Freight brokers: 2022 salary and commission survey results

Given that much of a freight brokerage’s work is handled through online platforms and/or over the phone, successful brokerages can set up base even in regions without a significant importing and manufacturing presence.

Brokerages can thus focus on lower-cost locations (places with lower taxes and office rents, for example) and could then choose to pass those savings on to their employees via more attractive commission structures.

So, how do salaries and other compensation differ among regions?

In April, FreightWaves conducted a survey of 286 freight brokers in the U.S., from each of the nine geographic subdivisions designated by the Census Bureau, to learn more about base salaries, commissions and talent.

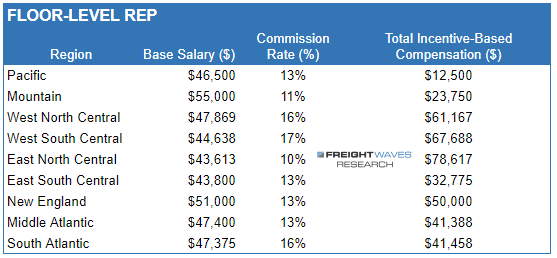

The survey found that the median entry-level base salary is $48,000. While many regions trended close to the median, there were notable exceptions. Two of these are the Mountain and East North Central regions, which posted the highest ($55,000) and lowest ($43,613) average entry-level base salaries in the U.S., respectively.

What about commissions?

This gap in base salaries was counterbalanced by incentive-based compensation, as the Mountain region reported one of the lowest commission rates (11%), while entry-level brokers in the East North Central region reported the highest level of incentive-based compensation ($78,617).

While commission plans based on team or companywide performance have become more prevalent in the past decade or so, nearly two-thirds of freight brokers still believe that being paid on individual performance is key to attracting and retaining top talent.

This makes sense, as highly skilled freight brokers who can sell and manage accounts are vigorously recruited by all industries looking for the same sales skills to drive growth.

According to the survey, the average commission rate on gross margins for both entry-level brokers and managers was nearly 15%. For executives, the rate was closer to 20%.

Concerning commission, there were clearer differences among regions. For example, managers’ commission rates could be as low as 10% (New England and West South Central) or as high as 18% (Pacific, Mountain and East South Central).

What is necessary for brokerages’ growth?

When it comes to scaling up rates, brokers’ opinions have largely remained the same since the previous survey conducted in 2019. Networking was still the most valued method of gaining traction (69%).

Unlike 2019, however, brokers in 2022 valued face-to-face meetings (53%) more than they advocated for cold calls (47%). In 2019, these positions were reversed.

With the pandemic-era acceptance of remote work, it is not impossible that brokerages could become even more untethered from locality, attracting talent from across the nation without changing addresses.

This shift has its benefits, as companies could take advantage of lower taxes and office rents in less populous regions without limiting their hiring pool.

Yet there are still those who believe in the tried-and-true methods: the hustle, the cold calls, the esprit de corps shared among brokers shouting on the same floor.

Time will tell where the profits truly lie.

The full results of the survey, including compensation by region and position, can be found in the Freight Intel Group whitepaper, “Freight Broker Compensation Survey, May 2022,” which can be downloaded here.

For more information on the FreightWaves Freight Intel Group, please contact Michael Rudolph at mrudolph@freightwaves.com, Joe Antoshak at jantonshak@freightwaves.com or Kevin Hill at khill@freightwaves.com.