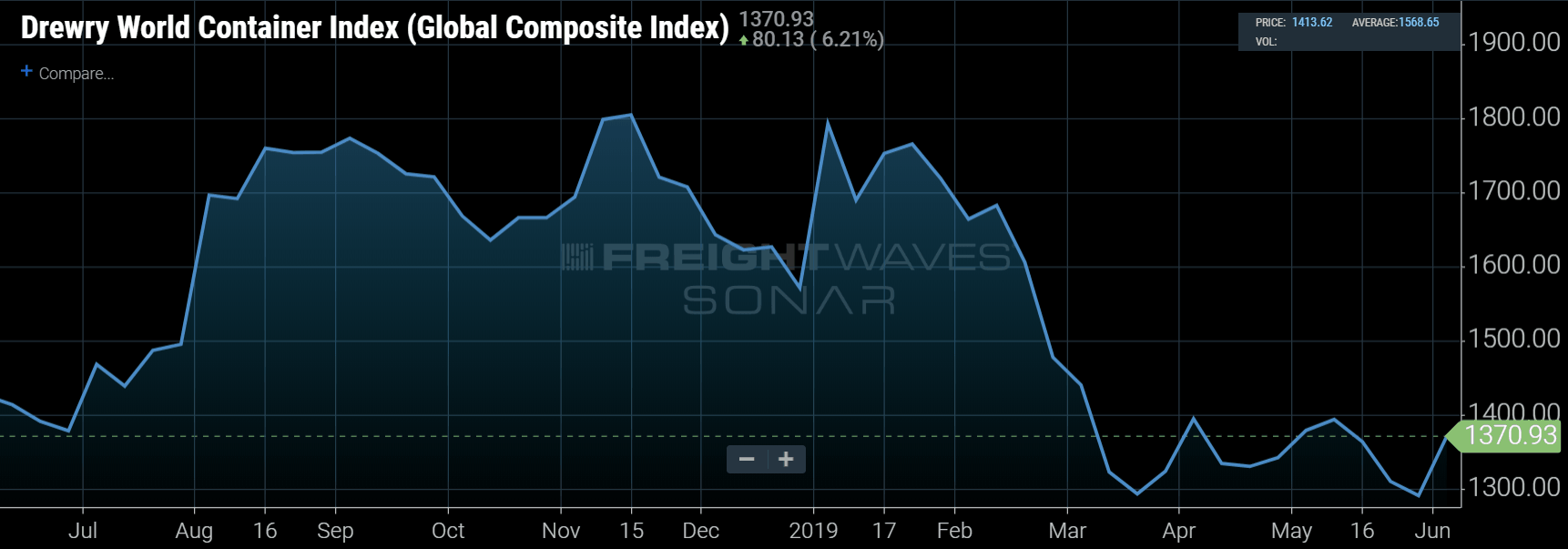

International shipping has become one of the largest drivers of domestic shipping volumes in the United States over the past several years. Knowing when and where container volumes are moving can be a leading indicator of when domestic shipping volumes are going to create disruptions in the U.S. freight market. FreightWaves continues to add more visibility to this sector with the Drewry World Container indices.

The Drewry World Container Index represents the average weekly spot rate for shipping a 40-foot container in seven of the United States’ largest maritime shipping routes. SONAR users will now have insight into lane specific rates in the following:

Los Angeles to Shanghai – LAXSHA

New York to Rotterdam – NYCRTM

Rotterdam to New York – RTMNYC

Shanghai to Genoa – SHAGOA

Shanghai to Los Angeles – SHALAX

Shanghai to New York – SHANYC

Shanghai to Rotterdam – SHARTM

Users will also be able to measure capacity or when demand is exceeding supply as well as general rate increases. When volumes surge in maritime lanes, as with trucking, the rates also increase. Increasing rates can be a leading indicator for increasing freight volumes entering the U.S., potentially creating market disruption.

The information is provided by Drewry, an well-respected independent research and consulting company with an international network of offices in London, Delhi, Singapore, and Shanghai.

Personal Consumption Expenditures: Durable Goods and Single Family Housing Units Sold

In addition to the Drewry WCI, SONAR users will also have access to two key macro-economic indicators, personal consumption expenditures in ($) billions (PCE.DG) and single family housing units sold in thousands (SFAMS.USA). Durable goods are what moves trucks. They are the reason for freight shipments as opposed to services which makes up most of the U.S. economy. Watching durable goods demand will help explain freight demand patterns in the broader economy. When expenditures for durable goods declines or flattens it is typically a sign of weakening economic conditions or a recession.

Single family housing units sold is a measure of housing demand, which drives a significant amount of freight in the U.S. It not only involves commodities like wood and building materials, but also furniture other finishing goods.