FreightWaves closes $20 million Series B funding round

FreightWaves, the leading provider of data and news for global freight markets, announced that it has successfully raised $20 million in a Series B financing round, bringing its total funding to nearly $40 million. The round was led by 8VC, the Silicon Valley venture capital firm that has participated in FreightWaves’ capital raises beginning with its seed round in late 2017 when the company began commercial operations.

“This round was entirely opportunistic and was initiated because we had a great deal of strategic interest from very important partners,” said Craig Fuller, founder and CEO of FreightWaves. “Our cash position was very healthy before the round, boosted by the growth of our operating cash flow due to the performance of the business over the past year. Our SONAR SaaS product continues to grow at monthly double-digit rates as clients experience the value of fast data and increasing visibility into the transportation and freight markets.”

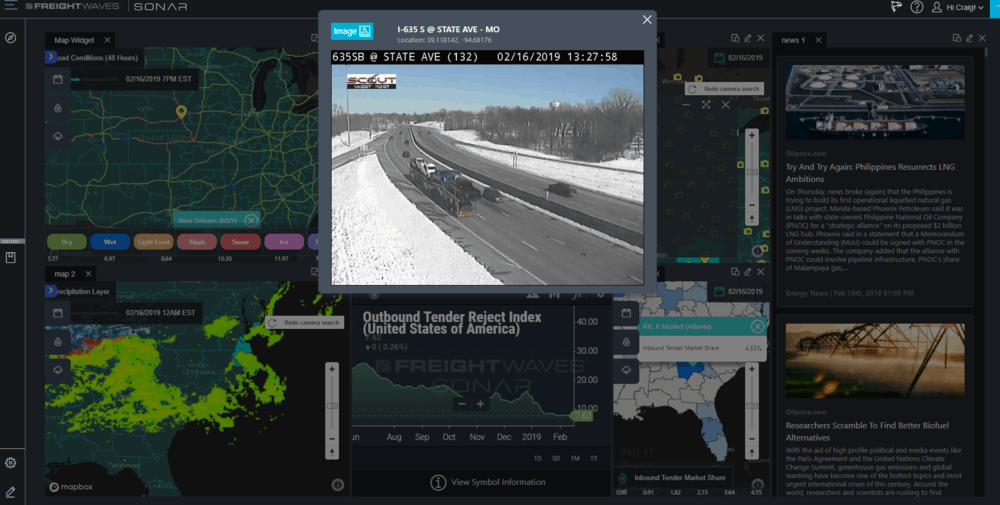

The company will deploy the funds to expand data and transparency products beyond trucking to include global air, rail, maritime, port, and warehousing. FreightWaves combines fundamental data from hundreds of unique sources and creates machine learning-powered indices that are actionable for clients. FreightWaves SONAR offers unprecedented speed in terms of insight (most data is less than 24 hours old) and provides a market dashboard that includes technical charting, heat/geo maps, watchlists, and data visualization and modeling tools.

FreightWaves has 15 full-time data scientists and six PhDs on staff. Data comes from hundreds of sources, including transportation management systems, load boards, electronic logging device (ELD) providers, telematics, on-board truck data from original equipment manufacturers, trailer and container tracking and sensors, port schedules and management systems, payment companies, factoring companies, freight payment and auditing firms, fuel vendors and refineries, warehouse operators, trucking companies, third-party logistics providers (3PLs), shippers, airlines and air cargo data aggregators, IoT providers and messaging companies, weather forecasting services, DOT highway cameras, federal and state governments, social media and other sources.

FreightWaves has, or is working to develop, partnerships with the companies that are sources of data regarding the state of the global freight economy. The data is often “uncleansed and unstructured”; the data science and market expert team come together to develop sophisticated machine learning models that help interpret the data.

While the data comes from many sources, much of the data that FreightWaves publishes is proprietary. Over 93 percent of the more than 120,000 time-series indices published by FreightWaves can only be acquired through its proprietary SONAR platform.

Fuller explained, “Often the data we receive lacks context from other unique sources. Moreover, it is most often ‘unstructured and noisy,’ requiring a fair amount of cleaning. The FreightWaves team spends an enormous amount of energy studying how the data can be predictive and prescriptive in the market. Once we have confirmed and peer-checked the data against our models, it gets published in an easy-to-use and consistently similar method on our SONAR dashboard, or available to clients through our application programming interface [API] so they can create unique actionable insights.” He continued, “The secret to our offering is access to the world’s most complete freight data, developed by a team with the deepest understanding of how the freight market, and the various components, actually work.”

The company also has a staff of nearly 25 journalists and creative contributors who publish daily content on the free news site, FreightWaves.com. The site covers news content spanning venture funding, M&A, tech disruption, all the modes of freight transportation and market-based analysis. The secret to the success of the news site is the combination of experienced journalists who tell compelling stories informed by data and the tribal knowledge of FreightWaves’ market experts, who have been involved in nearly all aspects of the business for decades.

Over the past two years, FreightTech has become a major venture theme, with over $3 billion in venture capital invested in 2018 alone. Two major segments took the majority of that funding – visibility and freight matching.

FreightWaves does not directly compete with the various visibility companies, but rather contextualizes the data that companies like these and others generate in its quest to help companies identify exceptions and issues in their supply chains.

“Visibility providers play an integral role in the future of supply chain, by providing workflow automation and tracking that help companies identify exceptions and challenges. As more companies enter the IoT space to solve for tracking, exception management, and visibility, data becomes increasingly complex and unstructured,” Fuller stated. “FreightWaves brings it together in an analytics system with a friendly dashboard that offers easy-to-use tools and context on a global scale. Our APIs are easy to ingest into proprietary optimization and decisioning systems, and because we don’t compete with the hundreds of workflow providers, we are able to partner with them and provide a more complete view with context from hundreds of sources representing billions of dollars worth of freight transactions.”

The company is also not involved in matching freight, leaving that to many of its clients and partners. FreightWaves sells data and analytics to most of the digital freight brokers in the market, and to the largest 3PLs, trucking companies and shippers. To help mitigate freight market pricing volatility, FreightWaves is developing a financially settled Trucking Freight Futures contract that will be launched in late March 2019.

Trucking Freight Futures contracts are strictly financially settled (meaning a truck never will show up) and were developed in partnership with Nodal Exchange and DAT. The CFTC-regulated tradable futures contracts are built to help participants in the market de-risk their exposure to the volatility of trucking spot rates. The contracts will help companies with exposure to the $726 billion trucking market hedge their exposure to massive volatility and will provide forward pricing and market health transparency.

Most notably, this round of financing saw participation from new large strategic investors including Hearst Ventures, a global investment group that makes strategic investments in fast-growing companies in the media and technology sectors, and Prologis Ventures, the venture capital arm of Prologis, Inc., the global leader in logistics real estate with operations in 19 countries across four continents. FreightWaves will benefit from strategic insights that both of these organizations bring.

Since its initial investment in Netscape in 1995, Hearst Ventures has grown to become one of the most active and successful corporate venture funds, with more than $1 billion in strategic investments in companies including BuzzFeed, E Ink, Hootsuite, Pandora, Roku, Via and XM Satellite Radio.

Corporate parent, Hearst, is a leading global, diversified media, information and services company with more than 360 businesses. Hearst has decades of experience in using data and editorial content to drive subscription-based revenue offerings for clients in the transportation and financial markets.

Hearst has a long legacy in the transportation data business with ownership in CAMP Systems International, vehicle appraisal guide Black Book, and automotive data provider MOTOR Information Systems. Hearst also owns and operates global financial services leader Fitch Group. This expertise will be a natural complement for FreightWaves, who operate at the intersection of commercial transportation and financial markets.

“FreightWaves combines powerful industry-specific data and analytics with fresh commentary, unique insights and risk management solutions that help decision makers across the freight ecosystem make better operational decisions,” said Hearst Ventures Managing Director David Famolari.

Prologis Ventures has been making venture investments since 2016 with a focus on next-generation solutions for addressing how the future flow of goods will affect global supply chains and the evolving needs of logistics customers. Other potential areas of investment include sustainability and construction, business intelligence and real estate technology.

“Prologis Ventures has been working closely with the FreightWaves team to map out electronic logging device (ELD) location data,” said Prologis Ventures managing partner Will O’Donnell. “We expect to leverage this data to understand how logistics facilities can operate more efficiently by improving the interaction of trucking companies, shippers and warehouse operators across the many facets of the modern supply chain.”

Revolution’s Rise of the Rest Seed Fund (ROTR Seed Fund) also participated in the latest round of financing. The fund is focused on making investments in high-growth businesses in non-traditional venture markets. FreightWaves won the Chattanooga Rise of the Rest pitch contest in May 2018 and has been working closely with the ROTR team to address the various challenges of dealing with explosive growth in markets where the local venture ecosystem is in the formative stages. Revolution’s Rise of the Rest Seed Fund invests in high-growth companies that, like FreightWaves, are scaling outside of the coastal tech hubs.

“In the Third Wave of the internet, entrepreneurs seeking to disrupt major real-world industries will focus on scaling in cities where that sector expertise resides. They will also rely on key partnerships to provide credibility and industry guidance,” said Steve Case, Chairman and CEO of Revolution and founder of Rise of the Rest. “FreightWaves embodies both of these concepts by combining Chattanooga’s history of logistics expertise with data from collaborations with some of the most important participants in the transportation ecosystem,” Case added.

Bob Corker, former U.S. Senator of Tennessee and chairman of the U.S. Senate Foreign Relations Committee, also participated in the round as an investor and will be working with the company to explore global expansion opportunities.

“Chattanooga is a transportation and logistics hub, and I am proud to see another homegrown company that is already making an impact in the world of freight,” said Corker. “I am excited for Craig Fuller and his team and wish them great success as they continue to build their company.”

Fuller believes that the company’s business model is relevant on a global basis.

“Supply chains are increasingly globally connected, and we are just starting to understand how one market or mode impacts another,” Fuller said. “Consumers care less and less about where products are sourced or how they get them, so long as they are responsibly and transparently sourced and transported. Our goal is to combine modal-agnostic freight data from sources all over the world and provide market context.”

The round also included every institutional investor that has previously participated, including Fontinalis Ventures, the mobility venture fund founded by Bill Ford, Pritzker Group Venture Capital, Ascend Venture Capital, Story Ventures, and Engage Ventures. Kelvin Beachum, offensive tackle for the New York Jets, also continued his investment in FreightWaves with additional participation.