Old Dominion Freight Line saw a continuation of robust growth rates during November. The less-than-truckload carrier credited a strong economy and its efforts to win market share as the reasons.

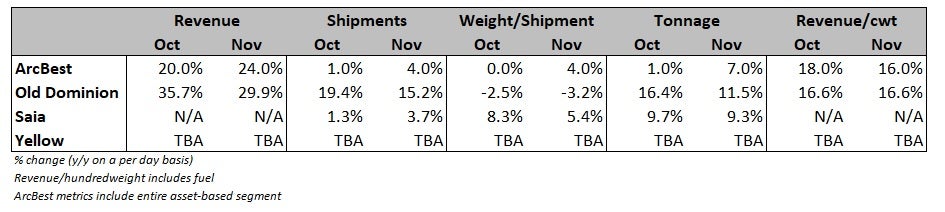

Daily revenue increased 29.9% year-over-year in November as tons per day increased 11.5% and revenue per hundredweight, or yield, was up 16.6%. November results reflected a modest deceleration from the October comps (revenue +35.7%, tonnage +16.4%). Yields increased by the same amount in both months and were up 9.4% excluding fuel surcharges in the first two months of the quarter.

Old Dominion’s (NASDAQ: ODFL) revenue growth also moderated slightly on a two-year stacked comparison, up 36.2% in November versus a 38.3% increase in October. Two-year tonnage comps were separated by a similar amount, up 18.6% in October and 16.7% in November.

Even with the slight moderation in trends, Old Dominion’s management remains bullish on its prospects as capacity expansion initiatives aim to deliver a larger portion of the LTL pie.

“Our revenue growth through November reflects our continued ability to win market share and the ongoing strength in the domestic economy,” Greg Gantt, president and CEO, stated in the press release. “We believe the sequential change in revenue per day for the fourth quarter of 2021 will once again exceed our 10-year average for this metric.”

On Old Dominion’s third-quarter call with analysts, management noted several short-term expenses associated with onboarding incremental capacity. The company is adding terminals and expanding door counts at existing facilities, as well as hiring drivers and staff to accommodate volume growth. The carrier reported a 21% year-over-year increase in headcount during the third quarter, which was its fifth straight quarter of above-trend hiring.

Inclusive of the cost headwinds, Old Dominion still expects to record a 74% operating ratio for full-year 2021, assuming normal sequential margin seasonality (typically 200 to 250 bps of degradation) holds in the fourth quarter. Gantt’s commentary calling for sequential revenue changes in the fourth quarter to exceed the historical average suggests the likelihood of that happening is high.

That would mark 340 bps of year-over-year margin improvement and place the carrier ahead of its long-term OR target of 75%. Many investors may be looking to the fourth-quarter call in early February to see if new goalposts are provided.

“We also expect that strong customer demand will continue into next year, as shippers continue to value our superior service and available network capacity at a time when the industry’s capacity is generally limited,” Gantt said. “While we have capacity to support additional volume growth, we remain committed to further investment in our business to support our expectations for increased market share in 2022 and beyond.”

Old Dominion’s top-line results outpaced that of other LTL providers as well.

ArcBest (NASDAQ: ARCB) reported Thursday daily revenue grew 24% year-over-year in November, following a 20% increase in October. The company also experienced comparable yield trends in the quarter.

The same day Saia (NASDAQ: SAIA) said tonnage has trended nearly 10% higher year-over-year so far in the fourth quarter. The carrier doesn’t provide revenue or yield metrics in its intraquarter updates but assuming it experienced mid-teen yield increases similar to its competitors, it’s likely booking mid-20% revenue gains compared to last year.

High freight demand and a lack of truck capacity have yields moving up across the industry. The current dynamic is affording carriers the opportunity to be more selective when choosing shippers and freight.

Another recent sign of pricing strength is the step up in general rate increases. Recently implemented GRIs have landed a couple of months earlier than normal and have been anywhere from flat to 200 bps higher than those implemented in early 2021.