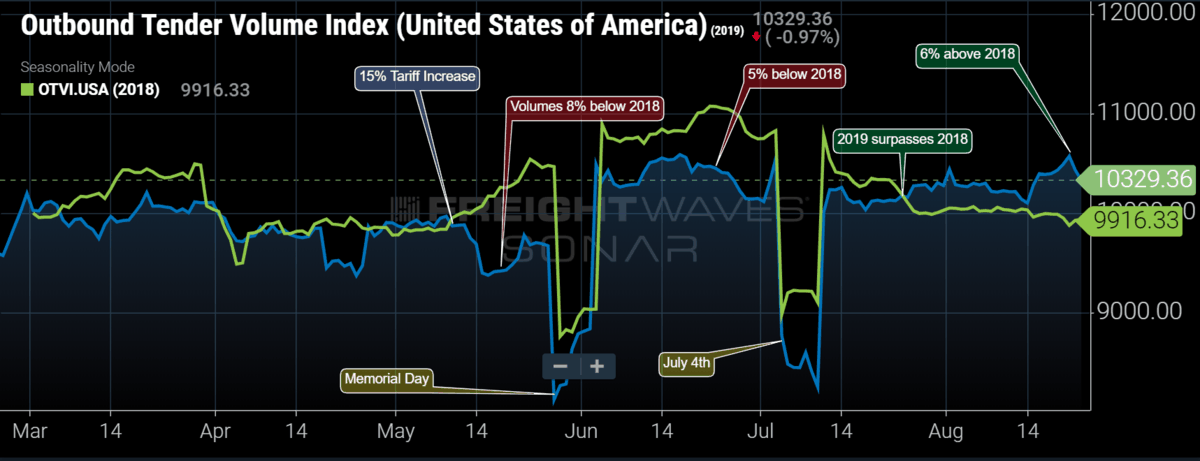

Chart of the Week: Outbound Tender Volume Index — USA (SONAR: OTVI.USA)

After approximately nine months of flat or contracting volumes and rates, the freight market has started to change course. The national Outbound Tender Volume Index (OTVI) just had its longest stretch of positive growth this year at 31 days of year-over-year growth. During this stretch, which started on July 24, volumes averaged 2.9% higher than the same period in 2018. Prior to this, the longest consecutive period of positive YoY comps was an 11-day period preceding the May 10 Chinese tariff implementation, where volumes averaged a marginal 0.7% higher.

Up to that point, it was unclear whether or not 2018 was just an over-heated year that produced tougher comps or the freight markets were really in a substantial downturn. From March 1 till May 9, volumes were averaging 1.3% under 2018. From May 10 till July 23, volumes averaged over 4% under the previous year. In other words, the spring was like rolling down a grassy hill, where the summer season was like falling off a cliff.

The period from March through July is generally considered the peak of construction and manufacturing in the economy. Agriculture and beverages are also major contributors to surging freight volumes during this time. The agricultural sector kept things interesting with above average rains in California making harvests difficult, but this segment of the transportation market (non-grain produce) is small in comparison to the durable goods that drive most of the freight market’s volumes.

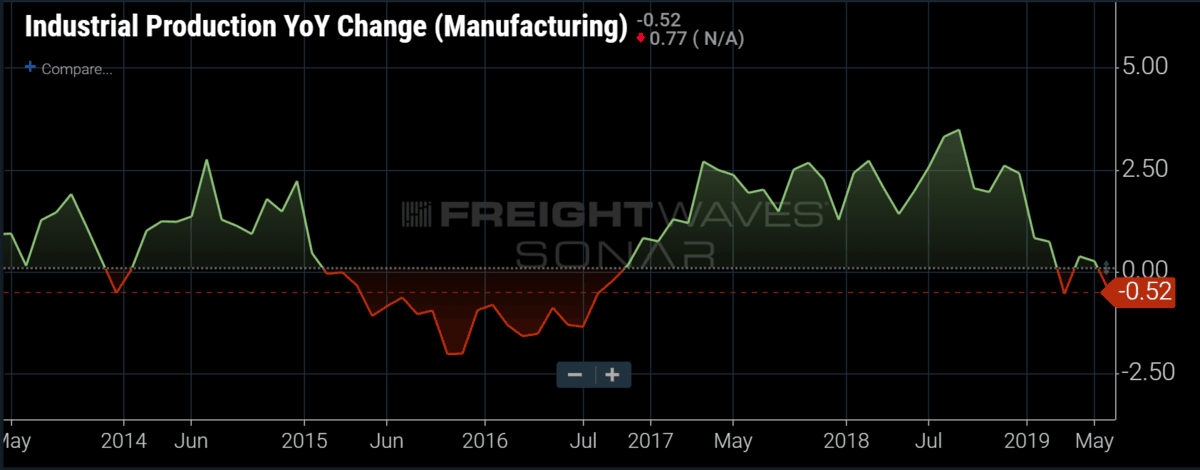

Many macroeconomic figures have supported an industrial slumping over the past several months. A weakening manufacturing sector, where annual growth has been mostly negative since February, and a lackluster new housing market has kept construction underwhelming.

There are those that would argue still that we are just reeling from a booming 2018, where growth was overheated due to things such as tax incentives and recovery from natural disasters. Looking at the definition of a recession—two consecutive quarters of negative growth—there is no mention of whether the contraction came after an anomalously robust period.

For trucking, the supply side increased to meet demand with more trucks entering the market on the heels of record new class 8 orders in 2018. With less freight to move, these trucks are nothing but additional cost, diluting the market and keeping rates down by increasing the competition.

Spot market rates have not crossed above 2018 levels yet, but it will take more time to see rates cross above previous year as the supply side of the equation is still elevated. The good news for carriers is the fact the 3rd and 4th quarters are driven more heavily by retail demand and increasing service requirements, which has been a strong point of the economy unlike manufacturing. The pull forward of 2018 has also fizzled as shippers have adjusted their supply chains, reducing inventory levels.

Pending further geopolitical other other unforeseen events, there is reason for optimism in trucking for the first time in months, and the data shows it.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week a Market Expert will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo click here.