Amid all the headlines on consumer demand, imports to America’s primary container gateway — the ports of Los Angeles and Long Beach — have sunk back to pre-COVID levels, not only due to congestion stranding massive amounts of cargo offshore, but also due to a pullback in ship arrivals that’s being obscured by the congestion story.

LA-LB imports normalizing

The Port of Los Angeles held its monthly press briefing on Tuesday, featuring Transportation Secretary Pete Buttigieg, but the port didn’t have its monthly numbers ready at the time of the event.

Two days later, the country’s largest port belatedly reported that it imported 467,287 twenty-foot equivalent units of containerized cargo in October, down 8% from October 2020 and down 4% from October 2018, pre-COVID.

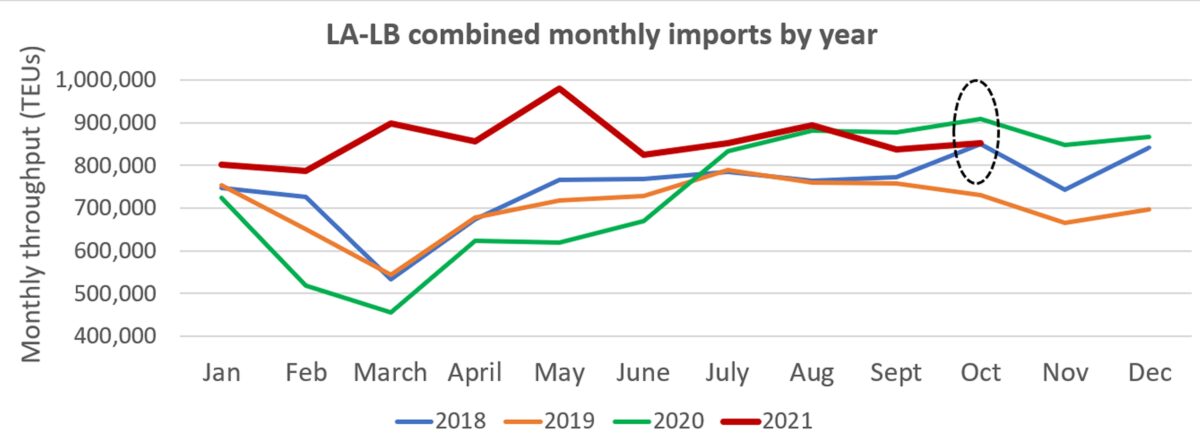

Looking at LA-LB volumes combined, October import volumes totaled 852,287 TEUs, down 6% from last October and flat with October 2018 levels. Monthly imports to LA-LB in October were down 13% from this year’s May peak of 980,450 TEUs.

LA-LB imports are still on track for a record year. Also, at the end of last month, statistics from the Marine Exchange of Southern California showed ships waiting offshore with a capacity of 637,326 TEUs. In other words, October would have been by far the best import month ever for Southern California, if only all that cargo could have made it ashore.

Ship arrivals are falling

The number of container ships arriving in LA-LB is actually falling as wait times from anchorage to berth are simultaneously surging.

The rising number of ships at anchor or loitering is creating the perception of a rising tide of U.S. imports, when in fact, higher wait times for ships are being caused by landside logistics issues and gridlock at the ports — not higher inbound container-ship arrivals.

The Marine Exchange publishes a daily harbor traffic update showing the number of container ships scheduled to arrive the following day. American Shipper analyzed the daily Marine Exchange data on scheduled arrivals for the following day from Aug. 1 through Wednesday.

In the second half of this year, container-ship daily arrivals in LA-LB peaked in September, at a monthly average of 6 per day, up from 5.2 in August. Average daily arrivals then fell to 5.6 per day in October and 5.4 in November to date.

Despite the pullback in arrivals, the average time it has taken for a container ship to get from waiting offshore (at anchorage or loitering) to a berth at the Port of Los Angeles has spiked 133% between Sept. 1 and Thursday, to 18.4 days.

An all-time high of 86 container ships were waiting offshore of Los Angeles and Long Beach on Tuesday, according to the Marine Exchange. In November to date, an average of 78.7 containers ships per day have been stuck offshore, up 37% from the monthly average of 57.4 ships in September, despite a 10% decrease in the monthly average of arriving container ships in November to date versus September.

Asked during Tuesday’s press conference whether the traditional peak holiday import period is coming to a close, Port of Los Angeles Executive Director Gene Seroka replied: “I would say yes. We’ll probably see a levelling off following the Thanksgiving, but not a big drop in imports because we do have an early Lunar New Year, in the first week of February. And then most retailers are telling me they’ll focus on inventory replenishment during our traditional slack season in quarter two.

“Our savvy retail community pulled forward a lot of their inventory and imports this year,” said Seroka. “We started seeing Christmas and holiday goods cross the docks in June, much earlier than they are traditionally see in late August and early September.”

Decrease in outbound empty containers

During a public hearing on Oct. 29, Matt Schrap, CEO of the Harbor Trucking Association, argued that the biggest source of Los Angeles/Long Beach congestion is not import containers that dwell too long, but rather, empty outbound containers that dwell too long. “Empties are the issue here,” he said.

To reduce port gridlock, outbound empty volumes need to increase, but in Los Angeles, they are decreasing. On Thursday, the port reported that 337,106 TEUs of empties were exported last month, down from 358,581 TEUs in September and 364,212 TEUs in August.

The situation with empties piling up at the terminals has gotten even worse in November, Seroka confirmed on Tuesday’s call. “We’ve got about 65,000 empty container units sitting on the docks right now,” he said. “That’s up from 55,000 just a couple of Fridays ago.”

Seroka is encouraging liner companies to bring in “sweepers,” ships that are deployed to return empties. “We’ve seen six sweeper ships so far pick up a little more than 17,500 TEUs of empties and there are another two on their way that can probably pick up another 2,500 TEUs, but we’ve got to do a lot more than that.”

Click for more articles by Greg Miller

Related articles:

- How to make a billion when your ships are stuck at anchor

- Last-minute reprieve: LA/LB delays pulling trigger on congestion fee

- Hapag-Lloyd rakes in $3.9B in Q3, sees no plunge in rates yet

- Import boom side effect: More container-ship accidents in Pacific

- Clock ticks closer to midnight for overwhelmed California ports

- $25B worth of cargo stuck on 80 container ships off California

- Shipping giant Maersk continues buying spree after best quarter ever