Cargo thefts surge 15% in 2022

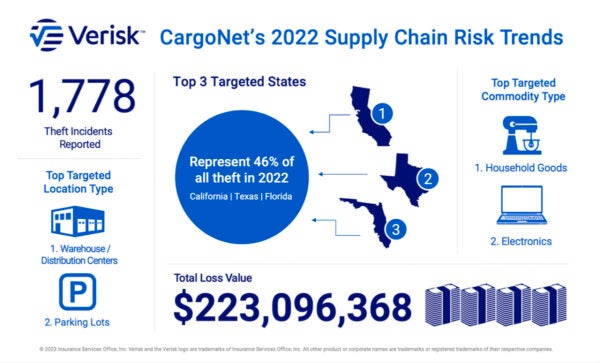

FreightWaves’ Noi Mahoney reports that, according to CargoNet data, a surge in cargo thefts near the end of 2022 led to an estimated $223 million in goods being stolen across Canada and the U.S.

Regarding who’s committing most of the cargo thefts, organized crime takes the top spot. Scott Cornell, transportation lead and crime and theft specialist at Travelers, said nine out of 10 cargo thefts are committed by an organized crime group. The top commodity stolen was household goods, followed by electronics, then food and beverage commodities.

“Most of the time, cargo theft is committed by organized rings and those rings are usually fulfilling orders,” Cornell said. “They have orders that they’re filling, trying to meet the needs of their customers that they have within their own supply chain that have asked them for electronics or energy drinks, cleaning supplies, things like that.”

According to CargoNet, the theft tactics are relatively simple yet straightforward. Identify a distribution center and what it holds, then watch the trucks leaving and entering the facility. Once a suitable truck is located, follow it to where it shuts down, or where many historically take their 10-hour breaks, and steal the cargo.

For many unaware, most trailers are only secured with a plastic seal or sometimes a simple padlock, easy pickings for a determined cargo thief with a pair of sturdy bolt cutters.

LMI January data shows second consecutive increase

The Logistics Managers’ Index reading in January increased 3 index points month over month from 54.6 in December to 57.6, the second consecutive increase in the overall index over the past eight months. For the LMI, a score above 50 indicates expansion while a score below 50 is a contraction.

Regarding the slight expansion in January, the report said, “Supply chains are not so flush with inventory that they are merely shifting goods around. Inventories are much lower now than they were in Q3 of last year, and it seems the supply chains are coming back to life with the goal of replenishment.”

Regarding inventories, the report noted that firms were finally able to decrease inventories over the holiday season with some movement toward replenishment. January inventory levels increased 5.2 points to 62.5 but there is not an expectation of supply chain congestion challenges. “Last year inventories were peaking in February and March due to port congestion, we would anticipate that this will not be the case this year, as the lack of backlog at the ports combined with shorter order times might lead back to something resembling ‘normal’ seasonality,” the report said.

One challenge for freight volumes and restocking remains constrained warehousing space. The report said, “Warehousing capacity contracted at a slightly slower rate (+1.7) than in December, reading in at 46.4. This marks the 30th consecutive month of contraction, the longest run of contraction that we have observed for any of our metrics during the 6.5 years of the LMI.”

Market update: Preliminary Class 8 orders see new year hangover

ACT Research recently released preliminary data on Class 8 orders that showed a January total of 18,400 units, the first decline year over year since August 2022. With many months of consecutive order growth, experts are not concerned yet regarding this lull.

“Given how robust Class 8 orders were into year end, the relative pause in January is not surprising,” noted Eric Crawford, ACT’s vice president and senior analyst, in the report. “We note that over the final four months of 2022, nearly 159k Class 8 net orders were placed, +92% y/y, and only 8% below those placed over the same period in 2020. January’s orders represent the first y/y decline in five months (August).”

Lingering supply chain disruptions may also be contributing to these declines. FreightWaves’ Alan Adler wrote, “Volvo Group North America is an outlier. It did not open its 2023 truck orderbook in the third quarter or for much of the fourth quarter, resulting in 21% lower orders. Volvo remains more affected by supply chain disruptions than Paccar and Daimler Truck, which suggested parts availability issues are largely behind them.”

FreightWaves SONAR spotlight: Spot rates and container volumes go out with the tide

Summary: The containerization bonanza that dominated the past two years appears to be coming to an end. This comes as the Inbound Ocean Shipments Index (IOSI) fell sharply over the past two weeks from 115.37 points on Jan. 25 to 75.60 on Wednesday, a decline of 34.5% as the impacts of the Chinese New Year for new order bookings mark the death knell for this historic run.

The IOSI ticker is useful to determine the demand generated by new bookings at specific origins compared to the historical data reported by destination ports or U.S. Customs. This forward-looking volume index can provide an early indication if maritime volumes are rising or falling and will show up in the Customs data weeks later once the vessels arrive.

The FreightWaves National Truckload Index (NTI) saw a similar rising-then-falling action as the glut of containers strained ports and distribution centers before being translated into truckload volumes. Falling truckload volumes, impacted by declining imports, declined 11.7% year to date from $2.82 on Jan. 1 to $2.49 as of Tuesday.

For ocean carriers, these declines in volumes are being affected by the Chinese New Year that ended with the Lantern Festival on Sunday. Following the event, it will take a few weeks for workers to return back to the cities and manufacturing hubs. The important trend to follow will be if there is a notable rise in volumes or if waning U.S. consumer demand falls back to historical norms.

The Routing Guide: Links from around the web

Trucking demand visibility is far more important than supply (FreightWaves)

Idling rules considered in multiple states (Land Line)

DOE/EIA price falls as diesel market heads into Russian export restrictions (FreightWaves)

FreightWaves opens 2023 Shipper of Choice nominations (FreightWaves)

Ex-Celadon trucking executives settle case with SEC (FreightWaves)

OOIDA brings 2023 priorities to Washington lawmakers (Transport Dive)