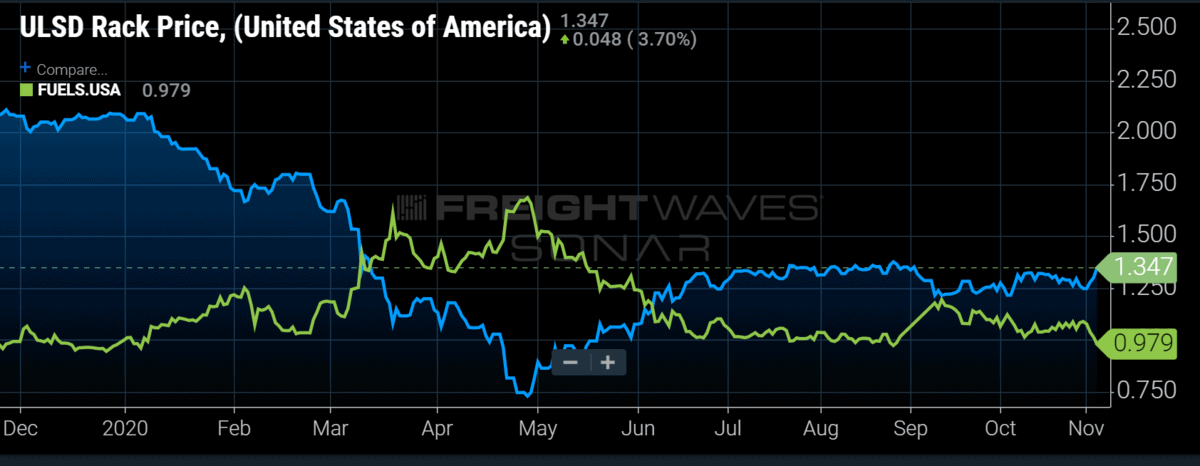

Chart of the Week: Ultra-Low Sulfur Diesel Rack Price, Fuel Spread between Rack and Retail Price – USA SONAR: ULSDR.USA, FUELS.USA

With trucking capacity as tight as it has been in over a decade thanks to the COVID-19 pandemic, truckload carriers are enjoying some of the highest spot market rates since 2018. A big component of those rates is fuel costs, which after a sharp drop in April due to low demand have been extremely stable until this week, compressing the spread between the wholesale (rack) and retail price at the fastest pace in months. The spread between these two prices (FUELS.USA) can have a big impact on carrier profitability and how prices are set for bids. This may be the beginning of a longer term change, which brings volatility back to fuel costs — and carrier profit margins and/or prices into 2021.

Earlier this week, FreightWaves’ award-winning oil market journalist John Kingston wrote about refineries closing due to diminished demand across the globe. Unfortunately for carriers, this will put increasing pressure on fuel prices over time and already has in the form of wholesale diesel increasing 8% or $0.10/gal between Monday and Thursday — the steepest increase since June, when the price of oil was recovering from record lows.

The difference between the summer increase and now is the fact suppliers are making the move to reduce production for a longer period of time while freight demand is experiencing record high levels thanks in part to the massive growth in e-commerce around the holiday season.

Wholesale diesel prices — the price that many carriers’ fuel purchase is based on — have been relatively stable since late June, hovering right around $1.33/gal before falling after Labor Day to hit a floor just below $1.25/gal. The price adjusted back to pre-Labor Day levels this past week.

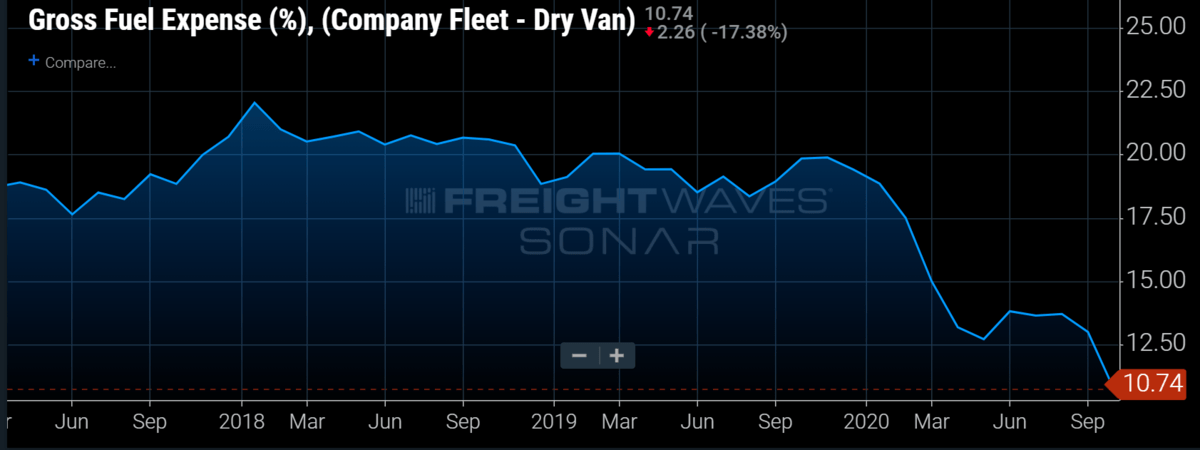

The price of diesel is obviously important to carriers for the fact that it is a significant cost, accounting for 15-30% of the cost of operating a truck in general. Over the past several months, that cost has been diminished thanks in part to the stickiness of the retail price — the price that many fuel surcharges are based on that carriers pass along to the customers.

Fuel surcharges are typically based on the price reported by the Department of Energy on a weekly basis. Retail prices tend to be much more stable than rack prices due to hedging and bulk purchases by retailers. For this reason the retail price of diesel fell from $2.85 to $2.40/gal (-16%) from the first week in March to the first week in May, while the rack price fell from $1.61 to $0.89/gal (-45%) during the same period.

Rapidly declining fuel cost was a tailwind for carriers during this period when volumes were still recovering. Carriers that purchased fuel based on the rack price got the benefit of buying low and passing along a fuel cost based on the slower moving retail price.

When fuel prices rise quickly as they have done this week, it means carriers will spend more for diesel while capturing less on their existing customers that have a consistent fuel surcharge structure. It should be noted that less-than-truckload (LTL) carriers do not experience the exact same effect due to the fuel surcharges being based on a percent of the freight charge rather than a cost per mile on the truckload side.

More importantly than the near-term impact to carrier margins is the long-term impact to pricing structures if fuel becomes more volatile due to production reductions. Carriers should keep a close watch on the price of diesel over the coming months as a return to a more volatile fuel price means more exposure to potential losses if not included in pricing packages.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo, click here.