Image: Shutterstock

The economy lost some momentum in the first quarter of 2019, and freight movements were not spared from the softening. However, there are a handful of reasons to be optimistic heading into the second quarter.

FreightWaves CEO and Managing Director Craig Fuller and FreightWaves Chief Economist Ibrahiim Bayaan teamed up to discuss the first quarter of 2019 and what to expect moving forward in the April Market Update.

While there are several factors at play when it comes to predicting market conditions in the second quarter, last year’s surge of imports from China in an attempt to sidestep tariffs could lead to increased freight demand in the coming months.

Inventories that were stored in warehouses late last year are expected to flow into the wider economy in the second and third quarter, bolstering freight demand, according to Bayaan.

“We’ve talked a lot over the last couple of months about how imports surged at the end of last year and ended up being stored in inventory,” Bayaan said. “I still think there’s a good amount of that that is just sitting on the coast, waiting to get unleashed into the rest of the economy.”

Both imports and exports downshifted in the first quarter, and import growth was negative year-over-year for the first time since 2016. However, Bayaan expects to see increased import volumes in the second quarter, another positive sign for freight demand.

“There was a big surge in imports at the end of 2018 to try to avoid tariffs, so part of the weakness during the first quarter is payback for that,” Bayaan said. “As retail rebounds, you should see better import growth going forward.”

The export sector has struggled because of weak growth in both Europe and China, but the China stimulus has already begun and will likely boost some growth in the second and third quarters.

“There have been rumblings that a trade deal is forthcoming between the U.S. and China,” Bayaan said. “It is much more important that global growth picks up, but a resolution on tariffs would also move things in a positive direction.”

While a trade deal would likely move things along in the right direction, general trade policy uncertainty could prove to be a weak point for the second quarter.

“There is still this overarching cloud of trade policy uncertainty that exists in the economy, which is weighing down a lot of business investment and slowing down economic activity in general,” Bayaan said.

Weak business investment overall could also take a toll on the upcoming quarter. Business investment slowed down considerably at the end of 2018 and into the beginning of 2019. Bayaan did not anticipate an improvement in the second quarter.

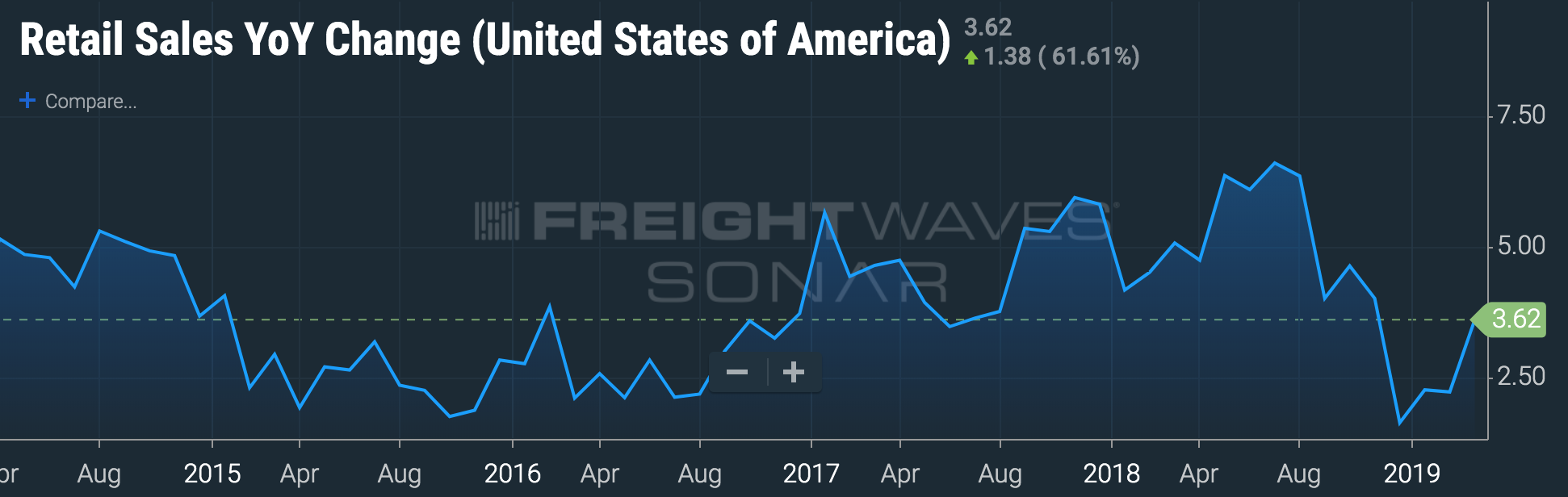

Rebounding retail activity at the end of the first quarter could be another harbinger for stronger freight demand in the second quarter.

Retail activity numbers were low earlier this year, which Bayaan attributed partially to poor weather conditions across the country. Retail rebounded from a disappointing February in March, with the growth rate climbing from 2.2 percent to 3.6 percent year-over-year. It was one of the strongest rebounds seen in the retail sector since mid-2017.

Chart: FreightWaves’ SONAR

While retail activity growth is still well below the pace seen in the middle of last year, Bayaan expects retail to be a strong source of freight demand going forward.

The overall labor market seems to be holding strong. After a scare in February, job growth rebounded significantly in March. Hiring is still moving forward at a decent clip, and unemployment remains at near multi-decade lows, according to Bayaan.

Unlike the overall job market, the trucking industry saw a decline in job growth for the first time in nine months.

“A single month doesn’t really mean a whole lot, but I think a lot of the fundamentals are in place to say that you are not going to see the same amount of hiring going on in the industry that you did over the last year or so,” Bayaan said. “There is a sense that there is already enough capacity in the market, so there’s no real reason to keep adding drivers the way they did over the last year.”

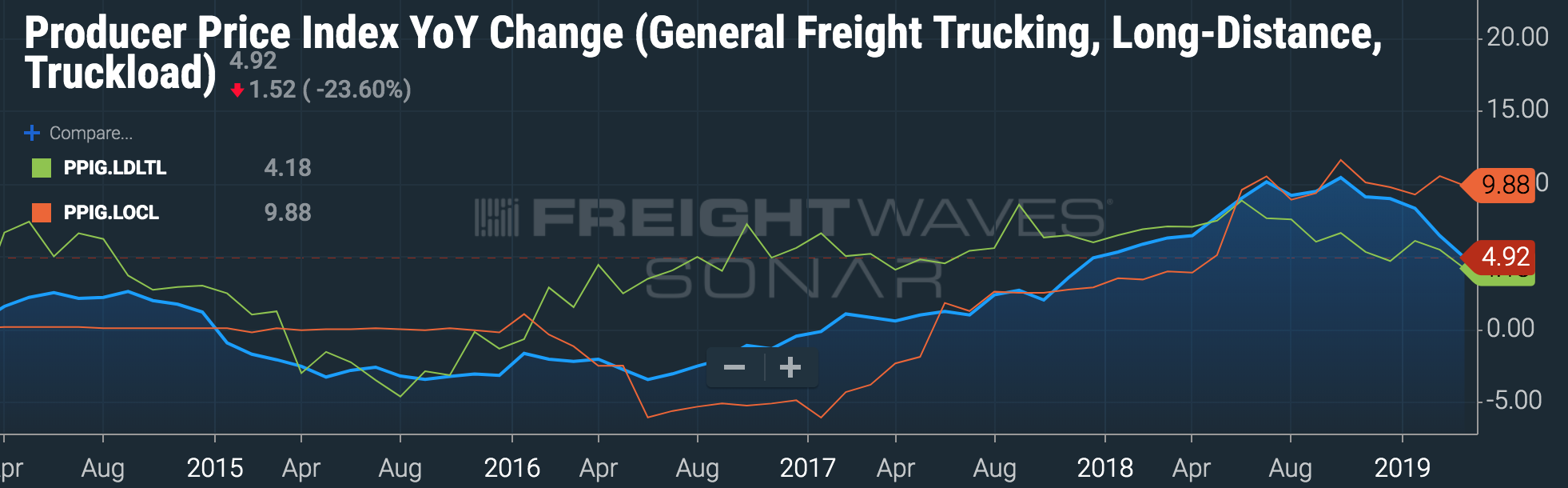

Rates for long distance trucking declined for the third straight month in March. Year-over-year growth continued to decelerate, falling below 5 percent.

Chart: FreightWaves’ SONAR

While freight volumes are expected to improve in the second quarter, loose capacity will continue to put downward pressure on rates.