Freight Alley is an area that roughly defines freight traffic moving throughout the southeastern US, particularly in Tennessee, South Carolina, North Carolina, Georgia, and Alabama. For years, the region has been a manufacturing powerhouse and in no-small coincidence a major distribution and logistics region. We have named this region Freight Alley because of the importance logistics and transportation plays in the region and how important the region is to the North American logistics map.

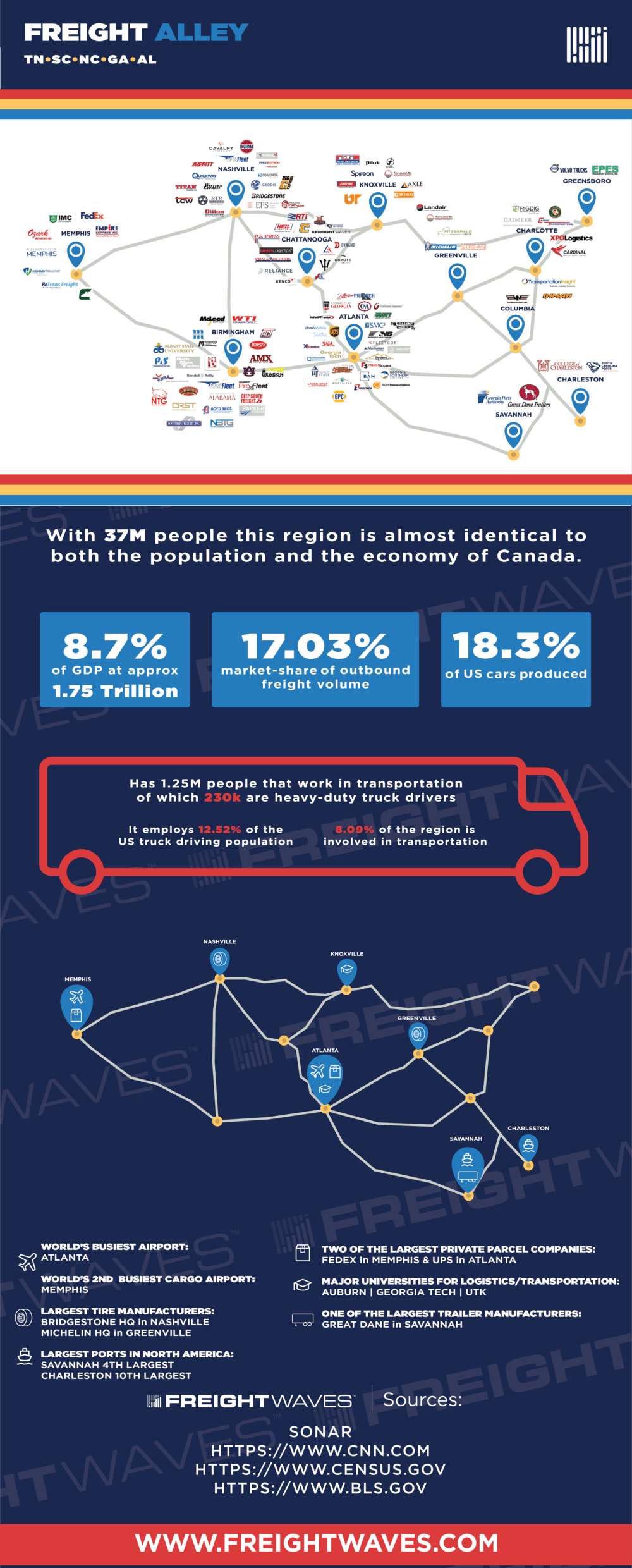

In many ways the area is similar to Canada in both population and economics. According to the latest census data, 37 million people calls this area home (the Canadian population is 36.29 million). Also, interesting enough, the GRP (Gross Regional Product) of Freight Alley is $1.75 trillion, slightly higher than the GDP of Canada at $1.53 trillion. But that is where the similarities really end: Canadians have their hockey and Tim Hortons and Freight Alley has NASCAR and Krystal (not to mention college football).

The region is also home to world’s busiest airport (Atlanta Hartsfield), the second busiest cargo airport in the world (Memphis), and home to two of the largest transportation companies, globally: FedEx (NYSE:FDX) and UPS (NYSE:UPS).

It also plays host to two of the largest truck manufacturers: Freightliner and its production facility just outside of Charlotte and Volvo North America’s HQ in Greensboro, NC. Two global tire manufacturers also have their North American headquarters in the region: Bridgestone and Michelin. Great Dane Trailers, one the top three manufacturers of trailers is located at the southern end of the region, in Savannah, GA.

The region is also littered with freight brokerages and trucking companies that provide an outsized portion of the transportation services in North America. While the area only has 11.28% of the U.S. population, it receives 14% of the freight. Also, freight plays an even bigger role than the economic makeup of the region compared to most of North America, being the origin point for 17.03% of all U.S. freight, but only 8.7% of GDP. Atlanta is also the number one freight market in the country, measured by SONAR data.

Of the region’s 37 million residents, 1.25 million people work in transportation and 230,000 are heavy-duty truck drivers. Freight Alley employs 12.52% of the country’s truck driving population.

Also interesting is that the region is one of the most important producers of automobiles in the U.S., producing 18.3% of the cars in the US, nearly twice the amount of cars that Detroit produces.

Universities have been ramping up their supply-chain programs across the U.S., hoping to take advantage of a broader trend in companies investing in supply-chain departments and resources, but three of the Universities in the area still have a major focus on logistics and transportation (Auburn, Georgia Tech, and UT).

A 2013 study conducted by Thrive Regional Partnership found that 42% of the region’s employment and 40% of its economic output ($6.6 billion) was related to “logistics-dependent” companies involved in manufacturing, transportation and warehousing, construction, mining, agriculture, retail/wholesale trade, and utilities. This compares to just 29% for the entire U.S.

At the heart of it all

The area is ideally situated to move freight, and that has been a big reason for its popularity. Chattanooga a city that sits directly in the center of Freight Alley has both benefited and contributed to the concentration of logistics services in the region.

According to a freight study by Cambridge Systematics, Chattanooga ranks No. 1 of all metropolitan cities when it comes to freight movement. The Thrive 2055 study, commissioned by the Chattanooga-Hamilton County Transportation Planning Organization, found that approximately 80% of all the nation’s freight travels through Chattanooga on its way to its final destination. This is due in large part to the convergence of three Interstates: I-75, I-24, and I-59.

The report predicted that the dependence on these businesses would grow in the future. With 80% of the U.S. population within a two-day truck transit time from Chattanooga, it’s no question that Gig City is the heart of Freight Alley.

“Total freight volume (by weight) in Chattanooga will grow from about 25 million tons in 2007 to 33 million tons in 2035, despite the recent recession,” the report notes. “Most of this freight will be inbound or outbound, reflecting Chattanooga’s position as a regional distribution center, manufacturing base, and freight hub.”

On a per-capita basis, Chattanooga has more truckload brokerages ($10M+) than any other city in the United States.

The great thing about freight brokerages is that jobs in that industry provide a lot of upward mobility, something that a small city desperately needs in a gig economy. Few jobs offer someone without a college education to make six figures. Freight brokerage does, however. All someone needs is a computer, brokerage software, access to a load board, and a keen sense of negotiation, and they are off to the races. Having access to a talent pool and guidance of other brokers in the area helps them scale.

Freight Alley is home to well more than fifty $20M+ asset-based truckload carriers, including U.S. Xpress (NYSE: USX), Covenant Transport (NASDAQ: CVTI), Western Express, P&S Transportation, Boyd Bros. (NASDAQ: DSKE) and CRST Malone.

Coyote also has a significant presence in Chattanooga by way of the acquisition of Access America in 2014. Lipsey Logistics, originally funded by a water company executive out of Atlanta, established its logistics home in Chattanooga primarily because of the talent-base that is found in Chattanooga. Lipsey is widely regarded as the leading FEMA broker in the U.S., providing natural disaster logistics for federal and state governments.

“When we launched FreightWaves in Chattanooga, our intention was to establish Chattanooga as a global hub for freight market data, leveraging the Gig City’s high-speed Internet and deeply seeded logistics industry network. It’s all about Tribal Knowledge and Data.”

AmeriCold Logistics, Kenco Logistics, Averitt Express, Geodis, Saia (NASDAQ:SAIA), Forward Air (NASDAQ: FWRD), and LandAir also call Freight Alley home. Ingram Barge, the largest barge company in the U.S., is also located in Nashville.

The US headquarters of Michelin (OTCMKTS: MGDDY) are squarely located in Freight Alley, having moved to Greenville, SC in 1988. Bridgestone (OTCMKTS: BRDCY) also calls Freight Alley home: its US headquarters have been in Nashville, Tennessee since 1992. With FedEX based in Memphis and UPS in Atlanta.

The nearby University of Tennessee-Knoxville ranks as the No. 3 university in the nation for logistics. Georgia Tech also has one of the most respected supply-chain programs in the country, ranking at No. 5 in the US and is widely respected as one of the top data-mining and business intelligence universities in the world using applied scientific principles in its supply-chain research and education.

The appeal of Freight Alley

Industries that are highly innovative tend to cluster. Talent is a huge issue for rapidly changing business models and you need to tap into the talent base of experienced employees, vendors, and strategists that are connected and have a deep understanding of how things work in that sector. If you are setting up a highly-innovative market data business based on freight, knowledge and real-time market insights are critical to scale.

“Chattanooga and the broader region is incredibly seeded with talent that understands the logistics industry with many leading firms having a significant presence here. Our freight market data business is able to take advantage of these connections to the freight market to expand our tribal knowledge, expand our data sources, and design products that will be needed and demanded by the market. Real-time information is critical to an industry seeing rapid digitization and innovation. No city in the U.S. is better positioned to understand the direction and economics of freight than Chattanooga,” Fuller says.

Booming Birmingham

What Chattanooga is doing with its technology push to land logistics and transportation startups, Birmingham has been able to do with its steel knowledge. That city is known for its expertise in the more specialized flatbed industry with a collection of flatbed carriers setting up shop, including Buddy Moore Trucking, Montgomery Transport, Blair Logistics. Three of the top ten flatbed carriers are based or have business units based in Birmingham including Daeske, CRST Malone, and P&S Transportation.

“Flatbed became popular in Birmingham during the steel boom [because] iron ore is rich in Birmingham,” Mauricio Paredes, director of information technology at P&S, tells FreightWaves. He adds that Birmingham steel did not play a major role in automakers’ just-in-time delivery processes and that allowed the city’s steelworkers to avoid the most damaging effects of the automotive industry collapse. Birmingham offers diverse choices in steel which also helped it weather the crisis. P&S is one of the largest flatbed operators with over 2,000 trucks.

“This separated Birmingham from the rust-belt and made it a prime location for larger flatbed carriers to create their headquarters,” Paredes notes.

Like Chattanooga’s easy Interstate access, Birmingham flatbed fleets also have quick access to Interstates that can allow carriers to easily route trucks to Chicago, Dallas, Houston and up and down the East Coast.

Growth of the Port of Savannah

No story about the freight market in the South would be complete without mentioning the growth of the Port of Savannah over the past two decades. It has only been about twenty years ago when the Port of Savannah added an intermodal facility to load cargo onto rail lines out of the port. Today, the port is serviced by CSX (NYSE: CSX) and Norfolk Southern (NYSE: NSC) and is the fourth-largest port in North America. It is also the fastest growing one. With the expansion of the Panama Canal, it is expected to grow at an even faster rate. On September 17, 2018, Georgia Ports Authority approved $92 million in funding for more intermodal rail capacity.

In July 2015, the State of Georgia, Georgia Ports Authority, Murray County, and CSX signed a memorandum to build an-inland intermodal port in Northwest Georgia. Three years later, the Appalachian Regional Port opened and will handle over 50,000 containers per year. It is expected to double within the next decade. The inland port is 45 miles from Chattanooga and 96 miles from Atlanta.

Other regional participants

P&S has taken advantage of the local talent as well, with many of its dispatch team graduating from nearby Auburn University or the University of Tennessee.

Companies that service the industry also have a significant presence in the area. One of the leading trade publications, Randall-Reilly Publishing is located in Tuscaloosa. Chainalytics, a leading Supply-chain consulting firm is based in Atlanta, as is Manhattan and Associates (NASDAQ: MANH) a major supply-chain technology vendor. McLeod Computing, one of the top software vendors to the freight industry is located in Birmingham. SMC3, the leading LTL pricing and rating service, has its HQ in Atlanta. Pilot Flying J, the largest truckstop and diesel fuel vendor to the trucking industry is located in Knoxville. Idle Air, the leading provider of in-cab climate control and entertainment also calls Knoxville home. Comdata/Fleetcor (NYSE:FLT), the largest fleet card provider in the business have HQs in both Nashville and Atlanta. U.S. Bank’s fleet-card business even gained a small foothold into the city, by way of its investment and acquisition of Chattanooga’s own TransCard fleet processing unit in 2012.

So, this coming holiday rush when tracking your package online, chances are that the shipment has traveled through the region between Savannah, Memphis, Knoxville, and Charlotte known as Freight Alley.