Truck broker Landstar System lowered its second-quarter guidance in a filing with the Securities and Exchange Commission Tuesday after the market closed.

The Jacksonville, Florida-based company said both revenue and earnings will come in below the ranges it provided when it reported first-quarter results at the end of April. At the time, the company’s management team said that while the softer market trends experienced in the first quarter had worsened a little in April, it expected a normal seasonal uptick in May.

That didn’t materialize.

The new outlook calls for revenue of $1.325 billion to $1.375 billion, a 5.3% reduction from previous guidance assuming the midpoint of both ranges.

The change is based on loads hauled by truck being down 16%-18% year over year (y/y) in the first seven weeks of the second quarter and revenue per load being off 14%-16%. The prior guide called for declines of 14%-16% and 12%-14%, respectively.

The new range for earnings per share is $1.75 to $1.85, which was lowered by 8% at the midpoint (15 cents lower on each end). The consensus estimate at the time of the Tuesday announcement was $1.97.

Shares of Landstar (NASDAQ: LSTR) were down 2.9% in after-hours trading on Tuesday.

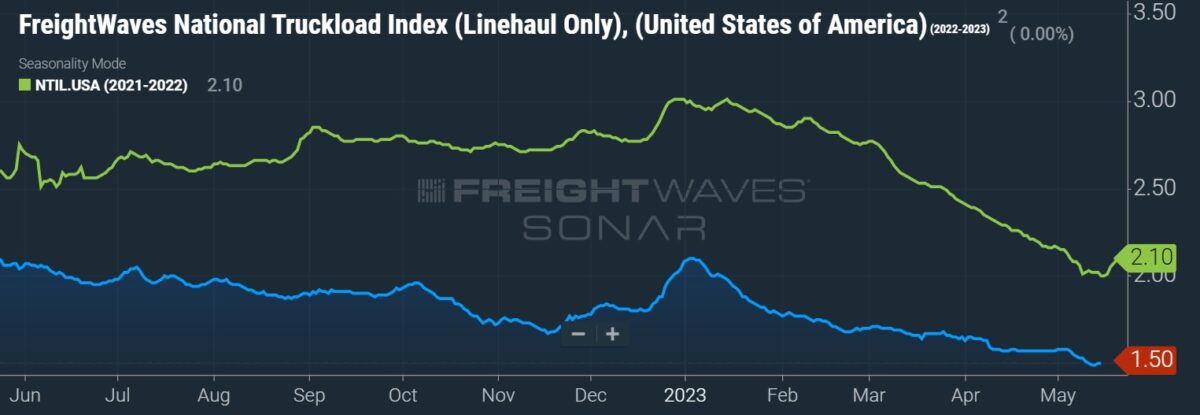

FreightWaves data shows truck capacity continues to remain loose and spot rates are still searching for a floor. While carriers are hopeful that big-box retailers have burned off excess inventories, no retailer has yet signaled a material need to refill its distribution centers. As such, the industry awaits a more meaningful reduction in carrier operating authorities or a pickup in demand in industrial or consumer-related end markets.

Landstar’s filing said the guidance change was ahead of management’s appearance at Wolfe Research’s annual transportation conference on Wednesday.

At an investor conference last week, management teams from J.B. Hunt Transport Services (NASDAQ: JBHT) and Schneider National (NYSE: SNDR) stated that little had changed from the commentary they provided on their quarterly calls in April.

Both companies had representatives on an intermodal panel at the Wolfe conference on Tuesday who said they were still waiting for demand to improve and that the outlook for the back half of the year remained uncertain.

More FreightWaves articles by Todd Maiden

- J.B. Hunt, Schneider still waiting for intermodal demand to turn

- R&R Express acquires North Carolina carrier Taylor Transportation

- Brokers, forwarders adjust course as market softens