Management at freight broker Landstar System said the market continues to stay soft and that a positive inflection likely won’t occur until the end of this year at the earliest.

“I would not declare bottom yet,” Jim Gattoni, president and CEO, told analysts on a Thursday morning call. He said if normal cycle durations hold, the market would start to tighten by late 2023 or early 2024, but he noted it will take better consumer demand before a recovery is realized.

Landstar (NASDAQ: LSTR) reported second-quarter earnings per share of $1.85 Wednesday after the market closed, 2 cents better than the consensus estimate but $1.20 lower year over year (y/y). The company lowered guidance in May, citing a lack of seasonal improvement in demand.

The company’s third-quarter guidance was worse than expected.

Landstar is calling for revenue of $1.275 billion to $1.325 billion, a 28% y/y decline at the midpoint of the range and lower than the consensus estimate of $1.39 billion at the time of the print. Earnings-per-share guidance of $1.65 to $1.75 was well below the $1.99 consensus outlook and more than $1 lower than the year-ago result.

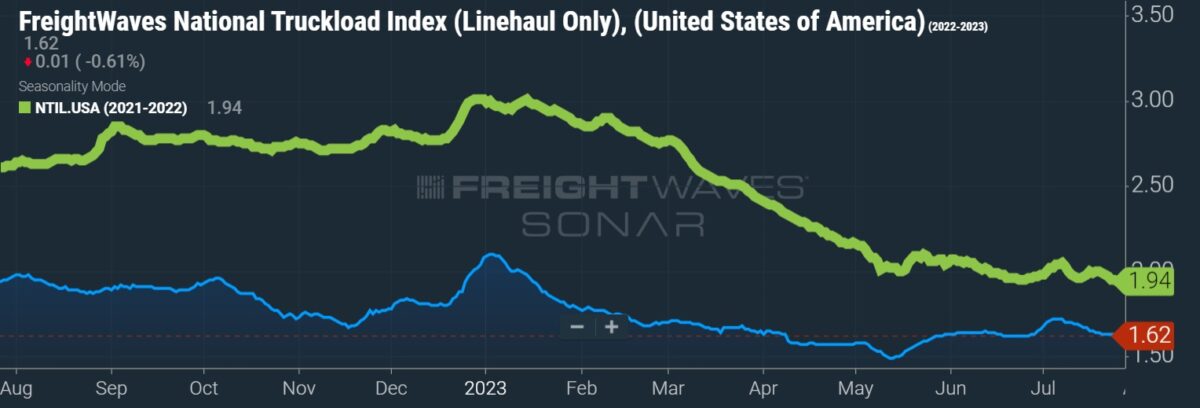

So far in July, loads and revenue per load for truck freight are underperforming normal sequential trends.

Management expects loads hauled by truck to decline 16%-18% y/y in the third quarter and revenue per load to be off by 10%-12% y/y. The guidance implies loads will be down 6% from the second quarter with revenue per load turning the corner, up 1%.

Gattoni said the guidance may be conservative but the monthly metrics are still underperforming normal seasonality by 100 to 200 basis points.

He said the company hasn’t really seen any green shoots in recent weeks. However, he noted revenue per mile on loads hauled by business capacity owners, which tends to be higher-priced freight, ticked up from May to June. The company has also seen an increase in inquiries about trailer availability. Gattoni said that those metrics have been indicative of market inflections in the past.

Landstar reported second-quarter revenue of $1.37 billion, a 30% y/y decline as total truck loads fell 16% and revenue per load fell 15%. The declines were more pronounced in the dry van market than in flatbed. Dry van loads were down 17% with revenue per load off 18%. The flatbed metrics experienced declines roughly half those amounts.

Total truck capacity on the platform was off 12% y/y with trucks provided by BCOs down 11% y/y, 2% lower sequentially.

Variable contribution, or revenue less purchased transportation and commissions, declined 26% y/y to $198 million. The contribution margin was up 90 bps to 14.4% as purchased transportation costs as a percentage of revenue declined 160 bps.

The company has generated $179 million in free cash flow year to date. It reduced its debt-to-capital ratio 300 bps y/y to 8% in the quarter. It raised its quarterly dividend by 3 cents per share to 33 cents.

Shares of LSTR were off 4.1% Thursday at 11:02 a.m. EDT compared to the S&P 500, which was up 0.5%.

More FreightWaves articles by Todd Maiden

- Old Dominion uses cost control to mitigate slumping demand in Q2

- Teamsters demand Yellow’s previous $11-per-hour offer

- LTL industry likely altered regardless of Yellow’s fate