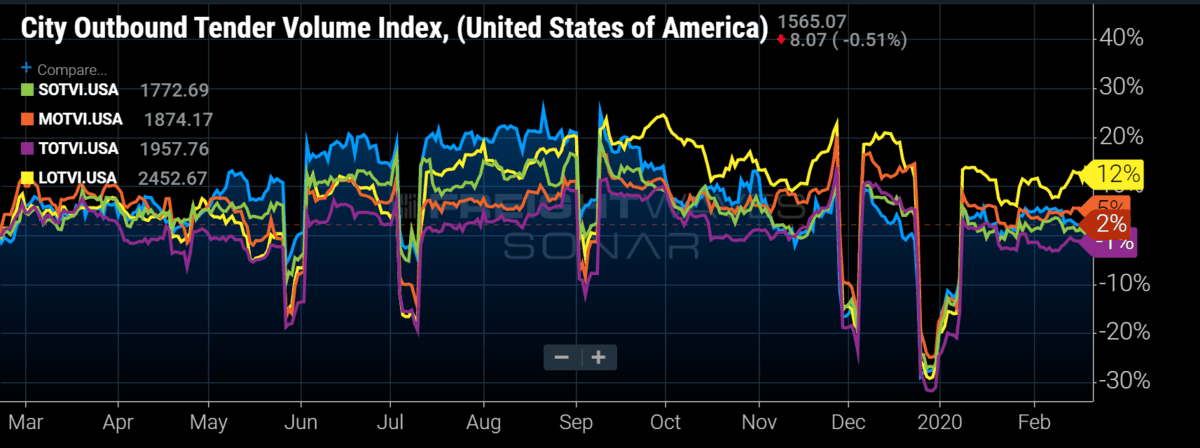

Chart of the Week: Outbound Tender Volume Index – Lengths of Haul – USA SONAR: LOTVI.USA, TOTVI.USA, MOTVI.USA, SOTVI.USA, COTVI.USA

It is still early in the year, and there are still plenty of hurdles to overcome for carriers, but a often overlooked pattern has changed since last summer that may help their bottom line — longhaul volumes (loads that move over 800 miles) have been averaging over 8% higher since September of last year.

Through much of 2019 volumes were dramatically softer than the previous year before starting to recover later in the year. June volumes — normally one of the two annual peaks of activity — were almost 7% lower than previous year. With many carriers having expanded their fleets to accommodate the volumes of high-volume growth in 2018, many struggled to keep their drivers on the road in 2019.

Outside of lower volumes helping drive the extremely loose market conditions, a lot of the loads offered were shorter in length. Loads that moved less than 100 miles were over 20% higher in June than the same month in 2018. Loads that move less than 250 miles do not help drive carrier utilization numbers as they tend to be difficult to tie together with other loads in conjunction with maintaining the federally mandated hours of service compliance.

More stops lead to less efficiency. Carriers charge by the mile most of the time, so when they are not driving, they are effectively not getting paid. To make up for this inefficiency many carriers will charge a minimum or a flat amount to ensure all costs are covered. Due to downward pressure on rates over the past year, many times carriers will drop their minimum charges below cost in the hope that they can find another load before the driver runs out of hours. Regardless, shorter haul freight leads to more work and higher costs per mile as a larger percentage of the trip time-wise is spent at a dock.

A fundamental shift in the market occurred in October when for the first time all year, longhaul freight volumes grew faster than local volumes year-over-year. That trend has become stronger in early 2020 with loads moving greater than 800 miles have averaged over 10% higher y/y since the start of the year. The impact to capacity will be hard to notice while overall volumes are seasonally suppressed, but as volumes increase through the spring, if the current pattern holds, carriers will see better utilization numbers and more activity on the spot market.

Freight that moves less than 250 miles does not disrupt capacity on the same level as freight moving longer distances due to the fact carriers can return to the origin within a day. This short distance means carriers can stay in an area covering freight requests repeatedly. Trucks will be stuck in larger origin markets like the ones in eastern Pennsylvania or norther New Jersey running back and forth all day for minimum charges. Many local runs originate in densely populated areas with high traffic making the 100-mile runs take as long as a more rural 300-mile run, adding to the inefficiency.

Long haul volumes are more disruptive to the balance of supply of trucks the U.S. as trucks spend more time on the road with less availability to pick up freight. In addition to occupying more time to move, long haul freight redistributes trucks across the country.

Regional networks are much easier to manage. The larger the diameter of the area covered the more complicated it is to manage the balance. The more imbalanced the market becomes, the higher the likelihood of tightening and tightness leads to higher rates. There are still many other factors to watch like the looming impact of the coronavirus, but this trend shift has already occurred and will be a factor into the summer.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week a Market Expert will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo click here.