Insurance woes weigh down Knight-Swift earnings

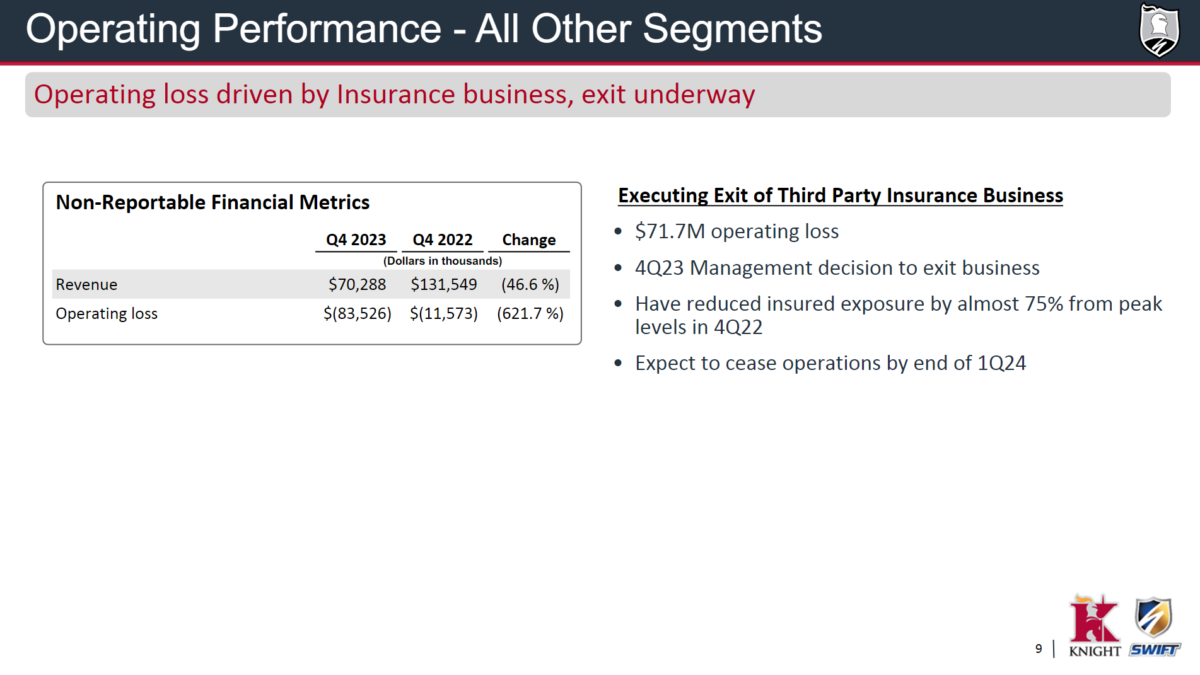

Q4 earnings are in for Knight-Swift, which recorded a $71.7M operating loss from its third-party insurance business.

This might be a future business school case study on risk management. Back in 2021, Knight-Swift launched Iron Truck Services. The press release described it as “an organization that brings together services essential to transportation carriers and includes insurance, equipment maintenance, fuel purchasing, and truck sales and rentals. Iron Truck Services provides affordable solutions to truckload carriers by leveraging the scale and infrastructure of the nation’s largest carrier, Knight-Swift.”

One of those offerings was Iron Insurance, which the release said, “provides auto, general, and cargo liability insurance, as well as physical damage insurance options at affordable rates. All policies are supported by risk management services that promote safe operational practices for policyholders.”

Back in 2021, there was unprecedented growth in small fleets and there was a financial incentive and opportunity for large fleets to try to get extra revenue while utilizing their extensive footprint of maintenance shops and nationwide roadside networks. But a flood of new entrants, many with little experience in either trucking or owning a business, means a higher likelihood for accidents and claims.

Changing freight market conditions caused that same truckload capacity to exit the market and create a smaller pool of carriers to insure. The warning signs were observable in July 2023 when Knight-Swift released its Q2 results. FreightWaves’ Todd Maiden wrote, “a loss in its third-party insurance business, versus the prior outlook for a profit, is a 45-cent hit to the original outlook.”

By the time Q3 rolled around, the losses continued to add up. Maiden wrote, “The number did include a $15.9 million operating loss in its third-party insurance business, which amounted to 8 cents using a normalized tax rate.”

Noting the attention, the company released a statement in a Q3 8-K filing, saying, “It will take some time for these changes in the insurance business to fully materialize in the results, but we are making progress raising premiums and improving the quality of risk as we work to mitigate volatility.”

Fast forward to Q4, and the company reported a third-party insurance-related loss of $71.7 million. What looked like an opportunity on paper turned into a drag on earnings in execution. Now with Q4 in the books, the company looks to exit and cease operations for third-party insurance by the end of Q1 2024.

Reading tea leaves with Covenant Logistics’ Q4 results

It’s earnings season! Looking at Covenant Logistics Group’s Q4 data, there are some cool tidbits that might explain broader truckload market changes.

Below are some indicators that stood out to me, as well as my notes on each:

- Easier access to drivers in equipment improved seated team percentage and lowered the average age of tractors/trailers. Healthy Class 8 tractor data for most of 2023 supports the thesis that fleets were able to shed older assets and replace them with newer assets. 2024 might be a toss-up since public for-hire fleets should have a smaller backlog of older equipment and it should be back to business as usual for their Class 8 capex plans.

- Open truck data is rarely seen in earnings, but it is as close to a working tractor percentage as you’ll find. Improvement suggests easier-to-reseat drivers and repair units in shops.

- Covenant truckload is a split between teams and dedicated. Expedited has better margins, but there are challenges for dedicated trucks via higher deadhead percentage paired with lower length of haul. That could be from internal customer truckload network changes where lower length of haul equals lower transportation costs.

- The biggest warning signs for trucking in 2024 will be watching cash flow. Average receivable days outstanding rose to 49.4 days in Q4 2023 compared to 39.8 days in Q4 2022. This means to me potential for higher debt load as carriers cover the gap until they get paid.

Evolution of cybersecurity in the supply chain with Antwan Banks

On Tuesday, FreightWaves interviewed Antwan Banks, director of enterprise security at the National Motor Freight Traffic Association (NMFTA), about recent trends in cybersecurity and their impacts on the supply chain. Before working at the NMFTA, Banks was the director of cybersecurity for the Metropolitan Atlanta Rapid Transit Authority for nine years in addition to being a veteran of Operation Desert Storm. He contrasted his cybersecurity experiences in the military and civilian roles, highlighting how private business, while light-years behind military cybersecurity, is catching up as state and nonstate actors target their systems for vulnerabilities.

When examining cybersecurity risks for motor carriers, one major challenge Banks noted was to highlight their “crown jewels” or most important systems or data to prioritize and protect. Until recently, many carriers failed to view their freight systems and data as sensitive enough to warrant extra protection compared to military or health care systems, which contain sensitive data about health or capabilities. NMFTA recently wrote how hacks and ransomware attacks targeting carriers in the past few years served as a wake-up call to executives.

For carriers that don’t have a cybersecurity plan, Banks notes a good first step is to schedule a tabletop exercise to simulate how your company will react and what steps it will take if an attack occurs. Afterward, create a plan and response for a “too-late situation” if proactive steps fail. Finally, Banks highlights the importance of adequate backup plans to restore key systems if they are taken offline or held for ransom. One challenge Banks noted was that many hackers target backup systems, so extra attention should be given to ensure the backup works and is not compromised.

You can view the entire episode here.

FreightWaves SONAR spotlight: Rising rejection rates a possible bright sign for carriers

Summary: Nationwide outbound tender rejection rates continue to climb as winter weather paired with truckload capacity exits provides a boost to carrier pricing power. In addition to changes in truckload supply, higher outbound tender volumes, atypical of seasonal expectations, are boosting truckload demand. Outbound tender volumes are up 646.53 points or 6.12% week over week (w/w) from 10,571.4 points on Jan. 15 to 11,217.93 points.

Outbound tender rejection rates rose 48 basis points in the past week from 4.77% on Jan. 15 to 5.25%. Examining rejection rates by equipment type, there were increases across the board. Van rejection rates climbed 46 bps w/w, reefer rose 151 bps w/w, and flatbed rejection rates increased 111 bps w/w. For carriers not hauling dry van freight, tender rejection rates continue to suggest greater pricing power, as rejected load tenders slowly matriculate into the spot market.

The climb in tender rejection rates corresponds with an increase in spot market rates for van and reefer loads. The seven-day average NTI spot rate for dry van rose 9 cents per mile all-in from $2.33 on Jan. 15 to $2.42 per mile. The FreightWaves Reefer Truckload Index (RTI.USA) rose 6 cents per mile w/w from $2.78 per mile on Jan. 15 to $2.84 per mile all-in. In spite of elevated rejection rates, the flatbed segment saw spot rates fall 10 cents per mile all-in w/w from $2.91 on Jan. 15 to $2.81.

The Routing Guide: Links from around the web

Matt Silver launches US-Mexico logistics tech startup Cargado (FreightWaves)

Ryder adds Kodiak Robotics to its autonomous trucking dance card (FreightWaves)

Why Walmart pays its truck drivers 6 figures (FreightWaves)

21-state lawsuit delays FHWA emissions plan deadline (Trucking Dive)

Volvo reveals new long-haul VNL with beefier electrical system (FreightWaves)

Tech battle: Samsara sues Motive Technologies for patent infringement, false advertising (FreightWaves)