On a quarterly call with analysts Wednesday, management from J.B. Hunt Transport Services said it was hopeful for a positive demand inflection at some point during the second quarter.

“We have had good signals from our customers about Q2 … having a more normal environment. We’re not sure at what point that is in Q2,” President Shelley Simpson told analysts. “We have confidence from what our customers are giving us and the data points that they have [about] what they’re going to be doing from an ordering perspective.”

She said J.B. Hunt is feeling the impact from import declines but noted its customers have indicated the diminished volumes are tied to what will likely be a near-term inventory correction.

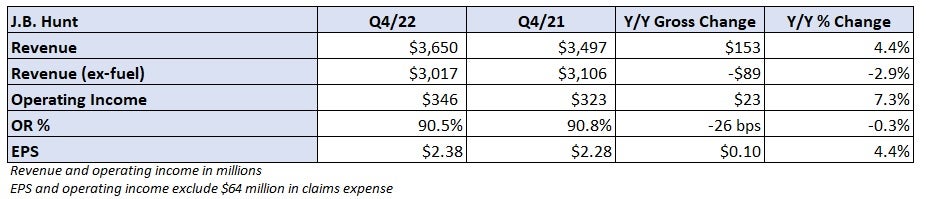

J.B. Hunt (NASDAQ: JBHT) reported fourth-quarter headline earnings per share of $1.92 Wednesday before the market opened, which was more than 50 cents worse than the consensus estimate. The number included $64 million in incremental reserve adjustments for prior casualty claims, resulting in a 46 cent hit to EPS. Also, a higher tax rate in the period compared to the level it paid in the first three quarters of 2022 resulted in a 4 cent headwind to EPS.

The company is seeing prior claims settle roughly five to 10 times higher than they would have five years ago. Chief Financial Officer John Kuhlow said J.B. Hunt will increase self-insurance amounts as core premiums are expected to increase 15%, with incurred losses climbing by as much as 30% to 35% this year.

“Our insurance claims cost for the claims experience is just dramatically going up. It’s a highly unpredictable environment,” Kuhlow commented.

The company recorded a reserve increase of $30 million during the second quarter. It does not expect another one-time true-up in 2023.

Consolidated revenue increased 4% year over year (y/y) to $3.65 billion in the fourth quarter. Excluding the impact from fuel surcharges, revenue was down 3% y/y.

Intermodal revenue increased 11% y/y to $1.75 billion. Loads were down just 1% y/y, which outpaced a 4% decline in total intermodal traffic on the U.S. Class I railroads. J.B. Hunt’s load count grew 4% y/y in October but fell 3% and 5% in November and December, respectively. The company’s average container fleet was up 2% y/y to more than 105,000 units; however, average loads per container slid again, down 3% y/y to 1.44 times per month. Box turns were 1% higher than the third quarter but the average fleet size in operation was down 4% over the same period.

Management remains confident that recent capacity additions, as well as the incremental capacity created when rail service and container dwell times at customer locations normalize, will not result in the company chasing volumes at the sacrifice of price. Revenue per load during the quarter increased 12% y/y (up 6% excluding fuel) as length of haul fell 2%. Compared to the third quarter, revenue per load was nearly 3% lower while average diesel fuel prices were off just slightly.

The operating ratio in the intermodal segment deteriorated 90 basis points to 88.5% (210 bps worse including the increase in claims reserves) as costs per load grew 120 bps faster than revenue per load.

Even with the falloff in imports and a shaky macro outlook, the company expects intermodal volumes, revenue and operating income to grow in 2023.

“There is a significant lag in demand at the moment,” Darren Field, president of intermodal, said. “Most of our customers, if not all, are optimistic about summer and the rest of the year. There’s an inventory correction going on.”

Dedicated revenue increased 24% y/y to $880 million as average trucks in service jumped 14% and revenue per truck per week increased 9% (up 3% excluding fuel). The company sold dedicated capacity representing roughly 2,000 trucks to customers in 2022, ahead of guidance of 1,000 to 1,200 trucks to be sold annually.

“Our pipeline is still full,” Nick Hobbs, chief operating officer and president of contract services, said. “We are experiencing what I would call just some hesitation from deals that are in there [where] the customer is trying to figure out what’s going to happen [in the] first part of the year. We are still signing deals.”

He said the company is well on its way to achieving the annual growth target again in 2023 as it already has 500 trucks sold. The division posted an 89.3% OR in the quarter, 50 bps better y/y (160 bps worse including the increased claims reserves).

Brokerage revenue fell 33% y/y to $496 million. Loads declined 27% and revenue per load was off 9%. Truckload volumes on the platform declined 21% y/y. Gross margin improved 340 bps y/y as the contractual percentage of brokerage revenue increased 18 percentage points y/y and spot rates remained depressed.

Excluding the impact from claims expense, operating income in the segment was $12.2 million, a 42% y/y decline. The unit lost $2.9 million inclusive of the increase in claims reserves.

J.B. Hunt’s brokerage segment is seeing the most volatility, due to its spot market exposure (38% of volumes in the fourth quarter). The unit saw “a continued weakening from October into December” with no real changes in demand in the first two weeks of 2023, according to Brad Hicks, president of highway services.

He noted potential for improvement from the second quarter into third quarter as customer inventories reset. “Until we see some of that freight demand rebound, imports start flowing, I think we’ll be in a comparable environment to what we saw in the fourth quarter in brokerage.”

J.B. Hunt also announced Wednesday it paid more than $8.8 million in appreciation bonuses to company drivers and full-time hourly employees. It paid a similar amount in bonuses last year.

Shares of JBHT were 4.9% higher at 1:38 p.m. Wednesday compared to the S&P 500, which was off 1.1%.

More FreightWaves articles by Todd Maiden

- Bank of America bullish on TL stocks as ‘truck demand near floor’

- XPO taps equities analyst as new chief strategy officer

- Total freight costs fall year over year in December for first time in 28 months