Paccar Inc. (NASDAQ: PCAR) soundly beat third quarter earnings and sales estimates as new truck deliveries worked down a backlog of record orders placed in 2018.

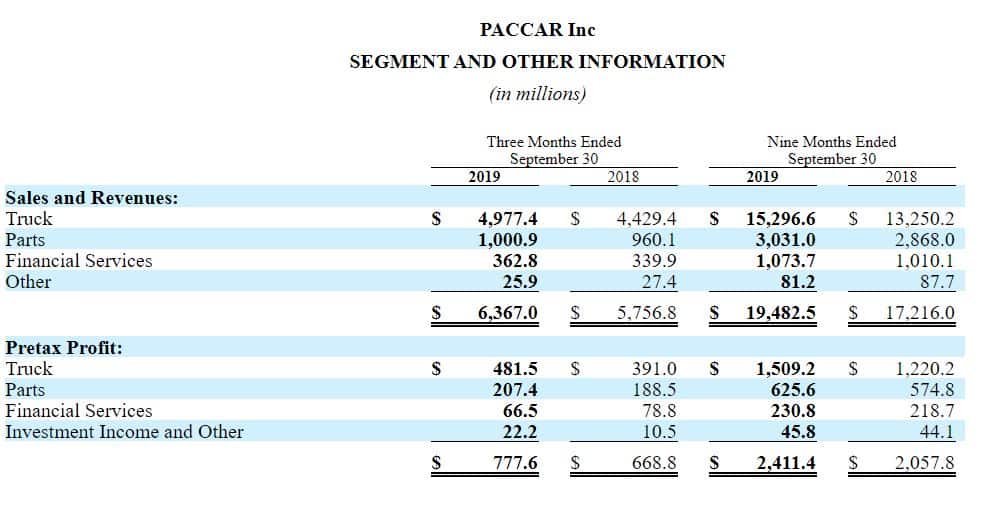

Net income of $607.9 million, or $1.75 per fully diluted share, was up 11% from the $545.3 million, or $1.55 per fully diluted share, earned in the same period in 2018. Third quarter revenue of $6.37 billion also was 11% ahead of the $5.76 billion earned in the July-September period of 2018.

The consensus of analysts following the company estimated $1.64 earnings per share or an improvement of 5.8%, according to investor site Seeking Alpha. Analysts predicted $5.97 billion in revenue, which at 10.1% was closer to the 11% Paccar achieved.

Absent the October 22 report, Paccar has beaten earnings estimates 88% of the time and revenue estimates 75% of the time in the last two years, according to Seeking Alpha.

Paccar shares closed 4.62% higher at $76.37 on October 22.

Paccar divisions include the Kenworth Truck Co, Peterbilt Motors and DAF, which sells cabover trucks in Europe and South America. It also designs, makes and sells engines and aftermarket parts and finances truck leases and purchases.

“Paccar’s third quarter results reflect strong global truck production and excellent global aftermarket parts results,” CEO Preston Feight said in a statement. Paccar reported a 9.5% after-tax return on revenue for the third quarter and for the first nine months of the year.

Paccar earned $1.86 billion, or $5.34 per diluted share, for the first nine months of 2019 compared to $1.62 billion, or $4.59 per diluted share, in the same period last year. Net sales and financial services revenues for the first nine months of 2019 were $19.48 billion compared to $17.22 billion last year.

Robust deliveries

Despite delivering a robust 31,700 trucks in the U.S. and Canada during the third quarter, Feight said Paccar’s prospects look strong for the rest of the year and into a slowing market driven by normal replacement demand in 2020.

Paccar predicts Class 8 truck industry retail sales for the U.S. and Canada for the full year of 2019 to range between 310,000 and 320,000 vehicles, which would be the second-highest market in history.

“Class 8 truck industry retail sales in 2020 for the U.S. and Canada are estimated to be in a range of 230,000-260,000 vehicles, a solid replacement vehicle market,” said Paccar executive vice president Gary Moore. “Good U.S. economic growth, 50-year-low unemployment and strong consumer spending are generating freight tonnage growth of 4.2% this year,”

Production cut

With industry orders falling for 10 consecutive months, Paccar reduced production by 6% to 8% at the end of the third quarter, Feight said on a conference call with analysts. He said Paccar’s backlog of unbuilt truck orders stood at 36% of the industry at the end of September.

“We feel like we have a reasonable backlog going into 2020,” Feight said. ”Orders are starting to pick up as they do at this time of year.”

Unlike competitors Daimler Trucks North America, Volvo Trucks North America and Navistar International Corp. Paccar has not announced any temporary layoffs to address slackening demand.

Used truck sales are down 10% to 15%, but Feight said pre-owned Kenworth and Peterbilt models sell for 10% to 15% more than competitors, Feight said, adding that company used truck centers in Los Angeles and Denton, Texas, help keep used models moving.

Other financials

Paccar Parts third quarter pre-tax profits of $207.4 million was 10% higher than the $188.5 million earned in the third quarter of 2018 on revenue of $1 billion, which was 4% higher than the $960.1 million in sales during the same three months in 2018. The company is opening new parts distribution centers in Las Vegas and Ponta Grossa, Brazil in 2020.

The company has invested $6.6 billion in new and expanded facilities, products and technologies during the past decade. The company estimates 2019 capital investments of $675 million to $725 million with a slightly lower outlay of $625 million to $675 million in 2020. Research and development expenses are expected to be $325 million to $335 million in 2019, dropping to $320 million to $350 million next year.

Paccar repurchased 832,800 common shares for $53.6 million in the third quarter, bringing total buybacks to $430.5 million under the current $500 million program authorized by the Paccar Board of Directors. Stockholders’ equity was a record $9.96 billion. The company ended the third quarter with $4.64 billion of manufacturing cash and marketable securities.