South Korean ocean carrier HMM may have a shiny new corporate identity but its first quarter results were written in the same dreadful red ink as last year. Although the ocean carrier generated large increases in revenues, its costs surged, which led to large losses in the first three months of 2019.

First quarter revenues

South Korean dry bulk and ocean shipping company HMM has revealed total revenues of 1.3 trillion Korean Won (US$1.9 billion) in the first quarter of this year. Earnings rose by about 18 percent compared to the first quarter of last year.

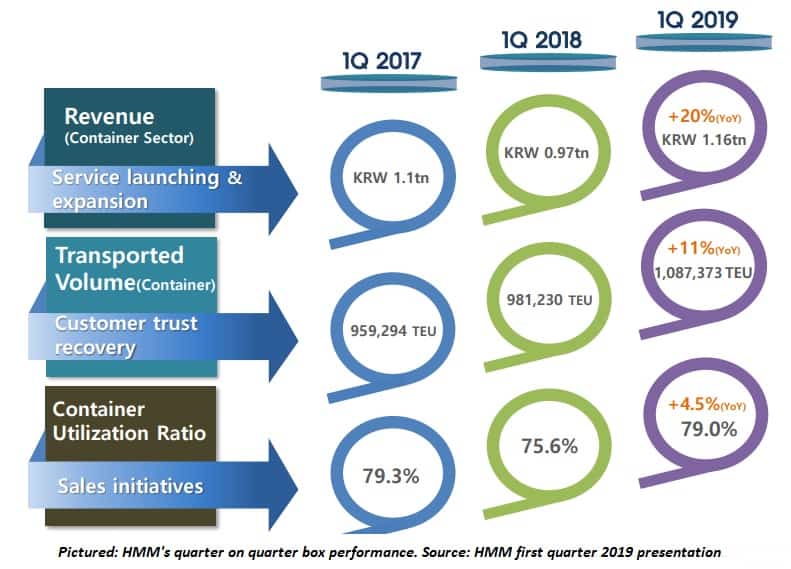

Container-derived revenues accounted for the overwhelming majority of those earnings. Box-generated revenues rose by 20 percent in the first quarter of the year to stand at KRW 1.17 trillion (US$978.77 million).

HMM noted that the increase in revenues was due to growth in the volume of boxes handled. Box volumes rose by 11 percent in the first quarter of 2019, on a like-for-like basis with the first quarter of 2018, to reach just under 1.09 million twenty foot equivalent units.

Rising costs led to losses despite revenue gains

But even though revenues rose the company made a loss owing to increases in the cost of sales and in general expenses.

HMM overall made a loss of KRW 179 billion (US$159 million).

Cost of sales surged by nine percent to stand at US$1.2 billion in the first quarter of the year when compared to the same quarter in 2018. Meanwhile the costs noted in the Selling, General and Administration account rose by five percent to stand at $67 million in the first quarter.

And so it wasn’t pretty in the profit/loss account. Losses of US$159 million were recorded in the first three months of 2019. HMM management may take consolation in the fact that the losses in the first quarter were marginally less dreadful than the losses recorded in the prior corresponding period in 2018. Incurred losses fell by a million U.S. dollars from the first quarter of 2018 to stand at $159 million.

Liquidity: fall in current ratio

HMM’s liquidity arguably worsened on a current ratio basis. In the first quarter of 2018, the company had KRW 123 (as expressed in units of 10 billion) of current assets and current liabilities of KRW 68 (in units of ten billion). Its current ratio back then was 1.8, meaning it had plenty on hand to cover its immediate bills. However, by the end of this year’s first quarter that position had markedly changed. Current assets rose to KRW 148 (in units of ten billion) while current liabilities shot up to KRW 178 billion (in units of ten billion), which gives it a current ratio of 0.83.

The overall debt to asset ratio increased too, rising from 60 percent at the end of the first quarter of 2018 to 73 percent by the end of the first quarter of 2019. That means about 73 percent of every Korean Won’s worth of assets owned by the company is financed by debt.

Market commentary

Commenting on the results, HMM noted that container freight rates dropped after the Chinese New Year holidays, which affected its financial performance. The company was also operating in an environment of weak freight rates owing to an oversupply of vessels. Costs increased owing to rising fuel bills.

The company noted that the trans-Pacific box market was weak owing to a front-loading of cargoes in the final quarter of last year and slack-season effects. European and South American box markets were both weak owing to an oversupply of vessels. Meanwhile the company said the Asian markets experienced weak demand in the Middle East.

Looking forward, the box-carrier has noted that the vessel oversupply situation is likely to ease. However, the looming IMO 2020 sulphur deadline “is expected to add fuel costs to shipping companies”.