On a call with analysts Friday, management from Forward Air (NASDAQ: FWRD) laid out some margin targets after posting a first-quarter earnings beat and issuing guidance well ahead of expectations.

Thursday after the close, the Greeneville, Tennessee-based asset-light trucking and logistics company reported net income from continuing operations of 60 cents per share, which was 3 cents ahead of consensus and 19 cents better year-over-year.

Continuing operations exclude the high-frequency pool distribution segment, which was sold in February.

Outlook moves higher

The outlook for the second quarter came in notably higher than analysts’ expectations. Revenue is expected to increase between 35% and 40% year-over-year, implying $387 million at the midpoint compared to the consensus estimate of $349 million. Earnings per share were forecast to a range of 96 cents to $1 compared to consensus of 79 cents.

Behind the bullish outlook is the company’s “strongest March ever,” according to Tom Schmitt, chairman, president and CEO.

Schmitt said Forward saw March tonnage increase 32.6% year-over-year in its expedited freight segment with less-than-truckload recording a 15.6% operating margin. The tonnage comp was easy as it includes a freight falloff in the second half of March 2020 when COVID-related shutdowns widened.

However, tonnage was 10.8% higher than March 2018, a big year for the industry.

Further, April has not seen a letup from March as tonnage was up 56% compared to April 2020, albeit another easy comp. Schmitt said Forward has experienced several high-volume days recently that have “never been seen before” by the company, referring to the current market as “boom times right now.”

Schmitt summed up the month saying, “I love our April.”

Margins to move higher sooner than later

Schmitt believes the company has reached an inflection point in operations following several acquisitions over the last couple years, notably in the final-mile and intermodal markets, as well as the addition of LTL locations. LTL service is now run out of more than 100 locations currently with the expectation that at least 10 facilities will be added annually over the next three years.

Some investors have been concerned with expansion beyond the company’s traditional core airport-to-airport LTL offering but Schmitt believes management has a handle on the company’s past acquisitions and that operational improvement is on the horizon.

In LTL, the company inherited some ship-from-anywhere-to-anywhere business through acquisition that has been a drag on margins and the ire of investors. Schmitt said growing scale in the business resulted in taking on freight that wasn’t appropriately priced for its level of complexity. The current capacity tightness is allowing those yields to be brought up to acceptable levels.

The company’s recent general rate increase of 6% has been accepted by customers without any pushback. Adding in increases in accessorials and general yield improvement efforts, the company is seeing double-digit type rate renewals.

He said the company’s core LTL business can still generate margins of 18% to 19% and its newer LTL business can reach 12% to 13% margins. The all-in LTL operating margin is expected to be 15% to 16%. The other offerings in the expedited division – truckload and final mile – are expected to produce high-single-digit margins.

Intermodal is forecast to produce double-digit revenue growth and double-digit margins, a “double-double,” Schmitt said, and a level the segment achieved in March.

He said the company’s consolidated operations will produce close to a double-double during the second quarter, which is a jump from the 6.3% operating margin produced in the first quarter. The goal is to beat the recent high of $164 million in earnings before interest, taxes, depreciation and amortization set in 2018.

First-quarter results

The first-quarter result included 20 cents per share in expenses related to cybersecurity and shareholder engagement, following a cyberattack at the end of 2020 and a proxy battle with an activist investor. Severe winter weather was called out as a 6-cent-per-share hit to the quarter as well.

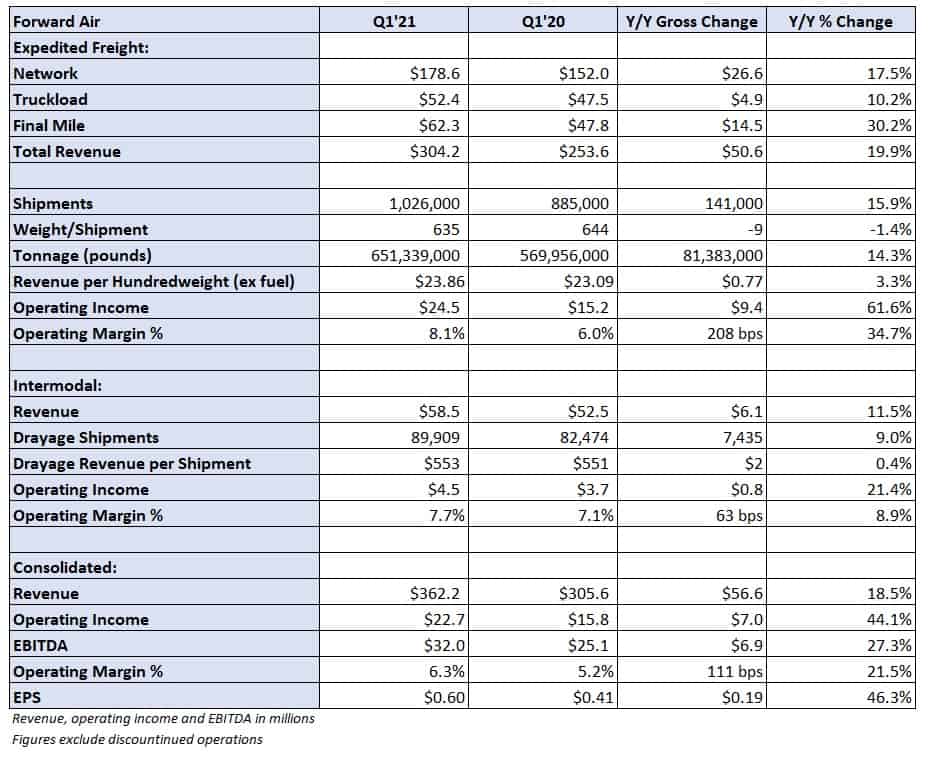

Expedited freight revenue increased 19.9% year-over-year to $304 million as tonnage jumped 14.3% and revenue per hundredweight excluding fuel surcharges was 3.3% higher. The division recorded 210 basis points of margin improvement posting an 8.1% operating margin.

Purchased transportation expense as a percentage of revenue increased 170 bps, but all other expense lines declined, including salaries, wages and benefits, which was down 160 bps.

Intermodal revenue was up 11.5% year-over-year to $59 million as drayage shipments increased 9% and revenue per shipment was flat. The division’s operating margin improved 60 bps to 7.7%.