As low driver retention continues to frustrate carriers both big and small, the question remains: What do drivers want?

The answers are plentiful: Respect, higher pay, better hours, more home time, increased benefits — the list goes on. Greater certainty about dwell time is also key.

U.S. Secretary of Transportation Pete Buttigieg was recently asked how much drivers should be paid. He answered that they should be paid “enough to show respect and regard for the fact that they are the very definition of essential workers.” He added that the industry has to stop wasting truckers’ time at the dock — or compensate them.

Many fleets are already addressing the compensation angle. The American Trucking Associations notes that weekly driver earnings are increasing at a rate more than five times the historical average. In fact, pay is up more than 25% for long-haul truckload drivers since the beginning of 2019.

But pay hikes only compensate drivers for their trouble; they don’t address daily work frustrations involving dwell times or get to the root of the problem.

Case in point: Turnover in trucking remains high — around 90% for some carriers as the industry competes for a finite number of drivers. The reasons for turnover seem to be more nuanced.

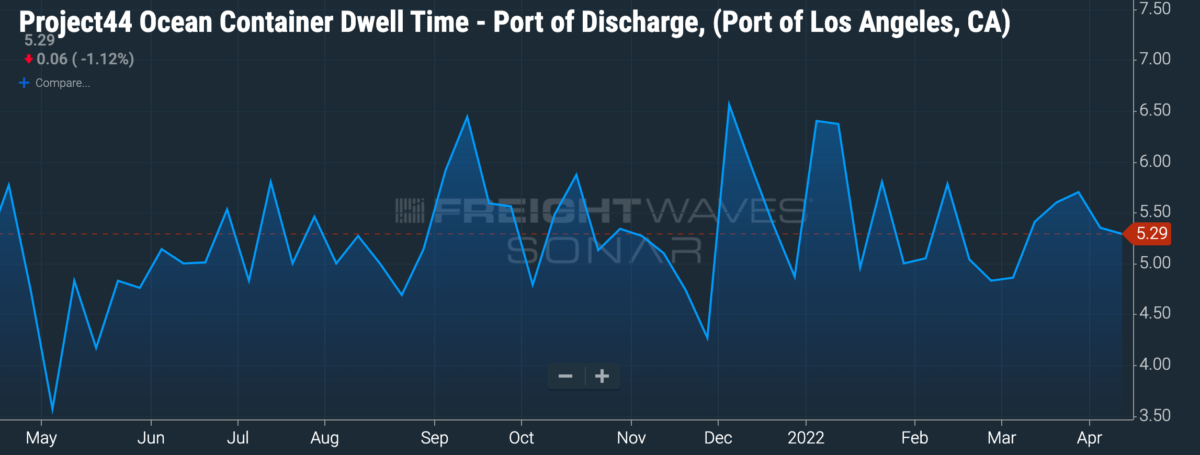

Drayage operators, for instance, have lost all patience with congestion, especially at the ports of Los Angeles and Long Beach.

When inefficiencies arise, no one bears the burden more than these drivers left waiting interminably for a shipment. A large portion are paid per load and wind up sitting idle at the ports waiting for a load they might not receive.

Raising compensation helps, but it won’t lessen drivers’ day-to-day woes.

What they’d prefer is to not waste time with the unknown.

Real-time visibility, once limited to a few aspects of the shipping process, is now required for an ever-growing number of freight metrics. More and more stakeholders, including drivers, want to know more about the specifics of each shipment — the what, when, where and, in the case of delays, the why.

With PowerFleet’s asset tracking solutions, fleets are realizing how telematics technology makes it possible to receive real-time updates on the locations of trucks and trailers. In addition, sensors and cameras can tell what the status of the asset is, such as whether it’s available.

“Armed with this knowledge, our customers are empowered to get their equipment back faster,” said Matt Harris, vice president of account management at PowerFleet, describing how fleets and leasing customers are investing in maintenance and technology upgrades to better utilize their assets.

PowerFleet has also recently launched a product solution that goes a step further to tell if the container on a chassis is empty or loaded. This kind of information is critical to reducing the time it takes to unload containers and turn available chassis faster.

Not only does this help put critical assets back in use, but also relieves drivers, many of whom spend about 40% of their workdays waiting to load and unload goods, from having to chase equipment or wait longer than needed at facilities.

Giving drivers shipment insights alleviates a great deal of day-to-day stress and reduces communication mishaps that often derail operations.

Earlier freight visibility devices provided only binary answers: “Yes, it’s loaded,” or “No, it’s empty.” But PowerFleet’s sensors use AI powered by Microsoft to take a snapshot of the trailer’s interior. With literally millions of images at hand, fleet managers can observe how each trailer is loaded to ensure correct packaging and palletization. If a load shift occurs, the sensor captures the event and makes it clear which party is to blame.

Delays have typically been seen as inevitable, but now the right telematics solution can make life easier for drivers who already have a lot on their plates.

Real-time visibility ensures that everybody’s in the know. And that’s just what many drivers are longing for.

Click for more FreightWaves content by Jack Glenn.

More from PowerFleet:

Reefer capacity remains tight: How to optimize available trailers

3 ways shippers are gaining control of their supply chains

Gaining intermodal asset status without manual inspection key to port efficiency