It is a painful time for owners of oil tankers and dry bulk carriers. But there are also bright spots amid the ocean shipping gloom. Not only is the container sector booming, but liquefied petroleum gas (LPG) shipping rates have just hit their highest point in a half-decade.

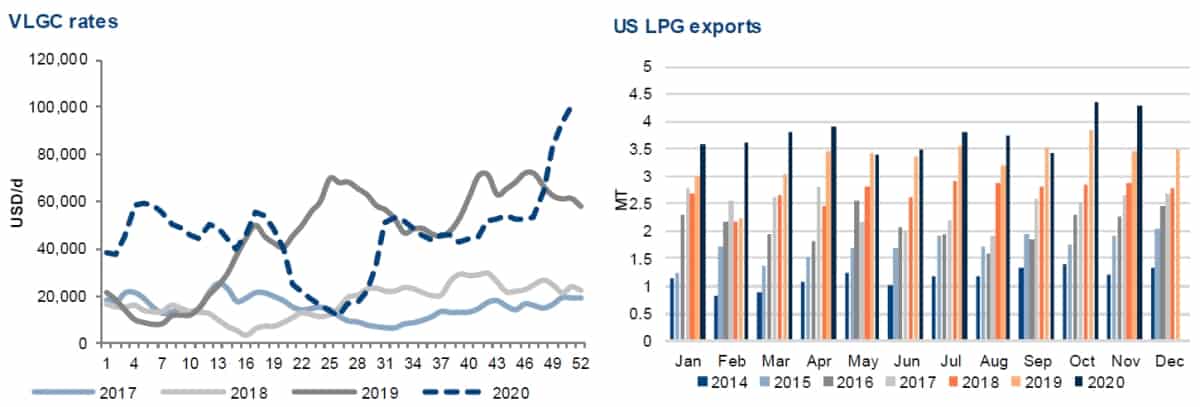

On Monday, the Baltic Exchange assessed rates for very large gas carriers [VLGCs, LPG carriers with capacity of around 84,000 cubic meters] at $103,000 per day. That’s up from lows of under $20,000 per day as recently as July.

Stocks of VLGC owners are heading upward. The two Norwegian players, Avance Gas (Oslo: AGAS) and BW LPG (Oslo: BWLPG) are up 120% and 112%, respectively, over the past six months. U.S-listed Dorian LPG (NYSE: LPG) is lagging, albeit still up 44% over this period.

For insights on what’s driving VLGC rates higher and whether this rate rally has legs, FreightWaves interviewed Scott Gray, a Texas-based LPG cargo broker at Libra Fearnley Energy.

Gray is known in industry circles as one of the co-founders of the Waterborne Reports, a highly respected gas-shipping intelligence company that was subsequently acquired by IHS Markit (NYSE: INFO).

US exports surprise to the upside

LPG — i.e., propane and butane — is produced through oil and gas production, as well as through the refining process. When COVID lockdowns cut consumption in the first half and oil pricing collapsed, it was feared to be a dire scenario for LPG shipping.

Lower U.S. production plus sharply reduced refinery output would theoretically slash U.S. LPG volumes available for export. VLGC rates have two main drivers: U.S.-Asia and Middle East-Asia flows. Because the U.S.-Asia voyage is much longer, it’s more important for rates. Thus, COVID-constrained U.S. LPG exports would cap VLGC spot rates.

But fears on U.S. exports turned out to be unfounded.

“I would say that U.S. waterborne LPG exports have not been impacted by the various and sundry events we saw in the first and second quarters,” explained Gray. “If you look at a graph of exports, it bobs and weaves but there’s no big spike to the downside. In fact, I’d go far as to say that the fourth quarter looks better on average than the first three quarters. We’re seeing 80, 82, 84 VLs [VLGCs] being loaded per month. I’d say that is robust.”

Unlike Middle East LPG, which is generated more from the refining process, U.S. LPG has been increasingly generated through natural-gas production, said Gray. Natural-gas production held up better than oil production and refining in the wake of COVID.

The same point was made on U.S. production during the latest quarterly call of BW LPG. “Despite lower oil production, we’ve seen higher [U.S.] LPG production,” said CEO Anders Onarheim. Niels Rigault, BW LPG’s executive vice president of commercial, added: “U.S. LPG production … has proven to be more resilient in a low-price environment.”

Far East demand is very strong

Listed VLGC owners highlighted strong Asian demand in recent months from China, Japan and Korea. In Asia, propane is used for heating and cooking as well as for production of plastics.

On the industrial side, LPG is consumed by propane dehydrogenation (PDH) plants. Some PDH plants use only propane as a feedstock; others use propane or naphtha, depending upon price. In layman’s terms, PDH plants produce propylene, the precursor to polypropylene, the precursor to plastic.

Given all the plastic packaging for goods consumed in the wake of COVID, propylene pricing is surging. And with it, Chinese propane pricing. “Propylene values are at or near record levels. So these guys are making as much hay as they can while the sun shines,” said Gray.

The higher the spread between U.S. propane and Chinese propane, the higher the transport costs can go while still providing shippers an acceptable profit margin on the sale.

“That [Asian] demand has kept prices high. When the difference [with U.S. pricing] increases, the shipping sector steps in and says, ‘We’ll take a piece of that pie.’ That’s what’s causing freight to scream up so much right now,” said Gray.

Middle East exports and Indian imports

LPG shipping demand must be seen in context of both Middle East and U.S. exports.

Middle East exports have been hit more by COVID than U.S exports because the pandemic precipitated OPEC production cuts and reduced refinery runs.

“We have seen reduced output from the Middle East as a result of lower refinery operations,” confirmed Gray. “There’s also a decline in volume from Iran mixed into that. In January, Iran’s output was around 575,000 tons. In November, it was 250,000 tons.”

A key development from global shipping demand has been the increased imports of U.S. LPG by India as opposed to supplies from the Middle East.

According to Rigault, “India started to import from the U.S. last year. The duration of the voyage is more than four times [that of] voyages from the Middle East, supporting ton-mile demand. India has primarily bought all their LPG from the Middle East. But they also see the prices in the U.S. and that it makes sense for them to also buy U.S. products.”

Gray is skeptical of the U.S.-India trade, which began early in 2019. “It started with a bang. It was considered a new thing. A new route. But it seems the Middle East marketers have taken some of that back. They’re saying, ‘Not in my backyard.’ Because it really is next door. It’s tough for the U.S. to compete on a long-haul freight basis when the Middle East can send it around the corner. Also, Indians have contracts in the Middle East. With us, it’s more spot opportunities.”

Canal and drydocking supply constraints

There are also two major constraints on ship supply that are boosting rates: Panama Canal congestion and LPG vessel maintenance and retrofit drydockings.

As previously reported by FreightWaves, transits through the Panama Canal have slowed during the past two months for ships without transit reservations. “We’ve seen increased volumes moving from the U.S. to Asia via the Cape of Good Hope as a result of delays, which has caused freight rates to increase,” said Gray.

“But it really is just the unreserved volumes,” he added. “If you’ve got a contract from the U.S. to Asia, you’ve probably got slots at the canal. It’s the opportunistic traders who are being impacted the most.”

The more important vessel-supply issue involves drydockings.

“There are 25-30 LPG ships in the Asian drydocks right now for required maintenance,” he noted. “Just step back and remember five years ago: That’s when all the newbuildings flooded in. Here we are five years later, and just like when you buy a car and have to bring it in, ships have to be maintained. And all these guys are going to the yard at the same time, tightening the market.”

Outlook for Q1 2021

How long can VLGC rates sustain their current multiyear highs?

On the drydocking front, rate tailwinds will persist. “In Q1, it very much looks like there will be at least as many ships in drydock [as in Q4],” said Gray. According to Rigault, “23% of the [global VLGC] fleet will drydock next year.”

On the cargo front, Middle East volumes could increase. OPEC cuts are being pared in January. “It’s going to have an impact at some point,” affirmed Gray.

Meanwhile, Joe Biden will become president on Jan. 20. Biden is expected to be less hawkish toward Iran that Donald Trump. That could eventually hike Iranian LPG exports.

The big unknown is the arbitrage spread between American and Chinese LPG, which will determine volumes on this long-haul route.

In Asia, even more PDH capacity is coming online. “I don’t see a case in the near term where petrochemical demand subsides,” said Gray.

That leaves the weather. If it’s cold in the U.S. and domestic LPG demand for heating intensifies, but it’s warm in northern Asia and demand decreases, the spread will narrow and cargoes will decline. Vice versa for the reverse scenario.

“If you look at the forecasts, they’re saying there’s a better chance of a warmer-than-average winter period here, and conversely the forecast for Europe and Asia calls for cold,” said Gray. “But that’s not to say you or I or anyone knows.” As always, he said, the LPG equation will come down to “weather, chemicals, Asia and shipping.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON LPG SHIPPING: How the Panama Canal is affecting ocean shipping: see story here. LPG shipping: volatile, spot-exposed, leveraged to COVID: see story here. Q&A: Dorian LPG CEO John Hadjipateras: see story here. Epic Gas thinks big (and small): see story here.