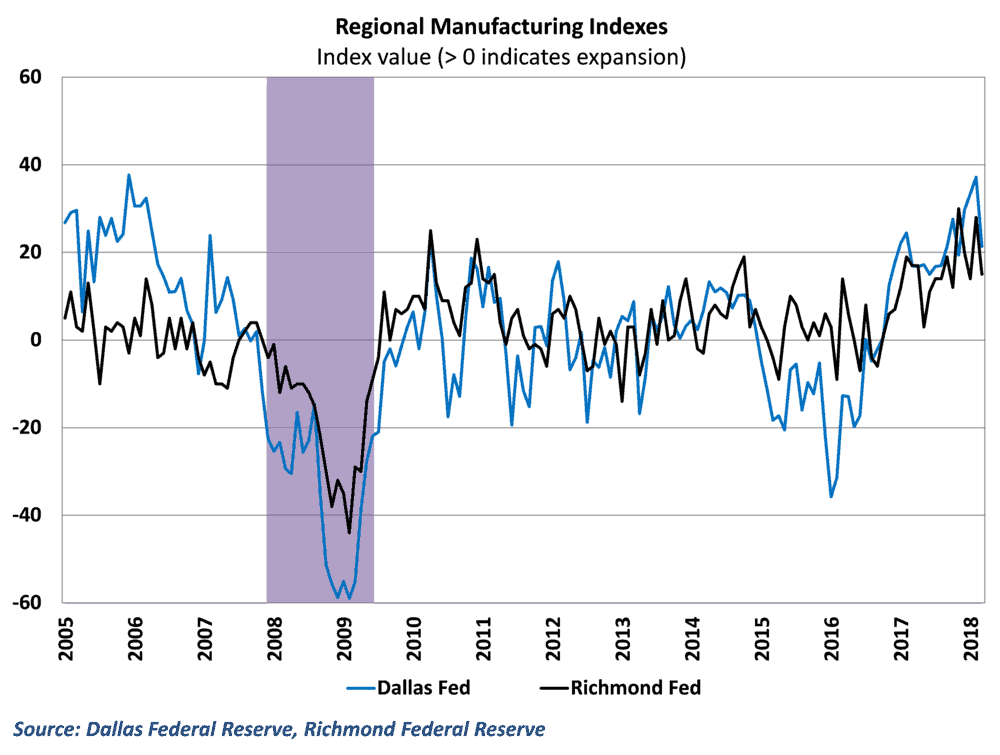

Regional surveys from both the Dallas and Richmond Federal Reserve showed some softening in manufacturing activity in March, and signs have emerged that the recent tariffs implemented by the Trump administration are starting to affect domestic producers.

The Dallas Fed’s manufacturing index, which covers manufacturing activity in the state of Texas, slipped to 21.4 in March, down from a post-recession high of 37.2 in the previous month. Results from the Richmond Federal Reserve’s manufacturing survey tell a similar story, as activity in March dipped to 14 from a reading of 28 in March. This serves as the latest in a series of signs that manufacturing activity is cooling in the economy after historically strong readings in recent months. (Story continued below)

About the regional surveys

Each month, the Dallas and Richmond Federal Reserve banks conduct surveys with local manufacturers on various aspects of business activity, including current production, new orders, shipments, hours worked, and prices paid and received. Indexes are created for each of the components of the survey by subtracting the percentage of businesses that say that activity is contracting from the percentage that say that activity is expanding. As such, any reading above zero indicating that activity in the region is expanding.

The methodology of these regional surveys is similar to the Institute of Supply Management’s (ISM) purchasing managers index for the manufacturing sector, and data from the Dallas and Richmond surveys (along with the Empire State manufacturing index for New York) can provide some advance insight into what ISM readings will be for the month. Historically, the ISM data has had close ties to truck tonnage in the US economy, and so the regional surveys can be seen as a view into freight demand at a regional level.

The Dallas Fed surveys are largely focused on manufacturing activity in the state of Texas, which is the second largest producer of manufacturing output in the US, behind only California. The Richmond Fed surveys cover activity in the 5th Federal Reserve district, which includes Maryland, Virginia, West Virginia, and the Carolinas.

Signs of tariff impact

The details of the regional surveys showed broad-based-declines in activity across a number of aspects of business activity, with lower readings in current production, new orders, hours worked, and shipments in March. In addition, data on prices showed a faster pace of growth in terms of the prices that manufacturers were paying for inputs into their processes, while reporting a slower pace of growth in the prices that they are receiving for services.

Several respondents attributed the rise in prices to the recent announcement of steel and aluminum tariffs by the Trump administration. One Texas manufacturer in the fabricated metals industry noted, “The national rhetoric regarding steel tariffs immediately raised the price of steel significantly. We had a large amount of steel under contract, yet to be purchased, which will ultimately increase costs and reduce profits considerably.” Another manufacturer of transportation equipment said, “We will likely have to raise prices due to the effects of aluminum tariffs.”

Moreover, several survey respondents in the Dallas Fed survey mentioned the increased uncertainty surrounding the tariffs, both in terms of the outlook for manufacturing demand and the ability of manufacturers to properly price their product. These kinds of responses give some insight into the initial reaction to recent trade policies, and become interesting trends to monitor now that the tariffs have been officially implemented.

Behind the numbers

The drop in the regional surveys was sharp for both the Richmond and Dallas Fed results, falling well below consensus expectations. As has been the case with much of the recent data, part of the explanation for the softening data is just a return to more normal conditions. Gains in factory orders and survey data surrounding manufacturing hit multi-year highs in several cases, so a drop off at some point was to be expected. In addition, the Richmond and Dallas readings cover a lot of manufacturing activity, but regional data from New York was favorable for March so the national readings are not likely to experience the same sharp downturn.

The tariff commentary within the report is informative, but even that may be a bit overstated. Keep in mind that the initial announcement was for tariffs across the board on aluminum and steel. At the time, these tariffs were expected to have big implications for downstream industries. When the final tariffs were implemented, the contained exemptions for most of the US’ major steel and aluminum trade partners such as Canada, Mexico, and the European Union. These regional surveys are conducted early in the month when the tariffs as an idea would have been far more threatening than the reality. the uncertainty around policy is still an issue, however, and it will be interesting to see how it affects policy going forward.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.