In a rare move, Knight-Swift Transportation Holdings Inc. (NYSE: KNX) issued full-year 2021 guidance a full quarter ahead of schedule. The Phoenix-based truckload (TL) and transportation provider said it expects 2021 adjusted earnings per share (EPS) to be in the range of $3.20 to $3.40, well ahead of the current consensus estimate of $2.90 according to Seeking Alpha.

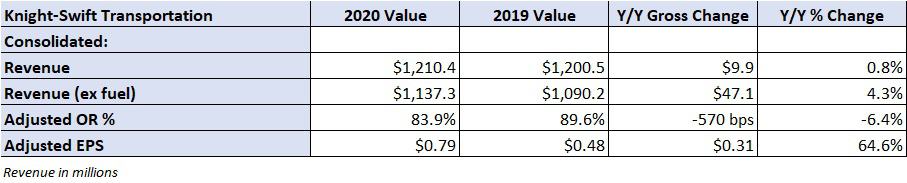

On Wednesday, the company posted third-quarter adjusted EPS of 79 cents, ahead of the consensus estimate of 64 cents and the 2019 third quarter of 48 cents. The adjusted result excludes 11 cents per share in amortization of intangible assets and legal accruals from before the Knight and Swift merger.

The carrier also increased its full-year 2020 EPS guidance to a range of $2.68 to $2.72 compared to the prior range of $2.15 to $2.30. The current 2020 consensus forecast calls for EPS of $2.39.

From the Wednesday press release, “Both the strength in freight demand and constrained capacity led to earlier peak volumes, which we expect will continue into the fourth quarter.”

Surging demand and tight truck capacity resulted in a 54% increase in adjusted operating income in the company’s trucking segment. The tight supply constraints led to 180 basis points of margin erosion in the company’s logistics segment (brokerage), which was partially offset by intermodal which swung back to profitability during the quarter.

The company doesn’t hold a conference call. Stay tuned to FreightWaves for more coverage on Knight-Swift’s earnings report.