Kirby Corp. (NYSE: KEX) reported third-quarter results that beat consensus estimates as barge operations in the U.S. Midwest returned to normal after months of severe flooding.

The Houston-based company narrowed its earnings guidance for 2019 as it expects a seasonally slow fourth quarter in marine transportation and the oil and gas industry.

The largest U.S. owner of tank barges for liquid bulk materials, Kirby reported net earnings of $48 million for the quarter, or $0.80 per share, up 15% from a year earlier. Revenue fell 5% to $666.8 million.

Chief Executive Officer Dave Grzebinski said the marine transportation business saw significant improvements in profitability. But the cyclical downturn in the oilfield markets continues to hit the company’s distribution and services segment.

“Our overall third quarter improved year-on-year, led by favorable results in marine transportation reflecting our enhanced earnings power from our recent investments and acquisitions,” Grzebinski said in a statement.

The marine transportation division reported an 8% revenue gain for the quarter to $412.7 million, while operating income rose 50% to $72.7 million and operating margin improved to 17.6% from 12.7% a year earlier.

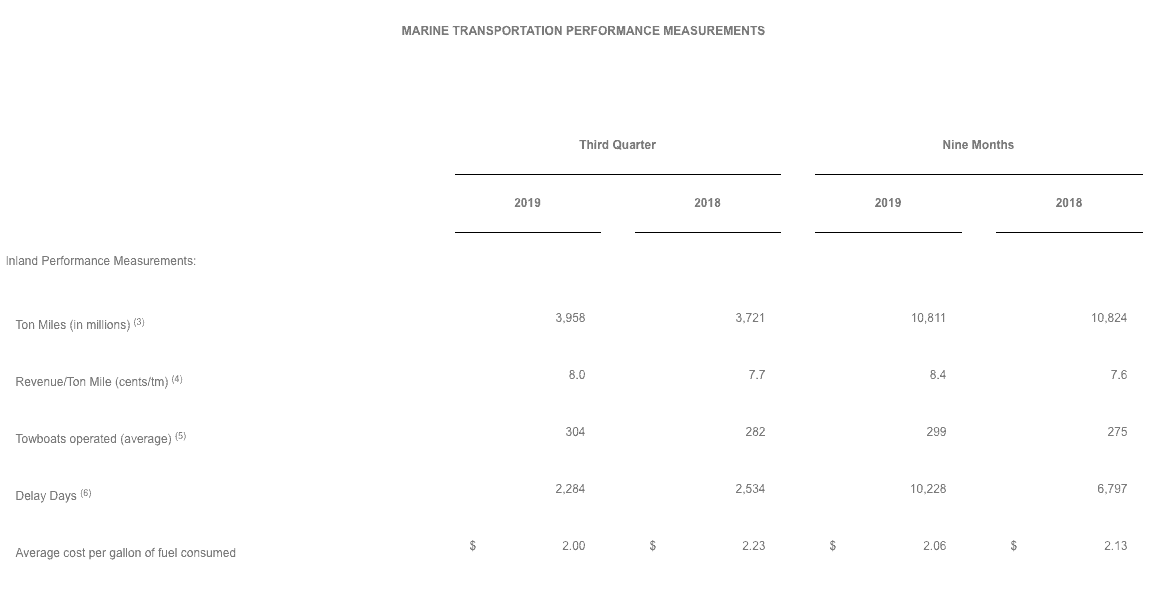

Inland barges saw better operating conditions, with receding floodwaters and favorable summer weather resulting in improved operating efficiencies across the fleet, the company said. Average barge utilization was in the low 90% range during the quarter. Pricing improved year-on-year, with spot rates increasing approximately 15% and average rates on expiring-term contracts increasing in the low to mid-single digits. Overall, revenues in the inland market increased 10% compared to the 2018 third quarter due to improved pricing and the contribution from acquisitions.

Coastal barge utilization was in the mid-80% range during the 2019 third quarter. Compared to the 2018 third quarter, spot market pricing was approximately 20% higher, and term contracts repriced higher in the mid-single digits. Revenues in the coastal market increased 3% year-on-year, primarily due to improved pricing and higher barge utilization.

Kirby’s distribution and services business, which sells and repairs major mechanical equipment such as diesel engines and pumps, saw revenue fall 21% to $254.1 million. Operating income fell to $9.1 million from $23.9 million a year earlier.

Oil and gas businesses saw declines in demand for new and remanufactured pressure pumping equipment and reduced sales of new and overhauled transmissions, parts and service. Kirby said it implemented reductions in workforce and other cost savings to mitigate the decline in demand.

For the fourth quarter, Kirby said the marine transportation segment will see “increasing delay days due to normal seasonal weather conditions,” and distribution and services will see “sequentially lower oilfield spending and seasonal declines in utilization of the rental power generation fleet.”

As a result, Kirby trimmed its earnings guidance of $2.80-$3.20 per share for full-year 2019 to a range of $2.80-$3 per share.