“Cost of shipping between the U.S. and China plunges” blared a headline in early October, citing a reported halving of rates in a matter of days. Was this the beginning of the end of sky-high trans-Pacific shipping costs, the onset of the correction importers have been waiting for?

Turns out it wasn’t.

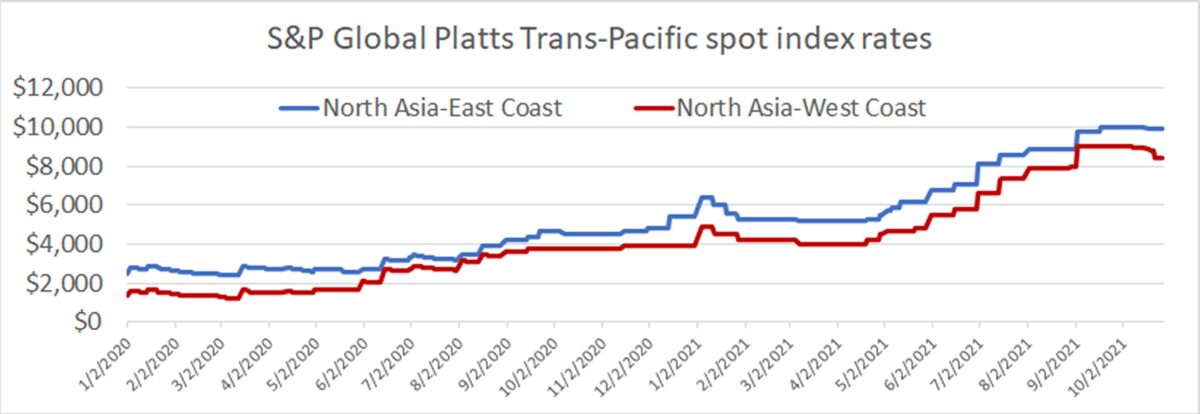

Spot rates for U.S. importers remain exceptionally high, with no sign of a true plunge. Some indexes do show a moderate pullback, others very little or none at all. The hope for any major decline in shipping costs has been pushed back to Chinese New Year in February at the earliest.

S&P Global Platts

The S&P Global Platts index for North Asia-West Coast rates — which does not include premiums charges — was at $8,400 per forty-foot equivalent unit on Wednesday. That’s down slightly from an all-time high of $9,000 per FEU in early October, but still up 140% year on year. Platts’ North Asia-East Coast assessment was at $9,950 per FEU, a mere $50 off the all-time high reached earlier this month.

Platts’ weekly report cited expectations from some sources that Asia-West Coast rates could increase in November, driven by inventory replenishment.

George Griffiths, editor of global container freight at Platts, told American Shipper, “The market should be quite weak at the moment because everybody’s got their Christmas demand all booked, but there’s still enough demand to keep rates where they are.

“The market is now saturated with cargo and demand is so high that sentiment almost doesn’t matter anymore. The fundamentals are driving the market and we haven’t seen a change in fundamentals,” said Griffiths.

He attributed the slight pullback in rates earlier this month to China’s Golden Week holiday. “There was just a little bit of breathing space, the first little gasp of air that left carriers conceding a little bit of ground towards shippers, but there are still these bottlenecks and there are still all these ships in San Pedro Bay.”

He called the Golden Week drop “a flash in the pan” and noted that rates “are still ridiculously expensive.” Griffiths added, “Now everyone’s waiting with bated breath, as they always do, for Chinese New Year, and the prospect of China taking two weeks off, when some of these supply chain issues could ease.”

Freightos Baltic Daily Index

The Freightos Baltic Daily Index (FBX) — which does include premiums in its trans-Pacific assessments — put the Asia-West Coast spot rate at $19,478 per FEU as of Thursday. This assessment spiked 21% from the day before, closing in on the high of $20,486 per FEU reached in mid-September. FBX Asia-West Coast rates have bounced back 50% from their recent low of $13,025 per FEU on Oct. 8 and are quintuple levels at this time last year.

FBX Asia-East Coast rates rose to $21,111 per FEU on Thursday, 4.5 times rates a year before and getting closer to the peak of $22,289 per FEU hit last month.

Xeneta

Rate assessments by Norway-based Xeneta do not show the same early October decline as the FBX. While they do show short-term Asia-West Coast rates rising more slowly, they also show some longer-term rates rising faster.

Michael Braun, vice president of customers solutions at Xeneta, said during a presentation on Wednesday, “We are not seeing any kind of major disruption on the production side in China due to electricity issues. The rates will stay high and infrastructure will remain constrained. For the time being, we don’t see any relief in the market.”

Regarding reports that trans-Pacific premium surcharges are falling, Xeneta CEO Patrik Berglund said, “We don’t see a reduction in premiums. We see a wide spread in premiums from one carrier to the next and also by location. Whether it’s Vietnam, Taiwan, Japan or China, these premiums have a very different spread. It’s not one market going from the Far East to the U.S.”

Xeneta reported that some annual contracts are already being negotiated for 2022. “There are long-term tenders running at the moment,” said Braun.

According to Berglund, “We’re already receiving rates for full-year 2022 and we’ve seen some odd results.” In some cases, he said, “Asia-U.S. East Coast has come in cheaper than Asia-U.S. West Coast, which says a lot about [sentiment that] congestion will not be solved in the intermediate term.”

Drewry

The weekly spot rate assessment of U.K.-based consultancy Drewry, released Thursday, was at $10,976 per FEU for Shanghai-Los Angeles, an increase of 1% week on week. While that’s down from an all-time high of $12,424 in mid-September, it’s still up 172% year on year.

Drewry put Shanghai-New York rates at $13,554 this week, up 178% year on year.

During a presentation earlier this month, Simon Heaney, senior manager of container research, said Drewry has pushed out its timeline for a supply chain recovery. The longer supply chain woes persist, the longer rates should stay elevated.

“There are no simple fixes,” warned Heaney. “This situation was not caused by a single sector and neither can one group fix it alone. Each sector has its own plans to manage the situation and its own investment strategies. They are working in silos. The lack of joined-up thinking is one reason we don’t see any solution being found in the short term and we don’t see any supply chain recovery before 2023.”

Click for more articles by Greg Miller

Related articles:

- Shippers fear ‘catastrophic’ fallout from ‘crazy’ California port fees

- Are historically high shipping rates causing consumer price inflation?

- Shadow inflation: Shipping costs are up way more than you think

- $25B worth of cargo stuck on 80 container ships off California

- Container ship owners see boom lasting through 2022