The Port of Los Angeles released record results for June on Wednesday. Neighboring Port of Long Beach followed suit with its own records later in the day.

Gene Seroka, the executive director of the Port of Los Angeles, also highlighted a major risk to the country’s supply chain if rail service is not improved. The shortfall of rail service to handle import cargo — which is causing more containers to pile up at terminals for longer — is front and center, he said during a press conference.

“All eyes are focused on improving the rail product. Full stop. The bottom line is that we must take action on this issue immediately to avoid a nationwide logjam,” he warned.

Best June ever for Los Angeles throughput

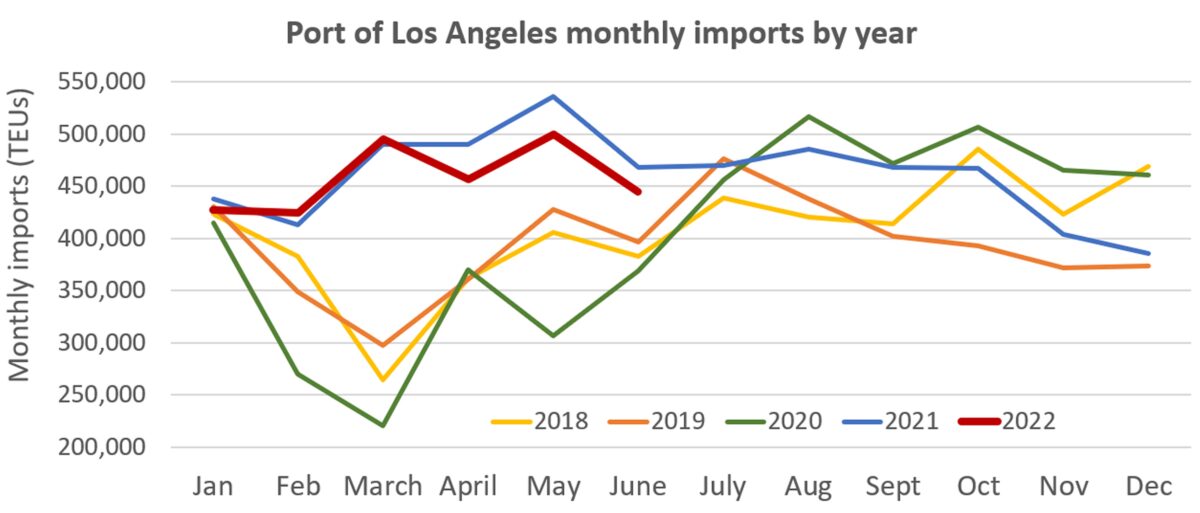

The Port of Los Angeles handled 876,611 twenty-foot equivalent units of total throughput for last month, making it the highest-performing June ever. Total throughput was up less than 1% year on year (y/y) but up 15% versus the prior five-year average for that month. Exports came in at 93,890 TEUs, down 2% y/y, with 338,041 empty containers shipped, up 8% y/y.

There were 444,680 TEUs of imports, down 5% y/y but up 12% from the trailing five-year average. It was the second-best June on record for Los Angeles imports.

June imports were down 11% sequentially — by 55,280 TEUs — from imports in May. However, ships with a total capacity of 91,664 TEUs were waiting in Los Angeles’ offshore queue at the end of June.

Asked during the press conference whether the decline in June versus May was due to rail issues that limited terminals’ capacities and their ability to unload ships faster, Seroka replied: “If we’re not moving in sync, we’ve got to handle containers more than once and that takes time and money and it takes efficiencies out of the system. So, if we have these 20,000 aging rail containers [dwelling nine days or more] on the ground, sure, it causes problems.”

Terminal congestion ‘nowhere near’ Q4 ‘dire straits’

Seroka maintained that current conditions “are nowhere near the inundation of containers on these terminals in the fourth quarter [of 2021]. I don’t see us in the dire straits I witnessed last year ahead of the holiday season.”

He emphasized that the total number of import containers on the port — 71,013 as of Wednesday — was down 25% from peak levels in late October. (However, port statistics show that that there haven’t been this many import containers in Los Angeles since Nov. 10.)

Seroka also stressed that long-dwelling containers are now mostly bound for rail transport, which was not the case in Q4 2021. “The rail cargo sitting nine days or longer now makes up 75% of all our aging cargo, which is why I’m advocating that we need to kick it into gear to get this problem solved.

“Everyone has a role to play. Cargo owners must pick up their boxes at inland rail terminals faster than they are today. The railroads need to get crews and engine power and rail cars back to the West Coast faster. And the marine terminals, shipping lines and ports need to provide key data to help prioritize the evacuation of this cargo.”

Peak season should be ‘strong’ but ‘tapered’

Seroka remains confident on peak season import volumes despite macroeconomic headwinds from inflation and inventories.

“Even though some retailers have high inventories and may look to discount goods, I expect imports to remain strong — although a tapered version of last year,” he said.

“The volume you’re seeing coming through right now was ordered about three or four months ago. The cargo that’s going to come over during the next couple of months is going to look different.

“Looking at the back half of the year, we’ll be seeing back-to-school, fall fashion, Halloween and the all-important year-end holiday goods coming across the Pacific,” he said.

“During the pandemic, we saw many Americans buying goods they don’t normally buy. A new couch. A new refrigerator. In my case, I picked up golf again and bought new clubs. It really didn’t help my game. We were spending on goods we don’t necessarily repeat buying. So, you’ll start to see those level off but other [buying] will continue.”

Record June for Port of Long Beach

The Port of Long Beach reported Wednesday that it handled total throughput of 835,412 TEUs last month, up 15.3% y/y, making it the strongest June in the port’s history. Exports fell 1.4% y/y to 115,303 TEUs and empties surged 21.6% to 304,433 TEUs. Long Beach imports came in at 415,677 TEUs. That’s down 5% sequentially from May, but up 16.4% y/y, making it the port’s best June ever for imports.

Click for more articles by Greg Miller

Related articles:

- Long Beach container backlog crosses red line as delays mount

- There’s still over $40B in cargo on container ships waiting offshore

- Win streak continues: Container lines just posted more record results

- California ports piling up again: Too many containers sitting too long

- Los Angeles port: Peak season coming soon, strong imports ahead

- Boom times not over yet: US container ports still near highs