The widening difference between the price of diesel fuel and the price of Brent crude oil suggests that energy markets are worried about the impact of upcoming maritime fuel regulations.

There’s a great deal of noise and many opinions about what effect the new maritime fuel regulation, IMO 2020, will have on the price of diesel fuel when it goes into effect January 1, 2020. The regulation mandates that commercial vessels use fuel that contains a maximum sulfur content of 0.5%, far less than the current allowed level of 3.5%.

Purchasers of ultra low sulfur diesel, which include trucking carriers and, because of fuel surcharges, shippers, are concerned that the demand for ultra low sulfur marine fuels will tighten refinery capacity and drive up the price of diesel. The possibility that some vessels will install scrubbing technology that allows them to continue using the old bunker fuel – so far about 6% of vessels have installed or have stated an intention to install scrubbers – further complicates any forecasts about IMO 2020 impacts.

Energy markets may be a better way to get a read on what the industry expects because traders are voting with their dollars, and by at least one measure there seems to be anxiety in the markets about potentially tightening diesel supply going forward.

The diesel crack spread, or the difference between the price of diesel as represented by gasoil contracts on the New York Mercantile Exchange and the price of Brent crude, the international benchmark, has widened considerably, to its widest level so far this year.

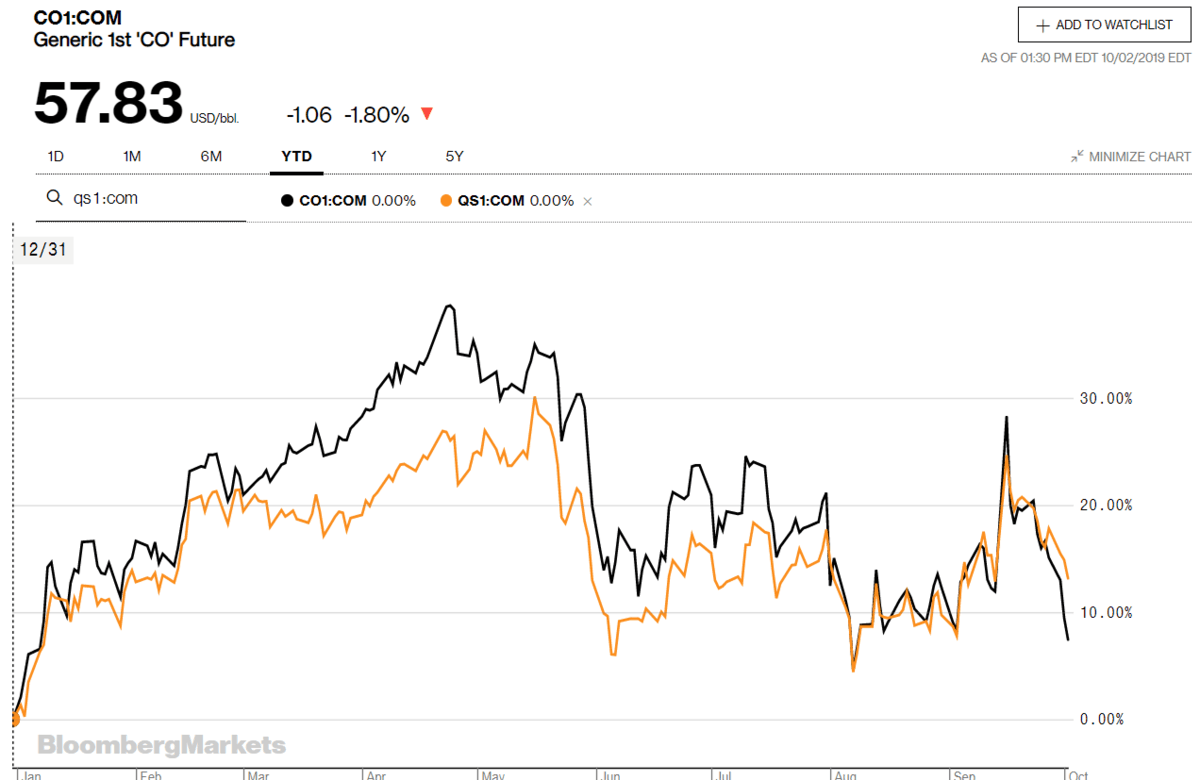

The chart below shows Brent in black and gasoil in orange on a percentage change basis year-to-date:

At the time of publication, national average diesel prices paid at the pump (DTS.USA) were $3.03/gallon, while Brent crude was trading at $57.52/barrel. Multiplying the diesel price by 42 to get a per-barrel price and subtracting the Brent price yields a crack spread of $69.72. For comparison, on May 1, the crack spread was $58.44.

For months, diesel has been the strongest performer in the oil complex, consistently diverging from the underlying crude markets, apparently as a result of mounting concern regarding IMO 2020. In theory, oil refineries benefit from the widening crack spread, as the price of distillates they take to market diverges from the input costs they pay for crude oil.

This morning, October 2, Stifel transport equities analyst Bruce Chan released a note presenting the results of transportation and logistics industry surveys on the likely impact of IMO 2020.

“With only three months left until d-day, there are still a broad range of views occupying different ends of the spectrum,” Chan wrote. “The consensus, in our view, points more toward some near-term disruption and incremental cost inflation, and less toward a seismic shift in the way global supply chains operate.”

Strikingly, shippers thought that carriers would bear the brunt of any fuel cost increases, while carriers thought that shippers would end up paying. It may turn out to be the consumer.

A majority of survey respondents moving containers across the Pacific Ocean thought that the new regulations would have a substantial impact on box rates.

“Among those with exposure to TransPacific container rates, roughly 20% anticipate a drag of less than US$150/FEU [forty-foot equivalent units], 60% anticipate between US$150-$300/FEU, and 20% expect US$300-$500 per box,” Chan noted. “No one expects more than US$500.”

Chan thinks that trucking carriers and other domestic transportation providers will not see a meaningful direct impact from the regulations unless refining capacity is affected. Intermodal and less-than-truckload (LTL) carriers may benefit from higher fuel prices, though, as higher fuel costs make intermodal more attractive compared to long-haul trucking and LTL carriers typically over-budget for fuel in their pricing schemes.

Ocean carriers are the most exposed, and they appear to know it.

“Ocean carriers will need to either consume more expensive low sulfur fuel/marine gas oil, or install an emission scrubber in order to use cheaper high sulfur fuel oil,” Chan explained. “With the need to switch fuels or take vessels out of the market to install scrubbers, we have seen charter rates move up in the last several months as liners don’t want to get caught without capacity.”

But survey respondents from all modes of transportation agreed that consumers would likely be among the most affected groups.

“Consumers will ultimately bear the brunt of higher costs as they are passed through, in our view, both on the water and via higher diesel prices, if they materialize,” Chan argued. He pointed out that consumers have already and will continue to absorb higher costs from tariffs, but that in 2019 to date consumer spending has been the strongest part of the U.S. economy.