Kawasaki Kisen Kaisha, Ltd. (JP:9107), also known as “K” Line, reported an operating profit of 11.1 billion yen in the first half of its current fiscal year, reversing a loss of 12.3 billion yen in the same period last year. “K” Line’s fiscal year runs from April 1 to March 30.

The improvement came even as “K” Line reported operating revenue of 372.4 billion yen in the first half of fiscal 2019-2020 — 11 percent less than the 416.1 billion yen recorded in the first half of fiscal 2018-19.

While it said the first half of the current fiscal year was better than expected, the company cautioned that the slowdown in the global economic outlook could lead to the deterioration in transportation demand and that “the business environment remains critical toward achieving the consolidated full-year business forecasts.”

“K” Line said it “will make a concerted effort to further improve its financial results, but it is with sincere regret that the company announces it has decided to pay no interim dividend. The year-end dividend remains yet to be determined.

“Our important task is to maximize returns to our shareholders while maintaining necessary internal reserves to fund our capital investment and strengthen our financial position for the sake of sustainable growth.”

“K” Line is Japan’s third-largest shipping company after NYK Line and MOL. The three companies are joint owners of Ocean Network Express (ONE), the world’s sixth-largest container carrier.

“ONE overall recorded a year-on-year increase and turned a profit,” “K” Line said. Other “K” Line containership business had a decline in revenue but a narrower loss.

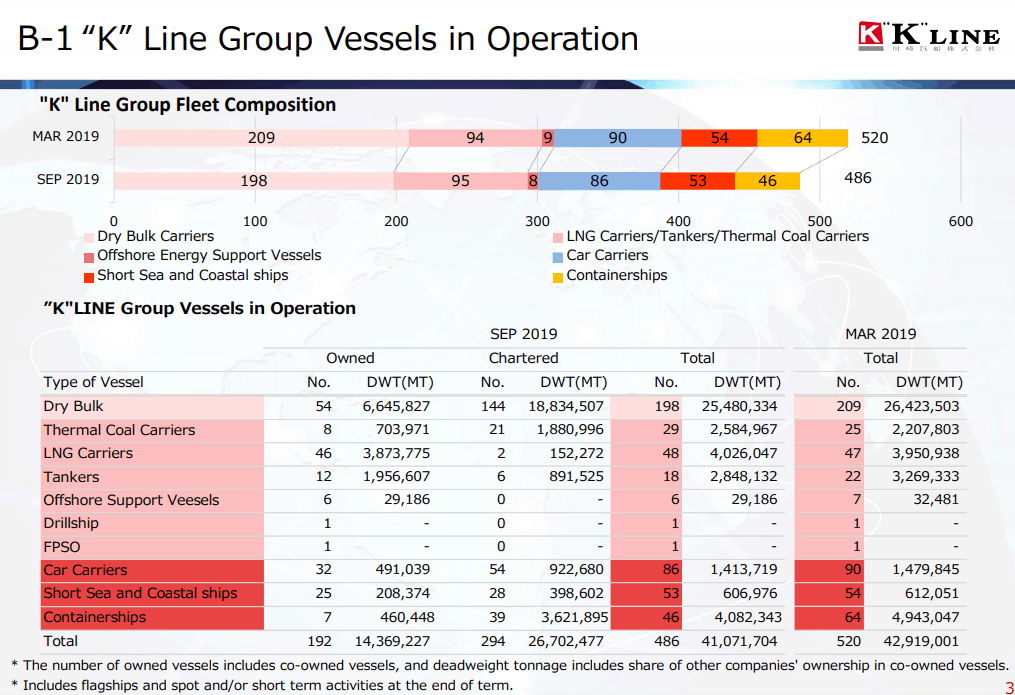

“K” Line said its fleet has shrunk since the beginning of the fiscal year, from 520 ships in March to 486 in September.

In the first half of the fiscal year, “K” Line’s dry bulk segment had revenue of 116.3 billion yen, an 11.9 percent drop from the same 2018 period, and profit plunged 90.5 percent to 2.1 billion yen.

“In the Cape-size sector, the demand for the transportation of iron ore from Brazil to China is vigorous, and in the medium and small size vessel sector, the demand for the shipment of grains from South America is strong as well as the market rate has recently been on a recovery. However, the overall vessel supply-demand, mainly in medium and small size vessel sector, did not recover in earnest because the scrapping of the vessels in surplus was shelved with the recovery of the chartering market,” the company said.

In its energy transport segment, which includes thermal coal carriers, LNG and LPG tankers, VLCCs, and offshore energy vessels, “K” Line said “the business stayed firm for mid- and long-term charter contracts. The segment had year-on-year increases in both revenue and profit. Revenue was up 4.3% to 43.8 billion yen, and profit was up 180.5% to 4.6 billion yen.

Product logistics is the company’s largest segment and had a big turnaround. Though revenues in the first half of the current fiscal year were 13.5% lower than in the first half of fiscal 2018-19, the segment had a profit of 10.5 billion yen in the six months ending Sept. 30, 2019 compared with a segment loss of 23.1 million in the first half of last year.

The company said its car carriers shipped fewer finished vehicles “because of the rationalization including the cancellation and the realignment for some unprofitable trades including other-than-Japan trades, even though stable cargo movements were maintained in the trades from the Far East.”

“Because of an improvement in vessel operation efficiency, a recovery in freight rates and optimization of the fleet allocation, the overall car carrier business recorded a year-on-year decrease in revenue but turned a profit,” the company said.

“K” Line said it had steady performance in its towage, sea-land integrated transportation, and domestic Japanese logistics and warehousing businesses. But it said there was a decline in air cargo elsewhere within Asia and to Europe and the United States so that “the overall logistics business recorded year-on-year decrease in both revenue and profit.”