Logistics warehouse operator Prologis Inc. sees the market for space remaining tight for some time. On its first-quarter earnings call with analysts Tuesday, management said available supply in the market is still at all-time lows.

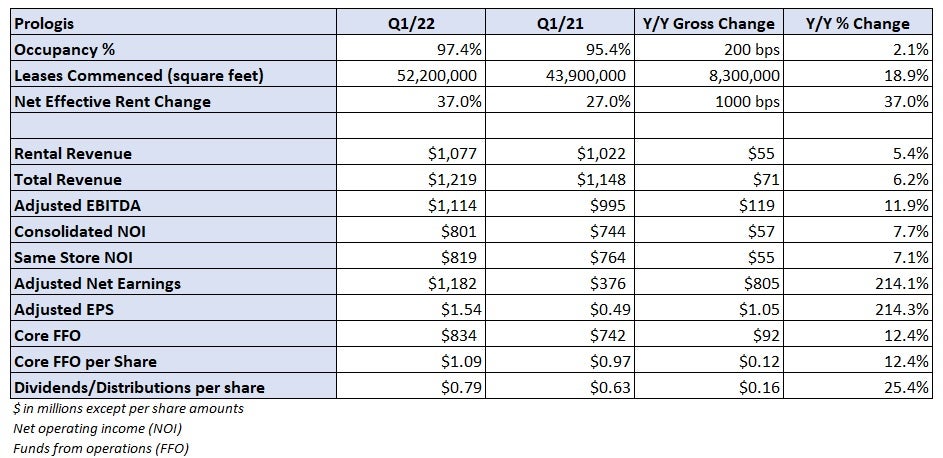

Prologis (NYSE: PLD) beat first-quarter expectations, reporting core funds from operations (FFO) of $1.09, 2 cents ahead of consensus and 12 cents higher year-over-year.

A sustained period of high consumer demand along with delays in new projects coming online have kept supply tight. “True months of supply,” which compares current vacancies plus the development pipeline to trailing net absorption, has fallen to 16 months in 30 key U.S. markets tracked by Prologis. Historically, that metric hovers around 36 months during expansionary periods.

During the first quarter, occupancy didn’t experience the normal seasonal decline. It remained flat with the fourth quarter at 97.4%. The metric was 200 basis points higher year-over-year as Prologis had 98.1% of its portfolio leased by the end of the period.

Hamid Moghadam, co-founder and CEO, said the U.S. market needs 800 million square feet of incremental space, pointing to an inventories-to-sales ratio that is 10% lower than pre-pandemic levels. He said in addition to the 10% in replacement merchandise needed, many supply chains will look to add another 10% of cushion to avoid future stockouts.

“People are running to catch up on the demand that they’re seeing from their end customers and they’re not getting there. They’re always behind,” Moghadam said.

He said there will be roughly a 5% temporary decline in inventories tied to a change in spending habits, away from goods to services and experiences, which was the trend leading up to COVID. The net result, he believes, is that 15% of inventory is still required throughout the supply chain, which will require additional space.

Prologis is forecasting U.S. market rents to increase 22%, compared to the 11% forecast provided in its last update.

“We are in unprecedented territory,” Moghadam said. “Industrial rents have never grown at these levels, but we’ve never had market conditions like we have now. We’ve never had e-commerce at this level of importance. We’ve never had [inventory] resilience become such a big factor. We haven’t had these bottlenecks in the supply chain that clog up the network.”

First-quarter net effective rent change (average rate over the life of the lease) was 37% across the entire portfolio and 41.5% in the U.S.

Moghadam said rents will continue to outpace acquisition and new build costs but the gap is likely to narrow moving forward. He pointed to surging energy and labor costs as reasons. Importantly, rents account for just 3% to 5% of total supply chain costs, which makes it easier for operators like Prologis to push through increases.

The company’s forecast is for market rents to increase by 25% to 26% in coastal markets in 2022 with interior areas seeing hikes in the midteens.

Prologis expects net earnings to range between $4.85 and $5 per share in 2022, a 10% increase to its outlook provided just three months ago. Core FFO guidance was raised almost 2% to a range of $5.10 to $5.16 per share, which was ahead of the consensus estimate of $5.04 at the time of the print.

Moghadam shrugged off the likelihood of a recession, at least in the near term.

“We just look at what our customers tell us and what they do and the actions and the words that they use. The posture of our customers is very much front foot forward because they are benefiting from certain secular trends that are in their favor.” He acknowledged risks such as inflation, higher fuel costs, the war in Ukraine and the midterm elections are potential headwinds that could cause favorable trends to reverse.

“We see our customers with their front foot forward and taking up more space, and that gives us comfort that we’re not facing a recessionary environment, at least not as it pertains to our business,” Moghadam said.

Debt-to-market capitalization was 13.5% at the end of the quarter with a weighted average interest rate of 1.7%. The company has no material debt maturities until 2026, which makes it “insulated in this rising rate environment.” Prologis ended the period with total investment capacity of $18 billion.

Prologis Ventures is an investor in FreightWaves.

Read more

Click for more FreightWaves articles by Todd Maiden.

- J.B. Hunt sees runway for high demand; small carriers could struggle

- Trucking: Cowen cuts estimates over ‘growing concerns for carriers’

- After XPO deal, STG CEO sees ‘perfect storm’ of opportunity