Sanctions continue to work: Russian crude and diesel exports are still going strong, helping to keep world energy markets supplied, while steep price discounts are curbing revenues to Russia’s government. Sanctions are also working for tanker owners. The shipowners bold enough to carry Russian oil and diesel have emerged as bigger winners, earning higher freight rates than in non-Russian trades.

Premiums earned for transporting Russian cargoes have recently surged even higher, according to data from price-reporting agency Argus. Over the past eight weeks, tankers loading Russian crude have earned 60% to 100% more in freight than tankers in comparable mainstream trades.

The Russian market “is becoming even more disconnected” from the rest of the tanker business, wrote Argus market reporter Matthew Mitchell and deputy freight editor John Ollett in a recent report.

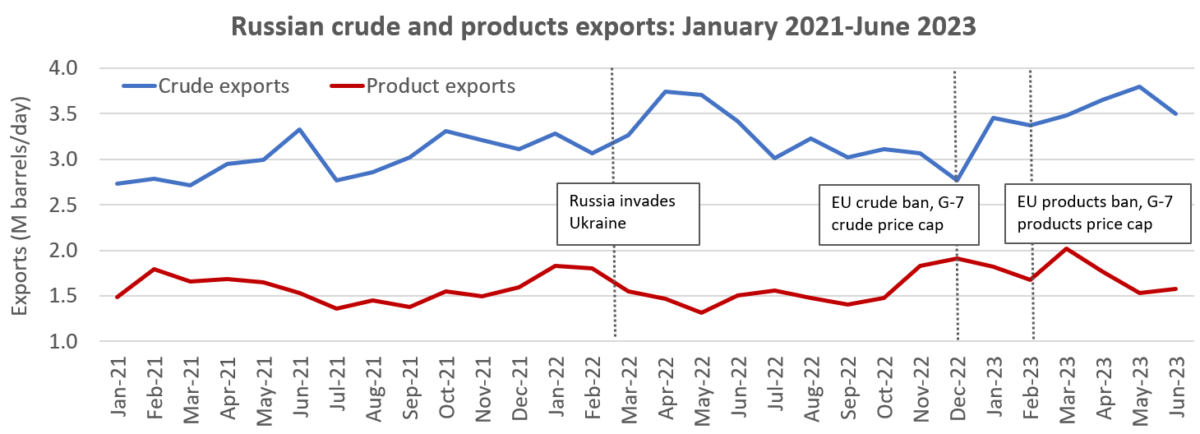

Russian crude and products exports stay strong

New data from Kpler confirms the ongoing strength in Russian export volumes. “The fact is that Russia continues to find downstream markets for its crude and products despite sanctions,” Reid I’Anson, senior commodity analyst at Kpler, told FreightWaves.

Russian crude exports rose to 3.8 million barrels per (b/d) day in May, the highest level since before the pandemic. June crude exports averaged 3.5 million b/d through Monday, down from May but still 15% higher than the average in the 12 months prior to the invasion of Ukraine.

The vast majority of Russian crude is flowing to China and India, with smaller volumes to Turkey and Bulgaria, said I’Anson.

Russian petroleum products exports are averaging 1.6 million b/d so far this month, according to Kpler data. That’s down from the record high of 2 million b/d in March, but still in line with pre-invasion volumes despite a boycott by the EU, formerly Russia’s largest buyer.

“Flows [of Russian refined products] to Brazil have picked up considerably alongside flows to the Middle East and North and West Africa,” said I’Anson.

Russian oil revenues fall

Russian oil revenues are falling despite higher export volumes, according to the U.S. Treasury Department, citing Russian government data.

With the EU, the U.S. and other countries refusing to take Russian cargoes, competition among buyers has been reduced, forcing Russia to sell its exports at a discount.

As of Friday, Russian Urals crude was selling at $23 to $24 less per barrel than Brent crude, according to Argus data.

Russian Ministry of Finance data confirms that the federal government’s oil revenues fell by more than 40% in the first quarter of 2023 compared to the same period last year despite higher volumes. Oil revenues accounted for 23% of Russia’s total budget versus 30% to 35% prior to the war, said the U.S. Treasury Department.

Urals price flirts with cap, then falls

Steep discounts on Russian crude and products allow buyers to pay more for transport, a boon for tanker owners willing to load Russian cargoes.

Most of the crude exported from Russia’s Pacific port of Kozmino is transported by Chinese and Russian tankers and vessels with opaque ownership in the so-called “shadow fleet.” On the European side, Russian Urals crude shipped out of the port of Novorossiysk in the Black Sea and Primorsk in the Baltic Sea is carried by a mix of shadow tankers and mainstream European-owned tankers operating under the G-7 and EU price-cap regimes.

Russian diesel is priced far below the price cap, now set at $100 per barrel, so there are no sanctions concerns. Russian crude out of Kozmino is above the $60-per-barrel cap on Russian crude exports — meaning tankers subject to EU and G-7 sanctions should not be involved. (Several have been involved, however, prompting a warning from the U.S. regulator.)

As the price of Brent rose in April, the price of discounted Urals loading in Novorossiysk and Primorsk was pulled up near the cap level, raising the sanctions risk for European shipowners. Since then, Brent has fallen back, dragging down Urals, which is no longer at imminent risk of breaching the cap.

The pricing situation in April “led a lot of shipowners to step back from the market,” wrote Argus’ Mitchell and Ollett. Now that Urals has come down, “mainstream shipowners have returned.”

Russian trade outperforms broader market

Crude and product tanker spot rates have pulled back globally since April due to refinery maintenance, production cuts and other issues pressuring transport demand. But freight data from Argus shows that tankers in the Russian trade have been largely shielded from these declines. Consequently, the premiums earned by these tankers versus those in a comparable non-Russian trade have increased since April.

Argus recently launched a new pricing product that compares weekly Russian crude export freight rates to a non-Russian baseline. This data shows a jump in the Russian freight premium starting in mid-April, around the time Urals was flirting with the $60-per-barrel cap level.

For an 80,000-ton cargo of Russian Urals loaded in Novorossiysk aboard an Aframax-class tanker and shipped to the west coast of India, Argus data shows that freight averaged $3.43 per barrel more or 42% higher than the baseline rate between early March and mid-April.

During the eight weeks from April 21 through Friday, the premium earned on this Russian route soared much higher, averaging $4.59 per barrel more or 81% above the baseline.

In the most recent week, Aframax owners carrying Russian cargo on this route earned a 92% “sanctions premium,” according to Argus data.

The same pattern is seen for larger Suezmax-class tankers loading 140,000-ton cargoes in Novorossiysk for delivery to the west coast of India. Argus data shows an average 33% premium versus the baseline for the weeks from March 3 to April 14, rising to an average 73% premium from April 21 to the week ending Friday as a result of the falling baseline rate.

Aframaxes loading 100,000-ton cargoes at Primorsk in the Baltic Sea for delivery to India’s west coast earned an average premium of $1.87 per barrel, 20% above the baseline, between early March and mid-April.

Then average premium shot up $3.98 per barrel, 61% above the baseline, in the weeks since then, according to Argus data. The Primorsk-India rate was 78% above the baseline rate in the most recent week.

The initial rise in the Russian freight premium coincided with the pullback in cargo interest from mainstream operators worried about the price cap in April. But the return of these mainstream tankers to the Russian market since then has not brought the premium back down.

“Freight rates have not dropped as shipowners insist on repeating the last-done levels and are not lowering their offers,” said Mitchell and Ollett. “Rates have balanced at their current levels and are not, for the moment, responding to shifts in the regular [non-Russian] spot market.”

Click for more articles by Greg Miller

Related articles:

- One year later: How Ukraine-Russia war reshaped ocean shipping

- China-Russia vs. US-EU: How global shipping is slowly splitting in two

- Price cap on Russian crude could soon face its biggest test

- European tanker owners make a fortune off Russian oil trade

- Welcome to the dark side: The rise of tanker shipping’s ‘shadow fleet’